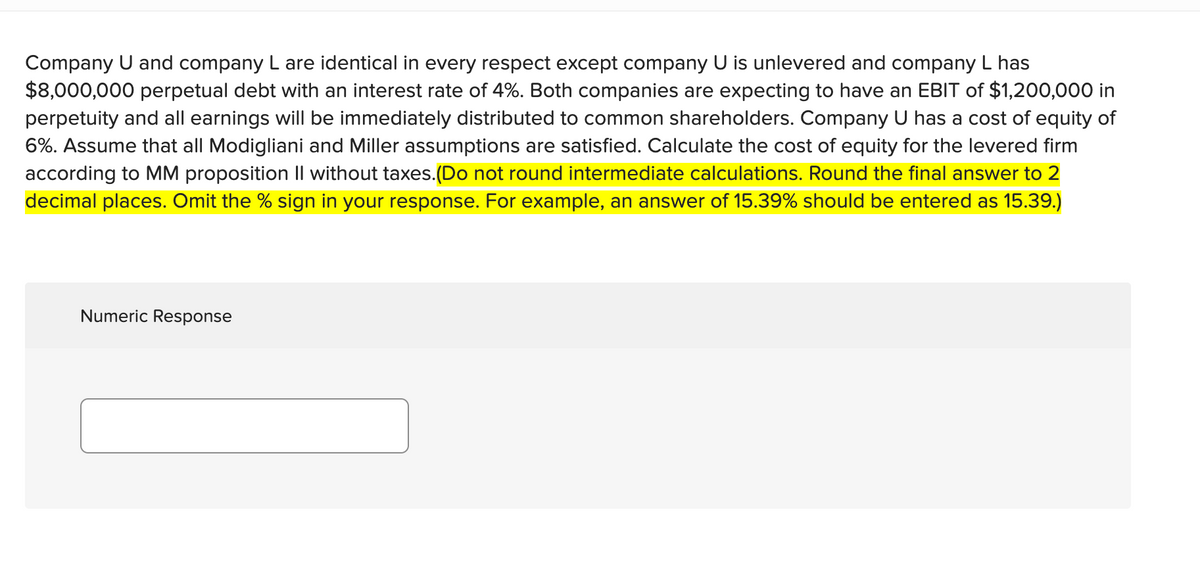

Company U and company L are identical in every respect except company U is unlevered and company L has $8,000,000 perpetual debt with an interest rate of 4%. Both companies are expecting to have an EBIT of $1,200,000 in perpetuity and all earnings will be immediately distributed to common shareholders. Company U has a cost of equity of 6%. Assume that all Modigliani and Miller assumptions are satisfied. Calculate the cost of equity for the levered firm according to MM proposition Il without taxes.(Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit the % sign in your response. For example, an answer of 15.39% should be entered as 15.39.)

Company U and company L are identical in every respect except company U is unlevered and company L has $8,000,000 perpetual debt with an interest rate of 4%. Both companies are expecting to have an EBIT of $1,200,000 in perpetuity and all earnings will be immediately distributed to common shareholders. Company U has a cost of equity of 6%. Assume that all Modigliani and Miller assumptions are satisfied. Calculate the cost of equity for the levered firm according to MM proposition Il without taxes.(Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit the % sign in your response. For example, an answer of 15.39% should be entered as 15.39.)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter17: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 7P

Related questions

Question

26) Can i please get help with this practice question.

Transcribed Image Text:Company U and company L are identical in every respect except company U is unlevered and company L has

$8,000,000 perpetual debt with an interest rate of 4%. Both companies are expecting to have an EBIT of $1,200,000 in

perpetuity and all earnings will be immediately distributed to common shareholders. Company U has a cost of equity of

6%. Assume that all Modigliani and Miller assumptions are satisfied. Calculate the cost of equity for the levered firm

according to MM proposition Il without taxes.(Do not round intermediate calculations. Round the final answer to 2

decimal places. Omit the % sign in your response. For example, an answer of 15.39% should be entered as 15.39.)

Numeric Response

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning