ck my ork The Titanic Shipbuilding Company has a noncancelable contract to build a small cargo vessel. Construction involves a cash outlay of $271,000 at the end of each of the next two years. At the end of the third year the company will receive payment of $645,000. Assume the IRR of this option exceeds the cost of capital. The company can speed up construction by working an extra shift. In this case there will be a cash outlay of $585,000 at the end of the first year followed by a cash payment of $645,000 at the end of the second year. Use the IRR rule to show the (approximate) range of opportunity costs of capital at which the company should work the extra shift. (Enter your answers as a percent rounded to 2 decimal places. Enter the smallest percent first.) The company should work the extra shift if the cost of capital is between % and ( Prev 6 of 8 Next>

ck my ork The Titanic Shipbuilding Company has a noncancelable contract to build a small cargo vessel. Construction involves a cash outlay of $271,000 at the end of each of the next two years. At the end of the third year the company will receive payment of $645,000. Assume the IRR of this option exceeds the cost of capital. The company can speed up construction by working an extra shift. In this case there will be a cash outlay of $585,000 at the end of the first year followed by a cash payment of $645,000 at the end of the second year. Use the IRR rule to show the (approximate) range of opportunity costs of capital at which the company should work the extra shift. (Enter your answers as a percent rounded to 2 decimal places. Enter the smallest percent first.) The company should work the extra shift if the cost of capital is between % and ( Prev 6 of 8 Next>

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 5MC

Related questions

Question

Transcribed Image Text:ck my

ork

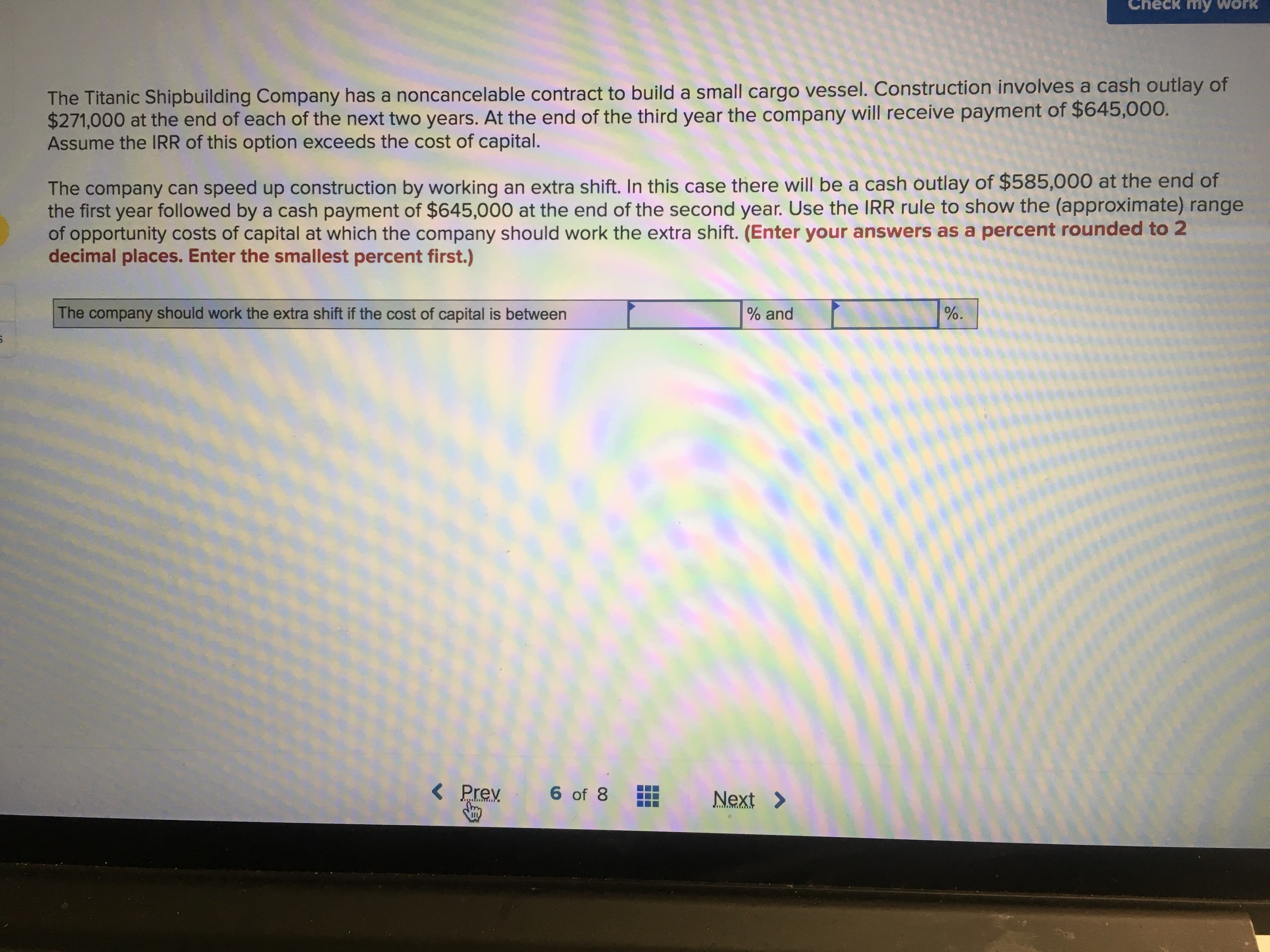

The Titanic Shipbuilding Company has a noncancelable contract to build a small cargo vessel. Construction involves a cash outlay of

$271,000 at the end of each of the next two years. At the end of the third year the company will receive payment of $645,000.

Assume the IRR of this option exceeds the cost of capital.

The company can speed up construction by working an extra shift. In this case there will be a cash outlay of $585,000 at the end of

the first year followed by a cash payment of $645,000 at the end of the second year. Use the IRR rule to show the (approximate) range

of opportunity costs of capital at which the company should work the extra shift. (Enter your answers as a percent rounded to 2

decimal places. Enter the smallest percent first.)

The company should work the extra shift if the cost of capital is between

% and

( Prev

6 of 8

Next>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub