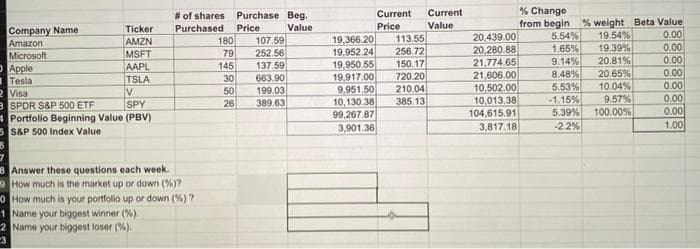

Company Name Amazon Microsoft Ticker AMZN MSFT AAPL TSLA Apple Tesla Visa V SPOR S&P 500 ETF SPY Portfolio Beginning Value (PBV) S&P 500 Index Value # of shares Purchased Answer these questions each week. How much is the market up or down (%)? How much is your portfolio up or down (%) ? Name your biggest winner (%) Name your biggest loser (%). 229888 180 79 145 30 50 26 Purchase Beg. Value Price 107.59 252.56 137.59 663.90 199.03 389.63 19,366.20 19,952.24 19,950.55 19,917.00 9.951.50 10,130.38 99,267.87 3,901.36 Current Current Price Value 113.55 256.72 150.17 720.20 210.04 385.13 20,439.00 20,280.88 21,774.65 21,606.00 10.502.00 10.013.38 104,615.91 3,817.18 % Change from begin % weight Beta Value 0.00 5.54% 1.65% 9.14% 8.48 % 5.53% -1.15% 5.39% -2.2% 19.54% 19.39% 20.81% 20.65% 10.04% 9.57% 100.00% 0.00 0.00 0.00 0.00 0.00 0.00 1.00

Company Name Amazon Microsoft Ticker AMZN MSFT AAPL TSLA Apple Tesla Visa V SPOR S&P 500 ETF SPY Portfolio Beginning Value (PBV) S&P 500 Index Value # of shares Purchased Answer these questions each week. How much is the market up or down (%)? How much is your portfolio up or down (%) ? Name your biggest winner (%) Name your biggest loser (%). 229888 180 79 145 30 50 26 Purchase Beg. Value Price 107.59 252.56 137.59 663.90 199.03 389.63 19,366.20 19,952.24 19,950.55 19,917.00 9.951.50 10,130.38 99,267.87 3,901.36 Current Current Price Value 113.55 256.72 150.17 720.20 210.04 385.13 20,439.00 20,280.88 21,774.65 21,606.00 10.502.00 10.013.38 104,615.91 3,817.18 % Change from begin % weight Beta Value 0.00 5.54% 1.65% 9.14% 8.48 % 5.53% -1.15% 5.39% -2.2% 19.54% 19.39% 20.81% 20.65% 10.04% 9.57% 100.00% 0.00 0.00 0.00 0.00 0.00 0.00 1.00

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter11: Investment Planning

Section: Chapter Questions

Problem 9FPE

Related questions

Question

Transcribed Image Text:Company Name

Amazon

Microsoft

Apple

Tesla

Ticker

AMZN

MSFT

AAPL

TSLA

2 Visa

V

3 SPDR S&P 500 ETF

SPY

Portfolio Beginning Value (PBV)

5 S&P 500 Index Value

# of shares

Purchased

8 Answer these questions each week.

How much is the market up or down (%)?

0 How much is your portfolio up or down (%) ?

1 Name your biggest winner (%)

2 Name your biggest loser (%).

180

79

145

30

50

26

Purchase Beg.

Price

Value

107.59

252.56

137.59

663.90

199.03

389.63

19,366.20

19,952.24

19,950.55

19,917.00

9,951,50

10,130.38

99,267.87

3,901.36

Current Current

Price

Value

113.55

256.72

150.17

720.20

210.04

385.13

20,439.00

20,280.88

21,774.65

21,606.00

10.502.00

10,013.38

104,615.91

3,817.18

% Change

from begin % weight Beta Value

5.54%

1.65%

9.14%

8.48%

5.53%

-1.15%

19.54%

19.39%

20.81%

20.65%

10.04%

9.57%

5.39% 100.00%

-2.2%

0.00

0.00

0.00

0.00

0.00

0.00

0.00

1.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning