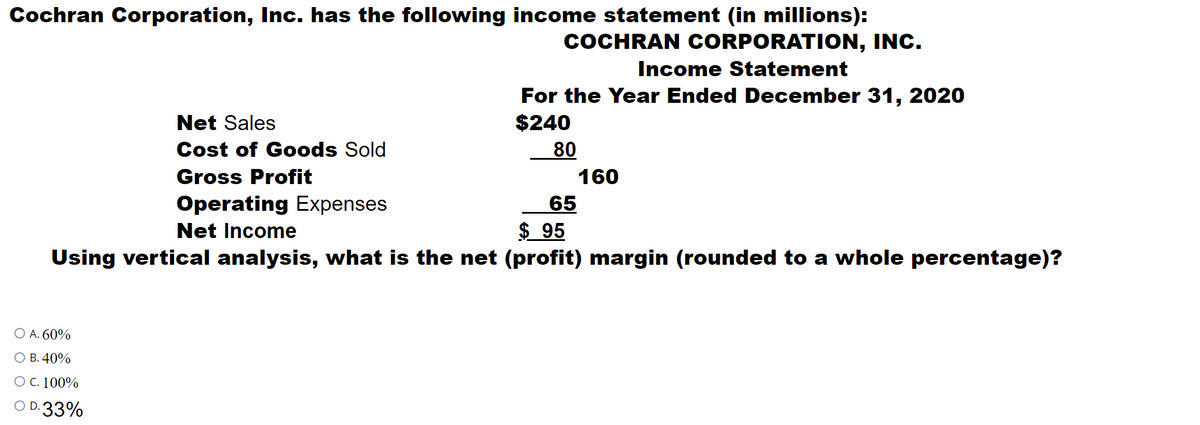

Cochran Corporation, Inc. has the following income statement (in millions): COCHRAN CORPORATION, INC. Income Statement For the Year Ended December 31, 2020 $240 Net Sales Cost of Goods Sold 80 Gross Profit 160 Operating Expenses 65 $_95 Using vertical analysis, what is the net (profit) margin (rounded to a whole percentage)? Net Income O A. 60% O B. 40% OC. 100% O D.33%

Cochran Corporation, Inc. has the following income statement (in millions): COCHRAN CORPORATION, INC. Income Statement For the Year Ended December 31, 2020 $240 Net Sales Cost of Goods Sold 80 Gross Profit 160 Operating Expenses 65 $_95 Using vertical analysis, what is the net (profit) margin (rounded to a whole percentage)? Net Income O A. 60% O B. 40% OC. 100% O D.33%

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 87PSB

Related questions

Question

no work required

Transcribed Image Text:Cochran Corporation, Inc. has the following income statement (in millions):

COCHRAN CORPORATION, INC.

Income Statement

For the Year Ended December 31, 2020

$240

Net Sales

Cost of Goods Sold

80

Gross Profit

160

65

$ 95

Using vertical analysis, what is the net (profit) margin (rounded to a whole percentage)?

Operating Expenses

Net Income

O A. 60%

О В. 40%

О С. 100%

O D.33%

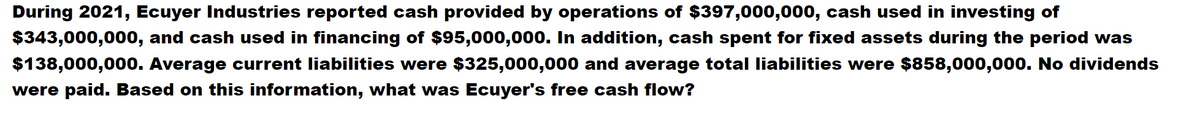

Transcribed Image Text:During 2021, Ecuyer Industries reported cash provided by operations of $397,000,000, cash used in investing of

$343,000,000, and cash used in financing of $95,000,000. In addition, cash spent for fixed assets during the period was

$138,000,000. Average current liabilities were $325,000,000 and average total liabilities were $858,000,000. No dividends

were paid. Based on this information, what was Ecuyer's free cash flow?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning