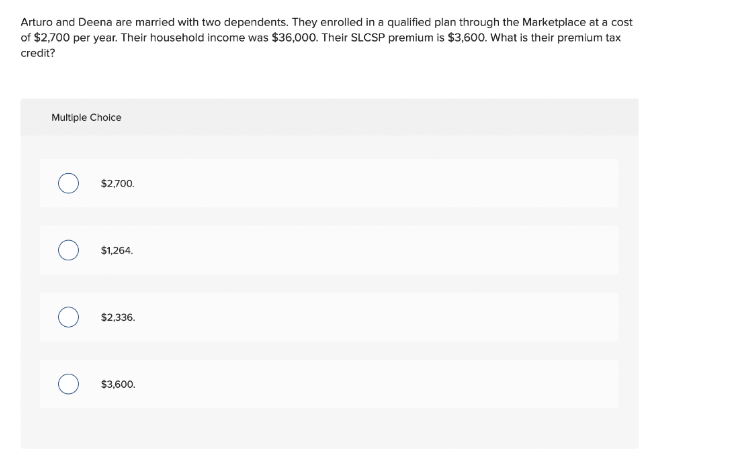

Arturo and Deena are married with two dependents. They enrolled in a qualified plan through the Marketplace at a cost of $2,700 per year. Their household income was $36,000. Their SLCSP premium is $3,600. What is their premium tax credit?

Arturo and Deena are married with two dependents. They enrolled in a qualified plan through the Marketplace at a cost of $2,700 per year. Their household income was $36,000. Their SLCSP premium is $3,600. What is their premium tax credit?

Chapter12: Tax Credits And Payments

Section: Chapter Questions

Problem 18CE

Related questions

Question

Transcribed Image Text:Arturo and Deena are married with two dependents. They enrolled in a qualified plan through the Marketplace at a cost

of $2,700 per year. Their household income was $36,000. Their SLCSP premium is $3,600. What is their premium tax

credit?

Multiple Choice

$2,700.

$1,264.

$2,336.

$3,600.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT