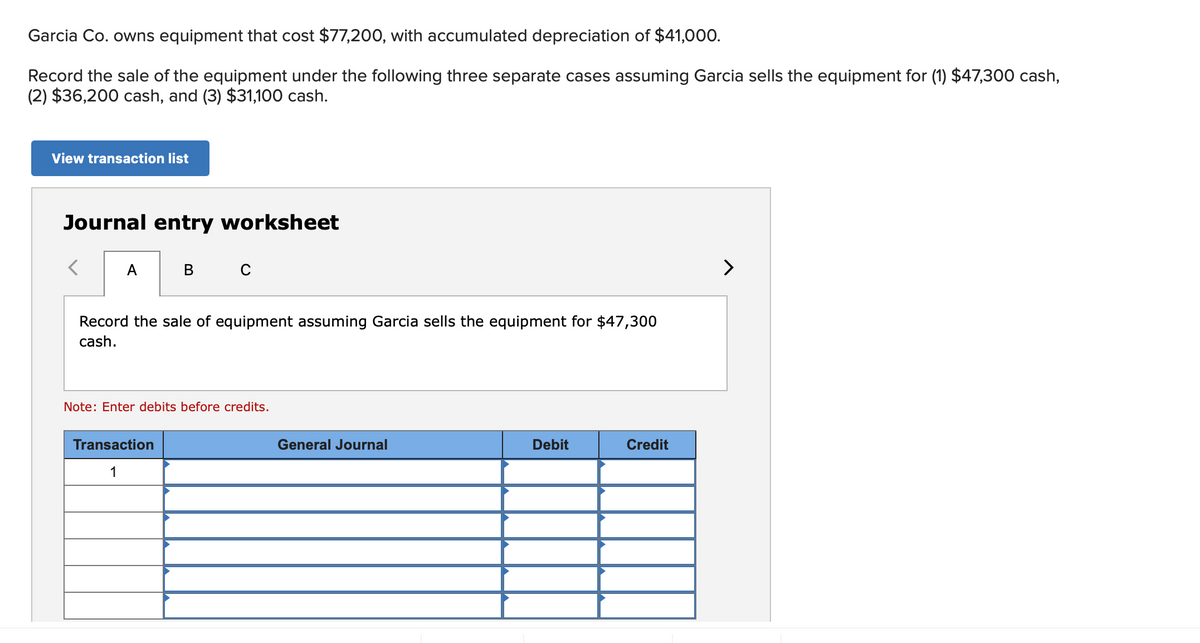

Garcia Co. owns equipment that cost $77,200, with accumulated depreciation of $41,000. Record the sale of the equipment under the following three separate cases assuming Garcia sells the equipment for (1) $47,300 cash, (2) $36,200 cash, and (3) $31,100 cash.

Garcia Co. owns equipment that cost $77,200, with accumulated depreciation of $41,000. Record the sale of the equipment under the following three separate cases assuming Garcia sells the equipment for (1) $47,300 cash, (2) $36,200 cash, and (3) $31,100 cash.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 12PA: Garcia Co. owns equipment that costs $76,800, with accumulated depreciation of $40,800. Garcia sells...

Related questions

Question

Transcribed Image Text:Garcia Co. owns equipment that cost $77,200, with accumulated depreciation of $41,000.

Record the sale of the equipment under the following three separate cases assuming Garcia sells the equipment for (1) $47,300 cash,

(2) $36,200 cash, and (3) $31,100 cash.

View transaction list

Journal entry worksheet

A

B C

>

Record the sale of equipment assuming Garcia sells the equipment for $47,300

cash.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning