Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 24, Problem 1P

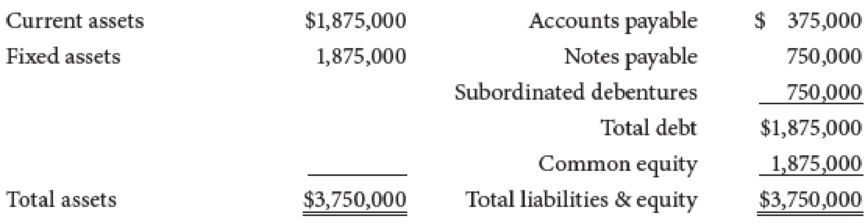

Southwestern Wear Inc. has the following

The trustee’s costs total $281,250, and the firm has no accrued taxes or wages. The debentures are subordinated only to the notes payable. If the firm goes bankrupt and liquidates, how much will each class of investors receive if a total of $2.5 million is received from sale of the assets?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

he Morrit Corporation has $600,000 of debt outstanding, and it pays an interest rate of 8% annually. Morrit’s annual sales are $3 million, its average tax rate is 25%, and its net profit margin on sales is 3%. If the company does not maintain a TIE ratio of at least 5 to 1, then its bank will refuse to renew the loan, and bankruptcy will result. What is Morrit’s TIE ratio?

Woods Construction Corp. has no debt and expects to earn annual NOP of $6,400,000 indefinitely. Woods has a required return on assets of 13%, a corporate tax rate of 23%, and there are no taxes on dividends or interest at the personal level. In any year, there is a 20% chance that Woods will go bankrupt. If bankruptcy occurs it will result in $11,000,000 worth of direct and indirect costs that would be discounted at the required return for assets.

a. What is the present value of expected bankruptcy costs for Woods?

The present value of expected bankruptcy costs for Woods is

$ ?. (Round to the nearest dollar.)

b. What is the firm value for Woods?

The firm value for Woods is $? (Round to the nearest dollar.)

c. What is the revised firm value for Woods if its shareholders face a 28% personal tax rate on stock-related income?

If its shareholders face a 28% personal tax rate on stock-related income, the revised firm value for Woods is $ ? (Round to the nearest…

The Morrit Corporation has $600,000 of debt outstanding, and it paysan interest rate of 8% annually. Morrit’s annual sales are $3 million, itsaverage tax rate is 40%, and its net profit margin on sales is 3%. If thecompany does not maintain a TIE ratio of at least 5 to 1, then its bankwill refuse to renew the loan, and bankruptcy will result. What is Morrit’sTIE ratio?

Chapter 24 Solutions

Financial Management: Theory & Practice

Ch. 24 - Prob. 1QCh. 24 - Why do creditors usually accept a plan for...Ch. 24 - Would it be a sound rule to liquidate whenever the...Ch. 24 - Why do liquidations usually result in losses for...Ch. 24 - Prob. 5QCh. 24 - Southwestern Wear Inc. has the following balance...Ch. 24 - At the time it defaulted on its interest payments...Ch. 24 - Prob. 4PCh. 24 - Prob. 5SPCh. 24 - Prob. 1MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Morrit Corporation has $960,000 of debt outstanding, and it pays an interest rate of 9% annually. Morrit's annual sales are $6 million, its average tax rate is 25%, and its net profit margin on sales is 4%. If the company does not maintain a TIE ratio of at least 3 to 1, then its bank will refuse to renew the loan, and bankruptcy will result. What is Morrit's TIE ratio? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardAlumbat Corporation has $800,000 of debt outstanding, and it pays an interest rate of 10 percentannually on its bank loan. Alumbat’s annual sales are $3,200,000, its average tax rate is 40 percent,and its net profit margin on sales is 6 percent. If the company does not maintain a TIE ratio of at least 4times, its bank will refuse to renew its loan, and bankruptcy will result. What is Alumbat’s current TIEratio?arrow_forwardThaler Inc. holds a $1 million receivable ($800,000 principal, $200,000 accrued interest) from Einhorn Industries, and agrees to settle the receivable outright for $900,000 given Einhorn’s difficult financial situation. How much gain or loss should Thaler recognize on this troubled debt restructuring?arrow_forward

- Seal Company is experiencing financial difficulty and is negotiating debt restructuring with its creditor to relieve its financial stress. Seal has a P2,500,000 note payable to United Bank. The bank accepted an equity interest in Seal Company in the form of 200,000 ordinary shares quoted at P12 per share. The par value is P10 per share. The fair value of the note payable on the date of restructuring is P2,200,000. What amount should be recognized as gain from debt extinguishment as a result of the "equity swap”? a. 400,000 b. 100,000 c. 500,000 d. 200,000arrow_forwardIf the Equity of NRWM, Inc. is $17,000,000; and the company owes $2,000,000 in unpaid payroll and owes $8,000,000 to the bank on a credit line, what is the FAIR MARKET VALUE of the assets it owns?arrow_forwardBaguio Company is experiencing financial difficulty and is renegotiating debt restructuring with the creditor to relieve its financiaal stress. The entity has P5,000,000 note payable to First Bank. The bank is considering two alternatives. Acceptance of land owned by the entity valued at P4,000,000 and carried at its historical cost of P2,800,000 Acceptance of an equity interest in the entity in the form of 40,000 shares with fair value of P120 per share. The share capital has a par value of P100 per share. Required: Prepare journal entry that Baguio Company would make under each alternative.arrow_forward

- Hominy, Inc., has debt outstanding with a face value of $5 million. The value of the firm if it were entirely financed by equity would be $18.2 million. The company also has 430, 000 shares of stock outstanding that sell at a price of $33 per share. The corporate tax rate is 22 percent. What is the decrease in the value of the company due to expected bankruptcy costs? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar, e. g., 1,234,567.)arrow_forwardAlum Co. has $800,000 of debt outstanding, and it pays an interest rate of 10% annually on its bank loan. Alum’s annual sales are $3,200,000, its average tax rate is 40%, and its net profit margin on sales is 6%. If the company does not maintain a times interest earned ratio of at least 4 times, its bank will refuse to renew its loan, and bankruptcy will result. What is Alum Co.’s current times interest earned ratio?arrow_forwardKing, Incorporated, has debt outstanding with a face value of $4.3 million. The value of the firm if it were entirely financed by equity would be $17.9 million. The company also has 320,000 shares of stock outstanding that sell at a price of $44 per share. The corporate tax rate is 21 percent. What is the decrease in the value of the company due to expected bankruptcy costs? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.)arrow_forward

- Swindle Company is experiencing financial difficulty and is negotiating debt restructuring with its creditor to relieve its financial stress. Swindle has a $3,500,000 bank loan payable with Love Bank. The bank accepted an equity interest in Swindle Company in the form of 300,000 ordinary shares quoted at $12 per share. The par value is $10 per share. The fair value of the bank loan payable on the date of restructuring is $3,200,000. What amount should be recognized as gain from debt extinguishment as a result of the equity swap?arrow_forwardAPA Company Owes the ABC Corporation P60,000 on account, which is secured by accounts receivable with a book value of P50,000. The unsecured portion is considered a claim under the bankruptcy law, the company has filed for bankruptcy. Its statement of affairs lists the accounts receivable securing the ABC account with an estimated realizable value of P45,000. If the dividend to general unsecured creditors is 80%, how much can ABC expect to receive?arrow_forwardRobin Corp. had the following in 2020: Taxable Income: $330,000 Federal income tax: $69,300 Interest on state gov’t (muni) bond: $5,000 Interest on corporate bond: $10,000 Meals expense (total): $3,000 Key person life insurance premiums: $3,500 Key person life insurance proceeds: $130,000 Ordinary & necessary business expenses $250,000 Dividends (from a less-than-20%-owned US corp.): $35,000 What is Robin Corp.’s current E&P? Assume that there is no cash surrender value on the life insurance policy?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

How Bankruptcy Works; Author: Two Cents;https://www.youtube.com/watch?v=tpI0XWjIsqI;License: Standard Youtube License