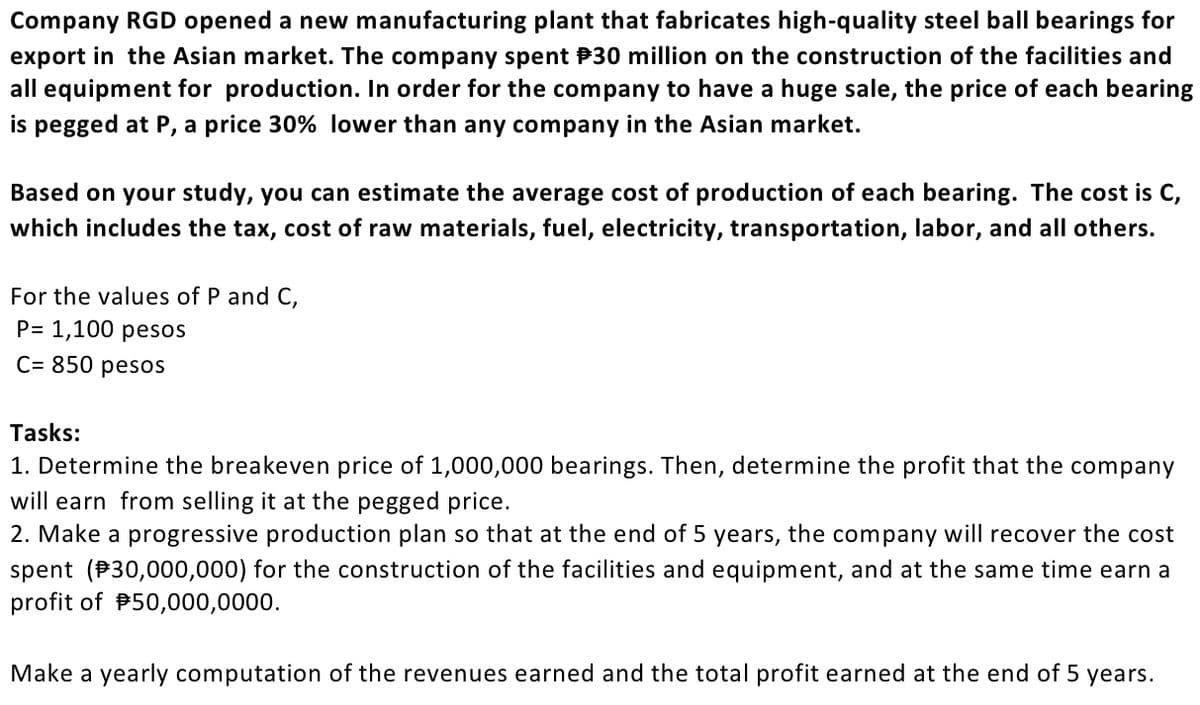

Company RGD opened a new manufacturing plant that fabricates high-quality steel ball bearings for export in the Asian market. The company spent P30 million on the construction of the facilities and all equipment for production. In order for the company to have a huge sale, the price of each bearing is pegged at P, a price 30% lower than any company in the Asian market. Based on your study, you can estimate the average cost of production of each bearing. The cost is C, which includes the tax, cost of raw materials, fuel, electricity, transportation, labor, and all others. For the values of P and C, P= 1,100 pesos C= 850 pesos Tasks: 1. Determine the breakeven price 1,000,000 bearings. Then, de mine the profit th the company will earn from selling it at the pegged price. 2. Make a progressive production plan so that at the end of 5 years, the company will recover the cost spent (P30,000,000) for the construction of the facilities and equipment, and at the same time earn a profit of P50,000,0000. Make a yearly computation of the revenues earned and the total profit earned at the end of 5 years.

Q: Problem 4-11 (Algorithmic) Edwards Manufacturing Company purchases two component parts from three…

A: Given data is

Q: Safa traders is a wholesale business unit based in Salala. The company is dealing with disposable…

A: The economic order quantity (EOQ) model is the inventory model which minimizes total annual…

Q: Mary hopes to sell 10,000 pieces of chrysanthemum last November but she was able to sell 15,000…

A: It is given that the total number of pieces sold is 15,000 at the price of 20 pesos each and the…

Q: Samoto Limited (SL) relies on an external supplier for production capacity. In order to gain access…

A: First, we have been provided with the following information about the net profits: High Demand…

Q: Rice is a staple food in many Asian economies and many farmers depend on growing and selling rice…

A: Truly speaking rice is also one of the most important and fastest-growing staple foods. Again we…

Q: 13. lina sold all 10 t-shirts for 1,500 pesos. suppose she added 50 pesos as mark up price for every…

A: 13. lina sold all 10 t-shirts for 1,500 pesos. suppose she added 50 pesos as mark up price for every…

Q: Discuss Vernon’s 1966 Product Life Cycle model as a means of explaining the evolution and sequencing…

A: The product life cycle (PLC) represents the life of a product on the market in terms of…

Q: Mr. Mohammed is the owner and the Manager of Big Fried Chicken LLC in Muscat; his company made a…

A: Total revenue in 2020= 300,000 OMR The total expenses in 2020=320,000OMR

Q: Price Estimation of various option showed in the table below Bid Price Option High Normal Low a1…

A: Decision making under uncertainty occurs where the information is not available to the decision…

Q: In 1985, Parveen Textile Mills Limited, Karachi, operated a high plant for the production of…

A: Parveen is a textile company that is one of the largest producers and exporters of garments based in…

Q: n project procurement management there are three main contract types: Fixed price, Cost Reimbursable…

A: Procurement is the acquisition of goods or services from an external source. The aim of the buyer is…

Q: Kantanka Limited is a family-owned automobile manufacturer with origin in Agona Swedru in the…

A: The act of hiring a company to deliver goods or services rather than creating them internally is…

Q: Akash Ltd has a surplus cash of Rs 90 Lakhs and wants to distribute 30% of it to the shareholders.…

A: The detailed solution to the given question is given Step 2.

Q: the prices the firms will charge? a. They may go to prison or face a ser

A: The answer to the above question is They may go to prison or face a serious fine. The second risk…

Q: 25. Priceline.com is an online travel agency for finding discount rates for travel- related…

A: Any company in the current days are mostly relying on technology and social networking for its…

Q: You are free to use relevant diagrams/frameworks/figures in supporting your answers to the questions…

A: Outsourcing is the process of taking help from outside for performing the functions or activities…

Q: 3. You have been asked to quantify the effects of removing a country's tarin on sueds of nard part…

A: a) customer's benefit can be determined from the distinction of the aggregate sum paid by the…

Q: The Irontown Independent School District wants to sell a parcel of unimproved land that it does not…

A: To prevail in the present economy, associations should gain by the abilities, information,…

Q: (a) Compute the price relatives for the three ingredients. Item Price Relative A B с (b) Compute a…

A: We use the base period price as the weight for calculating the weighted aggregate quantity index.…

Q: Lucy always wanted to live in downtown San Francisco. For 10 years she has worked as a manager at an…

A: Target market segmentation and evaluation: The target market is segmented and evaluated based on the…

Q: Explain "Columbia Sportswear" clothing brands Promotion plan. (in terms of how they promote? who…

A: Columbia sports wear is an American corporation that engages in production activities for producing…

Q: ISEM Power is considering the acquisition a local Waste-to-Energy plant which produces electricity…

A: As per Bartleby's guidelines, we only answer the first 3 sub-parts in case the question has multiple…

Q: b) Given this payoff as shown in Table Q2: Table Q2 State of nature (Payoff in RM thousand) #1 #2 A…

A: Given data: Alternatives #1 #2 A 120 30 B 60 40 C 10 110 To determine the range of p(1)…

Q: Questions: [1] if you are teacher Jana, what promotional strategies will you adopt? in terms of;…

A: Every business will require marketing and promotional strategies to bring in customers for its…

Q: 2) A company is considering a plan to produce or buy/outsource a certain item used in the production…

A:

Q: how people used to do marketing of spices in 1950 t0 2000.

A: Spices are non leafy parts of plants used as flavoring or seasoning. Spices and herbs have been used…

Q: Utikasn Ltd. purchase glass bowls for € 2.5 per unit or they can manufacture it with fixed cost of €…

A: Given: Per unit price = € 2.5 Fixed cost = € 69,000 Variable cost = € 1.5 Demand quantity =…

Q: If the total cost of an item is $180 and its variable cost is $0, this cost can be described as:…

A: For the given statement, the correct option is (c) fixed. If the total cost of an item is $180…

Q: Identify whether the item is group, an aggregate, or a category 1. Jolina magdangal Fan's club 2.…

A: Disclaimer: Since you have posted a question with multiple sub-parts, so as per company policy, we…

Q: When SS Electroplating Company started the electroplating operations in a residential location in…

A: Cost-cutting refers to the process of reducing the cost of certain procedures and processes that are…

Q: Mark Ewing has decided to enter contract with uber service provider in his area. The driver offers a…

A: Given information, Option Monthly Cost Mileage Allowance Cost Cost per Excess Kilometer A…

Q: Samoto Limited (SL) relies on an external supplier for production capacity. In order to gain access…

A: First, we have been provided with the following information about the net profits: High Demand…

Q: Compare the Porter's five forces model with pakistan state oil company. Also write conclusion.

A: Porter's five forces is a model designed to focus on the state of competition and includes the…

Q: After making a down payment of GH¢4000 for an automobile, the municipality paid GH¢400 per month for…

A:

Q: shortage of SCM experts. The top management is obviously worried in view of the anticipated volume…

A: A.These alternatives are accessible with Hind Motors to rapidly develop SCM aptitude:- The dynamic…

Q: You are the buyer for a major U.S. health care company. As buyer, your job is to procure and buy…

A: Marketing Marketing is a business activity where exchange of buying and selling of goods and…

Q: Company RGD opened a new manufacturing plant that fabricates high-quality steel ball bearings for…

A: Fixed Costs ÷ (Sales price per unit – Variable costs per unit) 1.

Q: Let us assume that a telecom company has just started its operations in the neighboring town of…

A: Earlier marketing was mainly seen as the activity of creating awareness among the buyers about the…

Q: Strong Construction Company is interested in taking loans from banks for some of its projects P, Q,…

A: THE ANSWER IS AS BELOW:

Q: Cambridge's annual sales first surpass Crimson's annual sales

A: Given, annual sales of Crimson Pharmacy= S = 2.3 + 0.5t annual sales of Cambridge Pharmacy=S = 1.2 +…

Q: The term of sale contract signed between company A (buyer) and its supplier is FOB origin. Company A…

A: Free on Board (FOB) is a shipment term used to indicate whether the seller or the buyer is liable…

Q: Subsidies help local and foreign firms in their competitiveness a. False b. True

A: Subsidy is a grant/ benefit provided by the government to a business, institution or an individual.…

Q: Assuming the role of a consultant Using North West Corner , Least Cost method and Vogels…

A: ANSWER : Project S,T,P taking from co-operative banks S-125 T-75 p- 50 Project P,Q,R taking from…

Q: Q2b A company consists of three factories in different locations, dstributing its products to four…

A: Given data is

Q: A software company is considering outsourcing one of its software products to India for maintenance…

A: When an organization, instead of producing a product in-house, gives the contract to some other…

Q: 3- Mr. Hameed opens a garment shop inside Lulu Hypermart in Nizwa. Based on the location of his…

A: Retail sells a wide variety of goods in small quantities to the end consumer. Retailers aim to give…

Q: You want to establish your own business and are thinking about releasing a new product. Customers…

A:

Q: A small electronic manufacturing company whichmakes communication devices has determined its costs…

A: There are external as well as internal factors that affect the productivity of the company. To keep…

Q: Could I have some brief bullet points on Pret a Manger expanding to Canada?

A: Pret a Manger is a United Kingdom based company which was founded in 1983. It is famous for its…

Complete your solutions and production plan

Task 1: Solution/computation of the breakeven price and profit for the production of 1,000,000 bearings

Task 2: Five-Year Progressive Production Plan

Solution of the number of bearings to be manufactured for 5 years and the recoverycost

Year 1:

Year 2:

Year 3:

Year 4:

Year 5:

Step by step

Solved in 2 steps with 6 images

- The Global Sourcing Wire Harness Decision Sheila Austin, a buyer at Autolink, a Detroit-based producer of subassemblies for the automotive market, has sent out requests for quotations for a wiring harness to four prospective suppliers. Only two of the four suppliers indicated an interest in quoting the business: Original Wire (Auburn Hills, MI) and Happy Lucky Assemblies (HLA) of Guangdong Province, China. The estimated demand for the harnesses is 5,000 units a month. Both suppliers will incur some costs to retool for this particular harness. The harnesses will be prepackaged in 24 12 6-inch cartons. Each packaged unit weighs approximately 10 pounds. Quote 1 The first quote received is from Original Wire. Auburn Hills is about 20 miles from Autolinks corporate headquarters, so the quote was delivered in person. When Sheila went down to the lobby, she was greeted by the sales agent and an engineering representative. After the quote was handed over, the sales agent noted that engineering would be happy to work closely with Autolink in developing the unit and would also be interested in future business that might involve finding ways to reduce costs. The sales agent also noted that they were hungry for business, as they were losing a lot of customers to companies from China. The quote included unit price, tooling, and packaging. The quoted unit price does not include shipping costs. Original Wire requires no special warehousing of inventory, and daily deliveries from its manufacturing site directly to Autolinks assembly operations are possible. Original Wire Quote: Unit price = 30 Packing costs = 0.75 per unit Tooling = 6,000 one-time fixed charge Freight cost = 5.20 per hundred pounds Quote 2 The second quote received is from Happy Lucky Assemblies of Guangdong Province, China. The supplier must pack the harnesses in a container and ship via inland transportation to the port of Shanghai in China, have the shipment transferred to a container ship, ship material to Seattle, and then have material transported inland to Detroit. The quoted unit price does not include international shipping costs, which the buyer will assume. HLA Quote: Unit price = 19.50 Shipping lead time = Eight weeks Tooling = 3,000 In addition to the suppliers quote, Sheila must consider additional costs and information before preparing a comparison of the Chinese suppliers quotation: Each monthly shipment requires three 40-foot containers. Packing costs for containerization = 2 per unit. Cost of inland transportation to port of export = 200 per container. Freight forwarders fee = 100 per shipment (letter of credit, documentation, etc.). Cost of ocean transport = 4,000 per container. This has risen significantly in recent years due to a shortage of ocean freight capacity. Marine insurance = 0.50 per 100 of shipment. U.S. port handling charges = 1,200 per container. This fee has also risen considerably this year, due to increased security. Ports have also been complaining that the charges may increase in the future. Customs duty = 5% of unit cost. Customs broker fees per shipment = 300. Transportation from Seattle to Detroit = 18.60 per hundred pounds. Need to warehouse at least four weeks of inventory in Detroit at a warehousing cost of 1.00 per cubic foot per month, to compensate for lead time uncertainty. Sheila must also figure the costs associated with committing corporate capital for holding inventory. She has spoken to some accountants, who typically use a corporate cost of capital rate of 15%. Cost of hedging currencybroker fees = 400 per shipment Additional administrative time due to international shipping = 4 hours per shipment 25 per hour (estimated) At least two five-day visits per year to travel to China to meet with supplier and provide updates on performance and shipping = 20,000 per year (estimated) The international sourcing costs must be absorbed by Sheila, as the supplier does not assume any of the additional estimated costs and invoice Sheila later, or build the costs into a revised unit price. Sheila feels that the U.S. supplier is probably less expensive, even though it quoted a higher price. Sheila also knows that this is a standard technology that is unlikely to change during the next three years, but which could be a contract that extends multiple years out. There is also a lot of hall talk amongst the engineers on her floor about next-generation automotive electronics, which will completely eliminate the need for wire harnesses, which will be replaced by electronic components that are smaller, lighter, and more reliable. She is unsure about how to calculate the total costs for each option, and she is even more unsure about how to factor these other variables into the decision. Based on this case, do you think international purchasing is more or less complex than domestic purchasing? Why? Is it worth the additional effort?The Global Sourcing Wire Harness Decision Sheila Austin, a buyer at Autolink, a Detroit-based producer of subassemblies for the automotive market, has sent out requests for quotations for a wiring harness to four prospective suppliers. Only two of the four suppliers indicated an interest in quoting the business: Original Wire (Auburn Hills, MI) and Happy Lucky Assemblies (HLA) of Guangdong Province, China. The estimated demand for the harnesses is 5,000 units a month. Both suppliers will incur some costs to retool for this particular harness. The harnesses will be prepackaged in 24 12 6-inch cartons. Each packaged unit weighs approximately 10 pounds. Quote 1 The first quote received is from Original Wire. Auburn Hills is about 20 miles from Autolinks corporate headquarters, so the quote was delivered in person. When Sheila went down to the lobby, she was greeted by the sales agent and an engineering representative. After the quote was handed over, the sales agent noted that engineering would be happy to work closely with Autolink in developing the unit and would also be interested in future business that might involve finding ways to reduce costs. The sales agent also noted that they were hungry for business, as they were losing a lot of customers to companies from China. The quote included unit price, tooling, and packaging. The quoted unit price does not include shipping costs. Original Wire requires no special warehousing of inventory, and daily deliveries from its manufacturing site directly to Autolinks assembly operations are possible. Original Wire Quote: Unit price = 30 Packing costs = 0.75 per unit Tooling = 6,000 one-time fixed charge Freight cost = 5.20 per hundred pounds Quote 2 The second quote received is from Happy Lucky Assemblies of Guangdong Province, China. The supplier must pack the harnesses in a container and ship via inland transportation to the port of Shanghai in China, have the shipment transferred to a container ship, ship material to Seattle, and then have material transported inland to Detroit. The quoted unit price does not include international shipping costs, which the buyer will assume. HLA Quote: Unit price = 19.50 Shipping lead time = Eight weeks Tooling = 3,000 In addition to the suppliers quote, Sheila must consider additional costs and information before preparing a comparison of the Chinese suppliers quotation: Each monthly shipment requires three 40-foot containers. Packing costs for containerization = 2 per unit. Cost of inland transportation to port of export = 200 per container. Freight forwarders fee = 100 per shipment (letter of credit, documentation, etc.). Cost of ocean transport = 4,000 per container. This has risen significantly in recent years due to a shortage of ocean freight capacity. Marine insurance = 0.50 per 100 of shipment. U.S. port handling charges = 1,200 per container. This fee has also risen considerably this year, due to increased security. Ports have also been complaining that the charges may increase in the future. Customs duty = 5% of unit cost. Customs broker fees per shipment = 300. Transportation from Seattle to Detroit = 18.60 per hundred pounds. Need to warehouse at least four weeks of inventory in Detroit at a warehousing cost of 1.00 per cubic foot per month, to compensate for lead time uncertainty. Sheila must also figure the costs associated with committing corporate capital for holding inventory. She has spoken to some accountants, who typically use a corporate cost of capital rate of 15%. Cost of hedging currencybroker fees = 400 per shipment Additional administrative time due to international shipping = 4 hours per shipment 25 per hour (estimated) At least two five-day visits per year to travel to China to meet with supplier and provide updates on performance and shipping = 20,000 per year (estimated) The international sourcing costs must be absorbed by Sheila, as the supplier does not assume any of the additional estimated costs and invoice Sheila later, or build the costs into a revised unit price. Sheila feels that the U.S. supplier is probably less expensive, even though it quoted a higher price. Sheila also knows that this is a standard technology that is unlikely to change during the next three years, but which could be a contract that extends multiple years out. There is also a lot of hall talk amongst the engineers on her floor about next-generation automotive electronics, which will completely eliminate the need for wire harnesses, which will be replaced by electronic components that are smaller, lighter, and more reliable. She is unsure about how to calculate the total costs for each option, and she is even more unsure about how to factor these other variables into the decision. Calculate the total cost per unit of purchasing from Original Wire.The Global Sourcing Wire Harness Decision Sheila Austin, a buyer at Autolink, a Detroit-based producer of subassemblies for the automotive market, has sent out requests for quotations for a wiring harness to four prospective suppliers. Only two of the four suppliers indicated an interest in quoting the business: Original Wire (Auburn Hills, MI) and Happy Lucky Assemblies (HLA) of Guangdong Province, China. The estimated demand for the harnesses is 5,000 units a month. Both suppliers will incur some costs to retool for this particular harness. The harnesses will be prepackaged in 24 12 6-inch cartons. Each packaged unit weighs approximately 10 pounds. Quote 1 The first quote received is from Original Wire. Auburn Hills is about 20 miles from Autolinks corporate headquarters, so the quote was delivered in person. When Sheila went down to the lobby, she was greeted by the sales agent and an engineering representative. After the quote was handed over, the sales agent noted that engineering would be happy to work closely with Autolink in developing the unit and would also be interested in future business that might involve finding ways to reduce costs. The sales agent also noted that they were hungry for business, as they were losing a lot of customers to companies from China. The quote included unit price, tooling, and packaging. The quoted unit price does not include shipping costs. Original Wire requires no special warehousing of inventory, and daily deliveries from its manufacturing site directly to Autolinks assembly operations are possible. Original Wire Quote: Unit price = 30 Packing costs = 0.75 per unit Tooling = 6,000 one-time fixed charge Freight cost = 5.20 per hundred pounds Quote 2 The second quote received is from Happy Lucky Assemblies of Guangdong Province, China. The supplier must pack the harnesses in a container and ship via inland transportation to the port of Shanghai in China, have the shipment transferred to a container ship, ship material to Seattle, and then have material transported inland to Detroit. The quoted unit price does not include international shipping costs, which the buyer will assume. HLA Quote: Unit price = 19.50 Shipping lead time = Eight weeks Tooling = 3,000 In addition to the suppliers quote, Sheila must consider additional costs and information before preparing a comparison of the Chinese suppliers quotation: Each monthly shipment requires three 40-foot containers. Packing costs for containerization = 2 per unit. Cost of inland transportation to port of export = 200 per container. Freight forwarders fee = 100 per shipment (letter of credit, documentation, etc.). Cost of ocean transport = 4,000 per container. This has risen significantly in recent years due to a shortage of ocean freight capacity. Marine insurance = 0.50 per 100 of shipment. U.S. port handling charges = 1,200 per container. This fee has also risen considerably this year, due to increased security. Ports have also been complaining that the charges may increase in the future. Customs duty = 5% of unit cost. Customs broker fees per shipment = 300. Transportation from Seattle to Detroit = 18.60 per hundred pounds. Need to warehouse at least four weeks of inventory in Detroit at a warehousing cost of 1.00 per cubic foot per month, to compensate for lead time uncertainty. Sheila must also figure the costs associated with committing corporate capital for holding inventory. She has spoken to some accountants, who typically use a corporate cost of capital rate of 15%. Cost of hedging currencybroker fees = 400 per shipment Additional administrative time due to international shipping = 4 hours per shipment 25 per hour (estimated) At least two five-day visits per year to travel to China to meet with supplier and provide updates on performance and shipping = 20,000 per year (estimated) The international sourcing costs must be absorbed by Sheila, as the supplier does not assume any of the additional estimated costs and invoice Sheila later, or build the costs into a revised unit price. Sheila feels that the U.S. supplier is probably less expensive, even though it quoted a higher price. Sheila also knows that this is a standard technology that is unlikely to change during the next three years, but which could be a contract that extends multiple years out. There is also a lot of hall talk amongst the engineers on her floor about next-generation automotive electronics, which will completely eliminate the need for wire harnesses, which will be replaced by electronic components that are smaller, lighter, and more reliable. She is unsure about how to calculate the total costs for each option, and she is even more unsure about how to factor these other variables into the decision. Based on the total cost per unit, which supplier should Sheila recommend?

- The Global Sourcing Wire Harness Decision Sheila Austin, a buyer at Autolink, a Detroit-based producer of subassemblies for the automotive market, has sent out requests for quotations for a wiring harness to four prospective suppliers. Only two of the four suppliers indicated an interest in quoting the business: Original Wire (Auburn Hills, MI) and Happy Lucky Assemblies (HLA) of Guangdong Province, China. The estimated demand for the harnesses is 5,000 units a month. Both suppliers will incur some costs to retool for this particular harness. The harnesses will be prepackaged in 24 12 6-inch cartons. Each packaged unit weighs approximately 10 pounds. Quote 1 The first quote received is from Original Wire. Auburn Hills is about 20 miles from Autolinks corporate headquarters, so the quote was delivered in person. When Sheila went down to the lobby, she was greeted by the sales agent and an engineering representative. After the quote was handed over, the sales agent noted that engineering would be happy to work closely with Autolink in developing the unit and would also be interested in future business that might involve finding ways to reduce costs. The sales agent also noted that they were hungry for business, as they were losing a lot of customers to companies from China. The quote included unit price, tooling, and packaging. The quoted unit price does not include shipping costs. Original Wire requires no special warehousing of inventory, and daily deliveries from its manufacturing site directly to Autolinks assembly operations are possible. Original Wire Quote: Unit price = 30 Packing costs = 0.75 per unit Tooling = 6,000 one-time fixed charge Freight cost = 5.20 per hundred pounds Quote 2 The second quote received is from Happy Lucky Assemblies of Guangdong Province, China. The supplier must pack the harnesses in a container and ship via inland transportation to the port of Shanghai in China, have the shipment transferred to a container ship, ship material to Seattle, and then have material transported inland to Detroit. The quoted unit price does not include international shipping costs, which the buyer will assume. HLA Quote: Unit price = 19.50 Shipping lead time = Eight weeks Tooling = 3,000 In addition to the suppliers quote, Sheila must consider additional costs and information before preparing a comparison of the Chinese suppliers quotation: Each monthly shipment requires three 40-foot containers. Packing costs for containerization = 2 per unit. Cost of inland transportation to port of export = 200 per container. Freight forwarders fee = 100 per shipment (letter of credit, documentation, etc.). Cost of ocean transport = 4,000 per container. This has risen significantly in recent years due to a shortage of ocean freight capacity. Marine insurance = 0.50 per 100 of shipment. U.S. port handling charges = 1,200 per container. This fee has also risen considerably this year, due to increased security. Ports have also been complaining that the charges may increase in the future. Customs duty = 5% of unit cost. Customs broker fees per shipment = 300. Transportation from Seattle to Detroit = 18.60 per hundred pounds. Need to warehouse at least four weeks of inventory in Detroit at a warehousing cost of 1.00 per cubic foot per month, to compensate for lead time uncertainty. Sheila must also figure the costs associated with committing corporate capital for holding inventory. She has spoken to some accountants, who typically use a corporate cost of capital rate of 15%. Cost of hedging currencybroker fees = 400 per shipment Additional administrative time due to international shipping = 4 hours per shipment 25 per hour (estimated) At least two five-day visits per year to travel to China to meet with supplier and provide updates on performance and shipping = 20,000 per year (estimated) The international sourcing costs must be absorbed by Sheila, as the supplier does not assume any of the additional estimated costs and invoice Sheila later, or build the costs into a revised unit price. Sheila feels that the U.S. supplier is probably less expensive, even though it quoted a higher price. Sheila also knows that this is a standard technology that is unlikely to change during the next three years, but which could be a contract that extends multiple years out. There is also a lot of hall talk amongst the engineers on her floor about next-generation automotive electronics, which will completely eliminate the need for wire harnesses, which will be replaced by electronic components that are smaller, lighter, and more reliable. She is unsure about how to calculate the total costs for each option, and she is even more unsure about how to factor these other variables into the decision. Calculate the total cost per unit of purchasing from Happy Lucky Assemblies.The Global Sourcing Wire Harness Decision Sheila Austin, a buyer at Autolink, a Detroit-based producer of subassemblies for the automotive market, has sent out requests for quotations for a wiring harness to four prospective suppliers. Only two of the four suppliers indicated an interest in quoting the business: Original Wire (Auburn Hills, MI) and Happy Lucky Assemblies (HLA) of Guangdong Province, China. The estimated demand for the harnesses is 5,000 units a month. Both suppliers will incur some costs to retool for this particular harness. The harnesses will be prepackaged in 24 12 6-inch cartons. Each packaged unit weighs approximately 10 pounds. Quote 1 The first quote received is from Original Wire. Auburn Hills is about 20 miles from Autolinks corporate headquarters, so the quote was delivered in person. When Sheila went down to the lobby, she was greeted by the sales agent and an engineering representative. After the quote was handed over, the sales agent noted that engineering would be happy to work closely with Autolink in developing the unit and would also be interested in future business that might involve finding ways to reduce costs. The sales agent also noted that they were hungry for business, as they were losing a lot of customers to companies from China. The quote included unit price, tooling, and packaging. The quoted unit price does not include shipping costs. Original Wire requires no special warehousing of inventory, and daily deliveries from its manufacturing site directly to Autolinks assembly operations are possible. Original Wire Quote: Unit price = 30 Packing costs = 0.75 per unit Tooling = 6,000 one-time fixed charge Freight cost = 5.20 per hundred pounds Quote 2 The second quote received is from Happy Lucky Assemblies of Guangdong Province, China. The supplier must pack the harnesses in a container and ship via inland transportation to the port of Shanghai in China, have the shipment transferred to a container ship, ship material to Seattle, and then have material transported inland to Detroit. The quoted unit price does not include international shipping costs, which the buyer will assume. HLA Quote: Unit price = 19.50 Shipping lead time = Eight weeks Tooling = 3,000 In addition to the suppliers quote, Sheila must consider additional costs and information before preparing a comparison of the Chinese suppliers quotation: Each monthly shipment requires three 40-foot containers. Packing costs for containerization = 2 per unit. Cost of inland transportation to port of export = 200 per container. Freight forwarders fee = 100 per shipment (letter of credit, documentation, etc.). Cost of ocean transport = 4,000 per container. This has risen significantly in recent years due to a shortage of ocean freight capacity. Marine insurance = 0.50 per 100 of shipment. U.S. port handling charges = 1,200 per container. This fee has also risen considerably this year, due to increased security. Ports have also been complaining that the charges may increase in the future. Customs duty = 5% of unit cost. Customs broker fees per shipment = 300. Transportation from Seattle to Detroit = 18.60 per hundred pounds. Need to warehouse at least four weeks of inventory in Detroit at a warehousing cost of 1.00 per cubic foot per month, to compensate for lead time uncertainty. Sheila must also figure the costs associated with committing corporate capital for holding inventory. She has spoken to some accountants, who typically use a corporate cost of capital rate of 15%. Cost of hedging currencybroker fees = 400 per shipment Additional administrative time due to international shipping = 4 hours per shipment 25 per hour (estimated) At least two five-day visits per year to travel to China to meet with supplier and provide updates on performance and shipping = 20,000 per year (estimated) The international sourcing costs must be absorbed by Sheila, as the supplier does not assume any of the additional estimated costs and invoice Sheila later, or build the costs into a revised unit price. Sheila feels that the U.S. supplier is probably less expensive, even though it quoted a higher price. Sheila also knows that this is a standard technology that is unlikely to change during the next three years, but which could be a contract that extends multiple years out. There is also a lot of hall talk amongst the engineers on her floor about next-generation automotive electronics, which will completely eliminate the need for wire harnesses, which will be replaced by electronic components that are smaller, lighter, and more reliable. She is unsure about how to calculate the total costs for each option, and she is even more unsure about how to factor these other variables into the decision. Are there any other issues besides cost that Sheila should evaluate?Based on the following table. Bid Ask EURUSD 1M FWD 7.05 7.34 EURUSD 2M FWD 14.99 15.15 EURUSD 3M FWD 22.57 23.05 EURUSD 4M FWD 30.25 30.55 EURUSD 5M FWD 38.03 38.43 EURUSD 6M FWD 45.91 47.2 EUR/USD Spot 1.1411 1.1422 What is the average annualized forward premium/discount for the EUR if you use the 3M forward contract (Format for answer: X.XX% or –X.XX%)

- You own Athleticon, which manufactures athletic wear. Your new contract with Atlanta United, a professional soccer team, allows Athleticon to be the sole suppler of athletic wear with the “Atlanta United” logo. No one lese can manufacture athletic wear with the “Atlanta United” logo. What do you think will be Athleticon’s level of profitability on the sale of “Atlanta United” athletic wear? Explain why. Your contract with Atlanta United only lasts 3 years. It was not renewed. Other firms can now manufacture athletic wear with the “Atlanta United” logo 2. What would you expect to happen to the price of “Atlanta United” athletic wear? Explain why.The Gray Ferrari I t all got started when Robert L. Johnson had dinner at Mr. K’s Chinese restaurant with Michael Jordan of the Washington Wizards and David Falk, the leading sports agent. When the discussion turned to cars, Johnson mentioned his interest in getting a Ferrari. Both Falk and Jordan recommended their respective dealers but Johnson found the going tough. Only a select number of Ferraris are made annually, and the automaker limits how many are sold through U.S. dealers to about 1,000 units. In practice, anyone placing an order would have to wait over two years for delivery for a car that would cost $200,000 to $300,000 depending on the model. A New Jersey dealer had a Ferrari available, but, at $300,000, Johnson felt the price was too high. Michael Jordan’s dealer had a 360 Modena available for $160,000. Although he bought it, it was not exactly what he had wanted because the Modena is not a convertible. Franco Nuschese, the owner of Georgetown’s…A software company is considering outsourcing one of its software products to India for maintenance and support services. The annual costs in the U.S. and India are as follows: It will cost $90,000 o train the personnel in India to take over the maintenance and support service that can be amortized over two years. The product will require management and supervision from the U.S. at $40,000 per year and it costs $5,000 per year to administer the contract. a. What are the total costs of outsourcing this service compared to the U.S. costs? b. What risks are associated with outsourcing this service? c. Should the product be outsourced to India?

