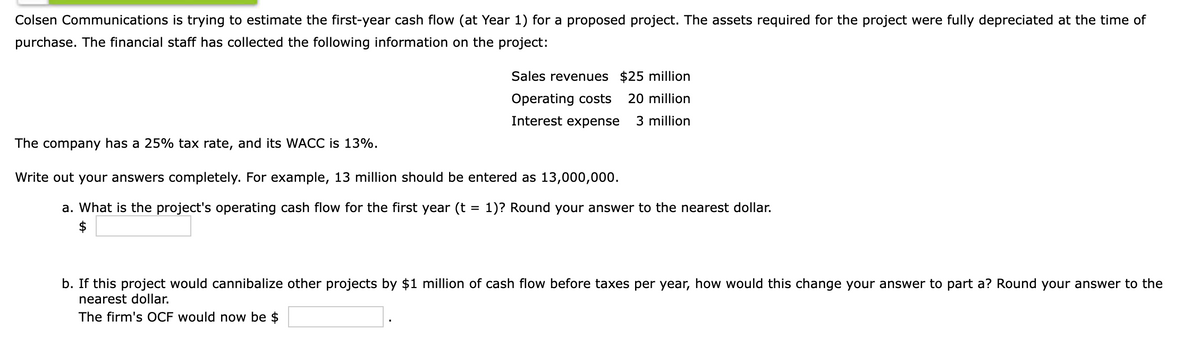

Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales revenues $25 million Operating costs 20 million Interest expense 3 million The company has a 25% tax rate, and its WACC is 13%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. a. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar. $ b. If this project would cannibalize other projects by $1 million nearest dollar. The firm's OCF would now be $ cash flow before taxes per year, how would this change your answer to part a? Round your answer to the

Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales revenues $25 million Operating costs 20 million Interest expense 3 million The company has a 25% tax rate, and its WACC is 13%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. a. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar. $ b. If this project would cannibalize other projects by $1 million nearest dollar. The firm's OCF would now be $ cash flow before taxes per year, how would this change your answer to part a? Round your answer to the

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 8P

Related questions

Question

Transcribed Image Text:Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of

purchase. The financial staff has collected the following information on the project:

Sales revenues $25 million

Operating costs

20 million

Interest expense

3 million

The company has a 25% tax rate, and its WACC is 13%.

Write out your answers completely. For example, 13 million should be entered as 13,000,000.

a. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar.

$

b. If this project would cannibalize other projects by $1 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the

nearest dollar.

The firm's OCF would now be $

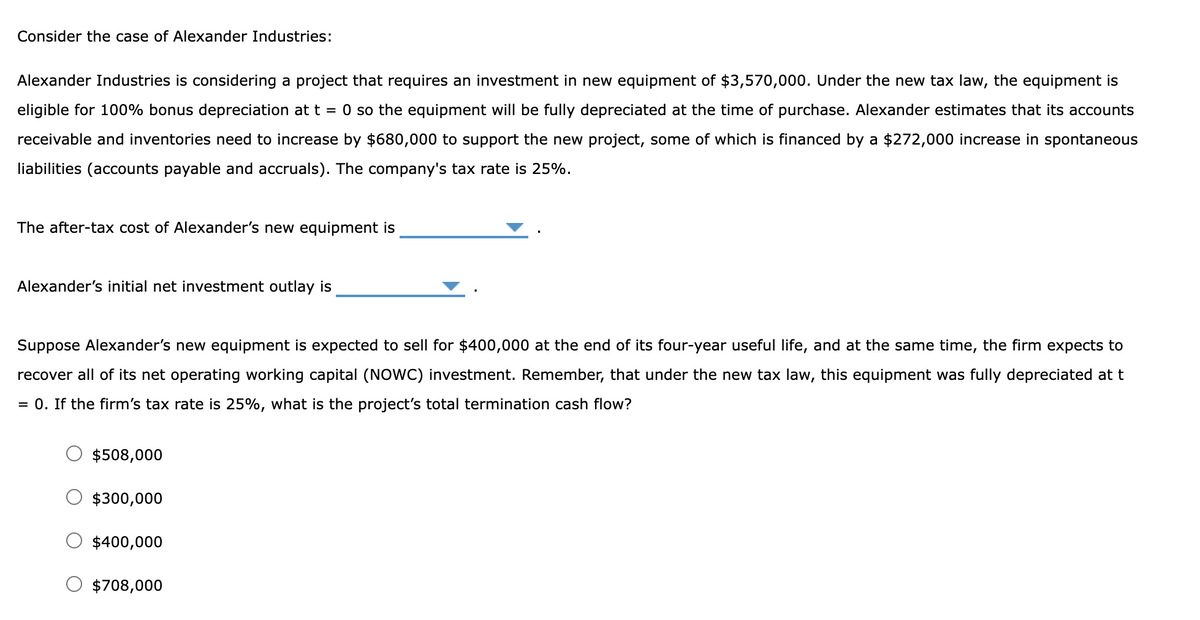

Transcribed Image Text:Consider the case of Alexander Industries:

Alexander Industries is considering a project that requires an investment in new equipment of $3,570,000. Under the new tax law, the equipment is

eligible for 100% bonus depreciation at t = 0 so the equipment will be fully depreciated at the time of purchase. Alexander estimates that its accounts

receivable and inventories need to increase by $680,000 to support the new project, some of which is financed by a $272,000 increase in spontaneous

liabilities (accounts payable and accruals). The company's tax rate is 25%.

The after-tax cost of Alexander's new equipment is

Alexander's initial net investment outlay is

Suppose Alexander's new equipment is expected to sell for $400,000 at the end of its four-year useful life, and at the same time, the firm expects to

recover all of its net operating working capital (NOWC) investment. Remember, that under the new tax law, this equipment was fully depreciated at t

= 0. If the firm's tax rate is 25%, what is the project's total termination cash flow?

$508,000

$300,000

$400,000

$708,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning