Click the icon to see the Worked Solution. The required return for investment A is %. (Round to one decimal place.) The required return for investment B is %. (Round to one decimal place.) The required return for investment C is %. (Round to one decimal place.) The required return for investment D is %. (Round to one decimal place.) The required return for investment E is %. (Round to one decimal place.) 7: Data Table (Click on the icon here in order to copy its contents of the data table below into a spreadsheet.) Security Beta A 1.34 в 0.93 0.13 D 0.96 E 0.67

Click the icon to see the Worked Solution. The required return for investment A is %. (Round to one decimal place.) The required return for investment B is %. (Round to one decimal place.) The required return for investment C is %. (Round to one decimal place.) The required return for investment D is %. (Round to one decimal place.) The required return for investment E is %. (Round to one decimal place.) 7: Data Table (Click on the icon here in order to copy its contents of the data table below into a spreadsheet.) Security Beta A 1.34 в 0.93 0.13 D 0.96 E 0.67

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 9PROB

Related questions

Question

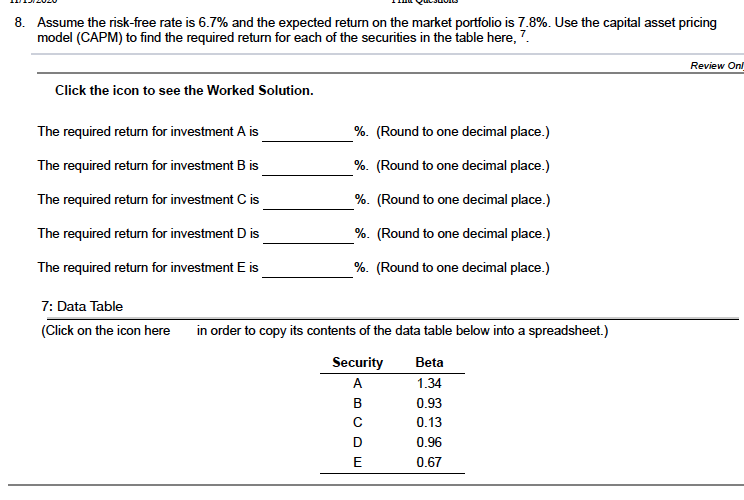

Transcribed Image Text:8. Assume the risk-free rate is 6.7% and the expected return on the market portfolio is 7.8%. Use the capital asset pricing

model (CAPM) to find the required return for each of the securities in the table here, 7.

Review On

Click the icon to see the Worked Solution.

The required return for investment A is

%. (Round to one decimal place.)

The required return for investment B is

%. (Round to one decimal place.)

The required return for investment C is

%. (Round to one decimal place.)

The required return for investment D is

%. (Round to one decimal place.)

The required return for investment E is

%. (Round to one decimal place.)

7: Data Table

(Click on the icon here

in order to copy its contents of the data table below into a spreadsheet.)

Security

Beta

A

1.34

в

0.93

0.13

0.96

E

0.67

Expert Solution

Step 1

Capital Asset Pricing Model (CAPM):

This model attempts to explain the relationship between the systematic risk and the expected return of the asset. It is generally used to determine the price and the expected return of the risky securities.

Step 2

Compute the required return for investment A using the equation as shown below:

Hence, the required return is 8.17%.

Step 3

Compute the required return for investment B using the equation as shown below:

Hence, the required return is 7.72%.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning