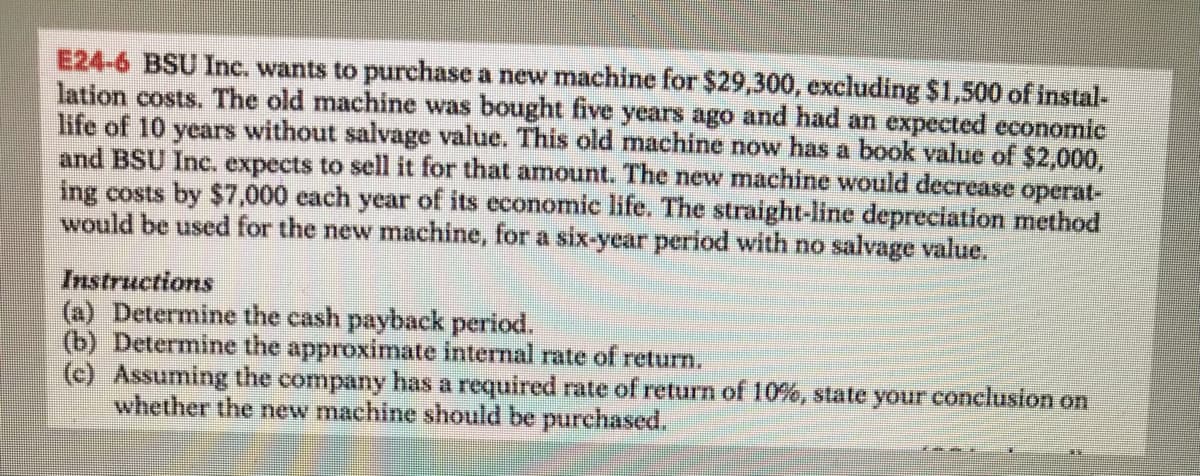

E24-6 BSU Inc. wants to purchase a new machine for $29,300, excluding $1,500 of instal- lation costs. The old machine was bought five years ago and had an expected economic life of 10 years without salvage value. This old machine now has a book value of $2,000, and BSU Inc. expects to sell it for that amount. The new machine would decrease operat- ing costs by $7,000 each year of its economic life. The straight-line depreciation method would be used for the new machine, for a six-year period with no salvage value. Instructions (a) Determine the cash payback period. (b) Determine the approximate internal rate of return. (c) Assuming the company has a required rate of return of 10%, state your conclusion on whether the new machine should be purchased.

E24-6 BSU Inc. wants to purchase a new machine for $29,300, excluding $1,500 of instal- lation costs. The old machine was bought five years ago and had an expected economic life of 10 years without salvage value. This old machine now has a book value of $2,000, and BSU Inc. expects to sell it for that amount. The new machine would decrease operat- ing costs by $7,000 each year of its economic life. The straight-line depreciation method would be used for the new machine, for a six-year period with no salvage value. Instructions (a) Determine the cash payback period. (b) Determine the approximate internal rate of return. (c) Assuming the company has a required rate of return of 10%, state your conclusion on whether the new machine should be purchased.

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 11PROB

Related questions

Question

please show proper working, thank you

Transcribed Image Text:E24-6 BSU Inc. wants to purchase a new machine for $29,300, excluding $1,500 of instal-

lation costs. The old machine was bought five years ago and had an expected economic

life of 10 years without salvage value. This old machine now has a book value of $2,000,

and BSU Inc. expects to sell it for that amount. The new machine would decrease operat-

ing costs by $7,000 each year of its economic life. The straight-line depreciation method

would be used for the new machine, for a six-year period with no salvage value.

Instructions

(a) Determine the cash payback period.

(b) Determine the approximate internal rate of return.

(c) Assuming the company has a required rate of return of 10%, state your conclusion on

whether the new machine should be purchased.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning