11. Bond Pricing. A General Motors bond carries a coupon rate of 8%, has 9 years until maturity, and sells at a yield to maturity of 7%. a. What interest payments do bondholders receive each year? (LOI) b. At what price does the bond sell? (Assume annual interest payments.) (LO2) c. What will happen to the bond price if the yield to maturity falls to 6%? (LO2)

11. Bond Pricing. A General Motors bond carries a coupon rate of 8%, has 9 years until maturity, and sells at a yield to maturity of 7%. a. What interest payments do bondholders receive each year? (LOI) b. At what price does the bond sell? (Assume annual interest payments.) (LO2) c. What will happen to the bond price if the yield to maturity falls to 6%? (LO2)

Chapter5: Bond, Bond Valuation, And Interest Rates

Section: Chapter Questions

Problem 24SP

Related questions

Question

help me

Transcribed Image Text:Fundamentals of corporate finan X

+

File | C:/Users/trana/Downloads/Fundamentals%20of%20corporate%20finance.pdf

Not syncing

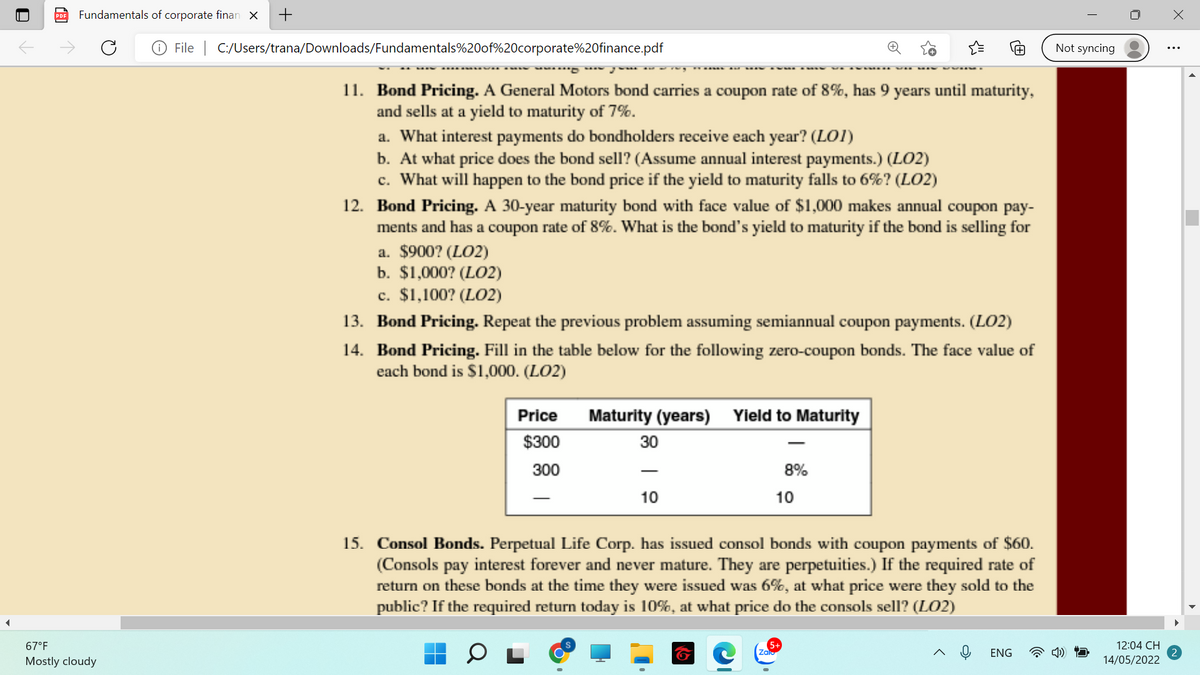

11. Bond Pricing. A General Motors bond carries a coupon rate of 8%, has 9 years until maturity,

and sells at a yield to maturity of 7%.

a. What interest payments do bondholders receive each year? (LOI)

b. At what price does the bond sell? (Assume annual interest payments.) (LO2)

c. What will happen to the bond price if the yield to maturity falls to 6%? (LO2)

12. Bond Pricing. A 30-year maturity bond with face value of $1,000 makes annual coupon pay-

ments and has a coupon rate of 8%. What is the bond's yield to maturity if the bond is selling for

a. $900? (LO2)

b. $1,000? (LO2)

c. $1,100? (LO2)

13. Bond Pricing. Repeat the previous problem assuming semiannual coupon payments. (LO2)

14. Bond Pricing. Fill in the table below for the following zero-coupon bonds. The face value of

each bond is $1,000. (LO2)

Price

Maturity (years) Yield to Maturity

$300

30

300

8%

10

10

15. Consol Bonds. Perpetual Life Corp. has issued consol bonds with coupon payments of $60.

(Consols pay interest forever and never mature. They are perpetuities.) If the required rate of

return on these bonds at the time they were issued was 6%, at what price were they sold to the

public? If the required return today is 10%, at what price do the consols sell? (LO2)

67°F

12:04 CH

Zalo

ENG

Mostly cloudy

14/05/2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you