- Case: AGUSTINE SCHOOL PROM Many children of high-income families in Cabanatuan City and Nueva Ecija are sent by their parents to study in exclusive schools in Manila. Unmindful of the costs, the parents maintain the view that real education has a high price tag. The public elementary schools as well as the public high schools are perceived, rightly or wrongly, as not being able to deliver the quality of educational services needed. Even if this is so, enrolment in public schools has swelled to more than 60 students per class. The rule in public schools, except college, is to accommodate everybody. Currently, the opening of Montessori and private elementary schools in the area has provided some relief to parents who want quality education for their children. The older private schools are now competing with the new Montessori and private elementary schools which charge higher tuition fees. Miss Jana Agustin is a teacher at the same time marketing officer to promote the school. She…Ay 1 - mcq Company X and Company Y Ahrens Vitamins. Inc., have high market commonality, both geographically and in the market segments in which they compete. Company X, the number two firm in the industry, has undertaken a major strategic attack upon Company Y, the market leader. Which of the following statements is MOST likely to be true? A. Company Y will respond after a long delay as the nutrition supplement industry is a slow-cycle industry. B. As the market leader, Company Y has little to fear from an attack by Company X and will not expend organizational slack ana major response. C. Company Y will respond aggressively because of the high multimarket contact between both companies. D. Company Y will not respond aggressively since this is a strategic move and not a tactical action.7-A US company operates its business in Oman but the company is located and registered in US. US company purchased goods from its subsidiary company in Oman. If the US company has to make payment to Oman company, which price method from the below options it can follow? a. Purchase price b. Selling price c. Goods purchased cost d. None of the options