Company

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11E: On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an...

Related questions

Question

Please Complete all requirement and Do Not Give solve In Image format

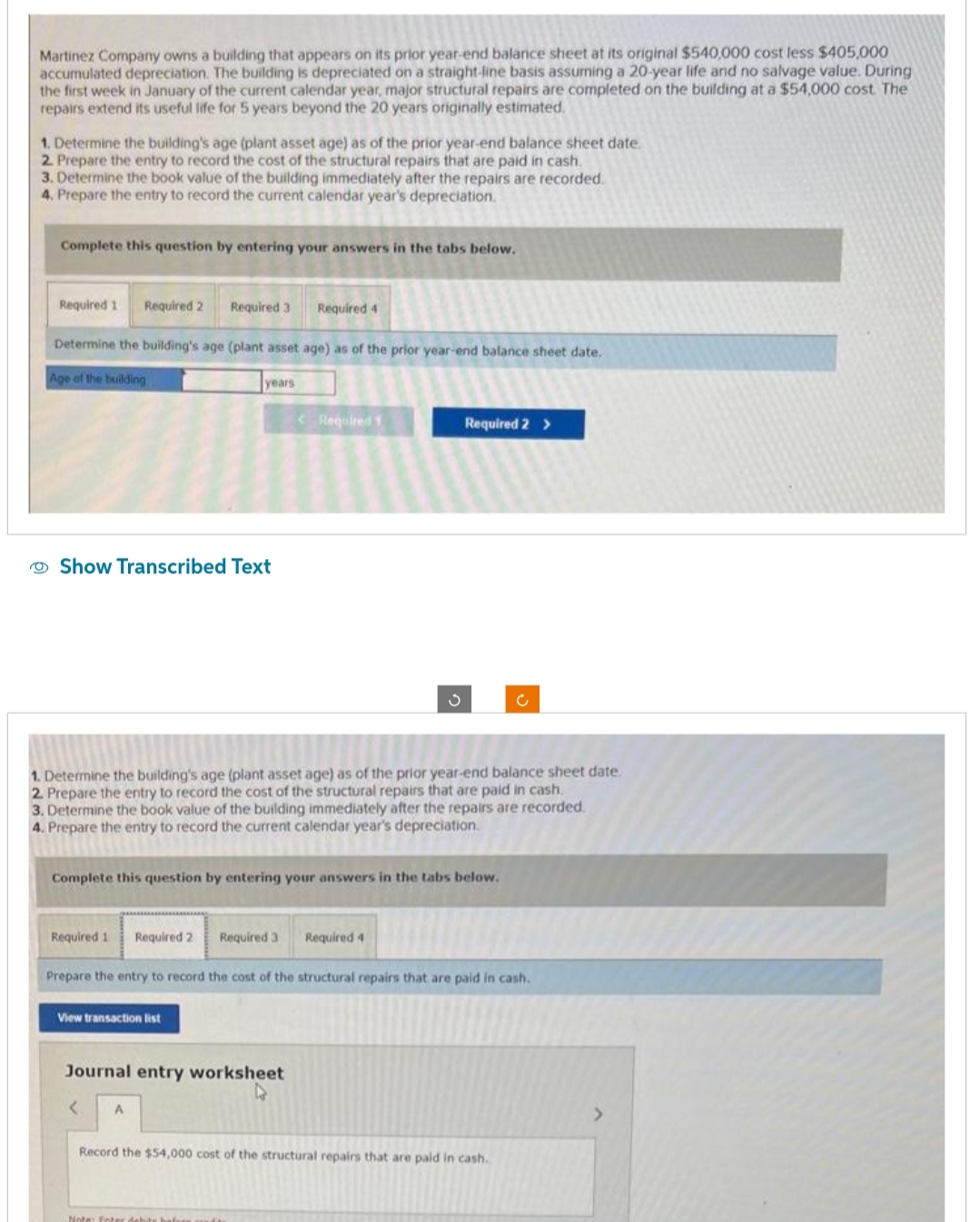

Transcribed Image Text:Martinez Company owns a building that appears on its prior year-end balance sheet at its original $540,000 cost less $405,000

accumulated depreciation. The building is depreciated on a straight-line basis assuming a 20-year life and no salvage value. During

the first week in January of the current calendar year, major structural repairs are completed on the building at a $54,000 cost. The

repairs extend its useful life for 5 years beyond the 20 years originally estimated.

1. Determine the building's age (plant asset age) as of the prior year-end balance sheet date.

2. Prepare the entry to record the cost of the structural repairs that are paid in cash.

3. Determine the book value of the building immediately after the repairs are recorded.

4. Prepare the entry to record the current calendar year's depreciation.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3 Required 4

Determine the building's age (plant asset age) as of the prior year-end balance sheet date.

Age of the building

Show Transcribed Text

Required 1

years

1. Determine the building's age (plant asset age) as of the prior year-end balance sheet date.

2. Prepare the entry to record the cost of the structural repairs that are paid in cash.

3. Determine the book value of the building immediately after the repairs are recorded.

4. Prepare the entry to record the current calendar year's depreciation.

Complete this question by entering your answers in the tabs below.

Required 2

View transaction list

< A

Required 1

Journal entry worksheet

4

3

Required 3 Required 4

Prepare the entry to record the cost of the structural repairs that are paid in cash.

Required 2 >

Note: Enter debit

c

Record the $54,000 cost of the structural repairs that are paid in cash.

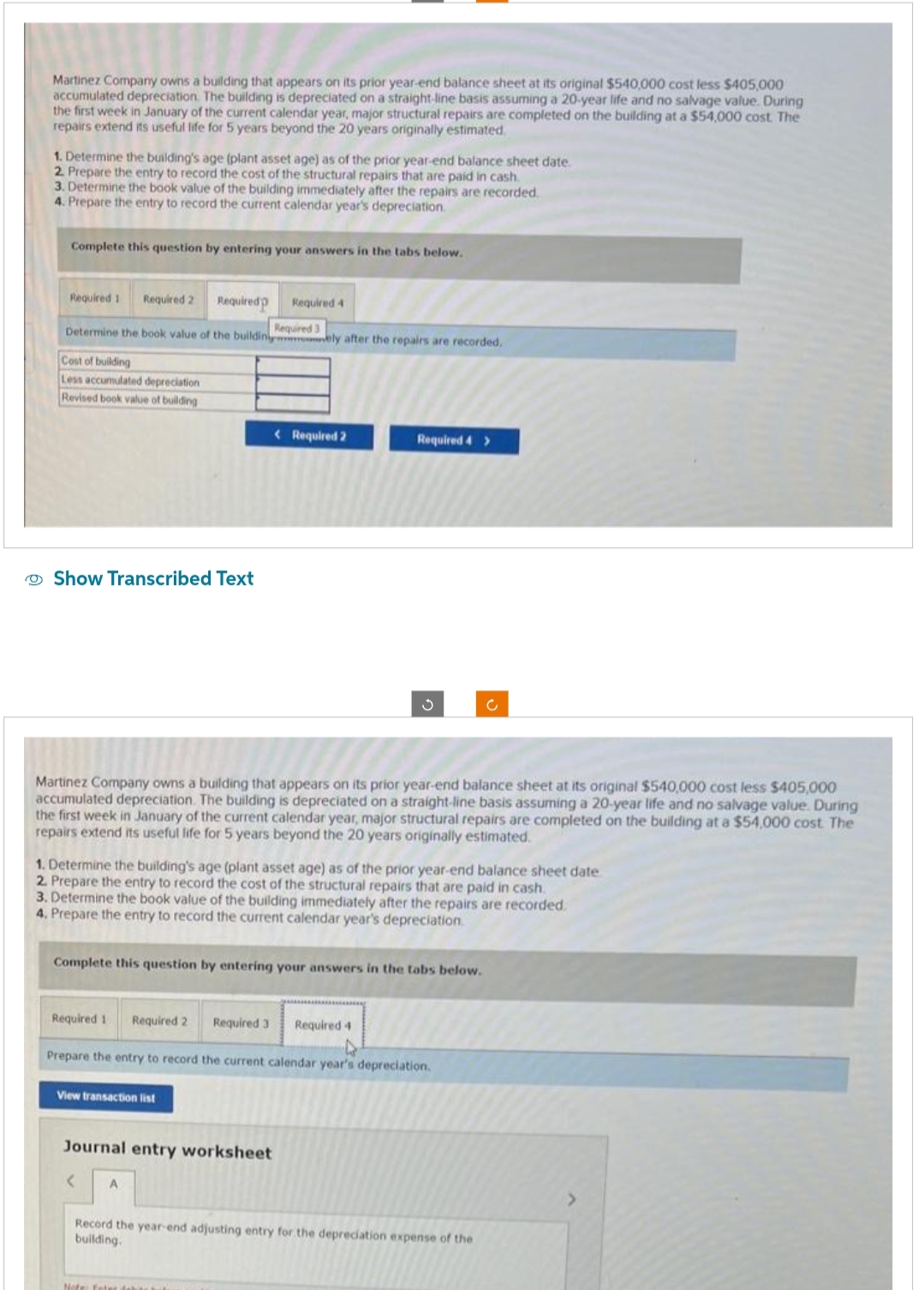

Transcribed Image Text:Martinez Company owns a building that appears on its prior year-end balance sheet at its original $540,000 cost less $405,000

accumulated depreciation. The building is depreciated on a straight-line basis assuming a 20-year life and no salvage value. During

the first week in January of the current calendar year, major structural repairs are completed on the building at a $54,000 cost. The

repairs extend its useful life for 5 years beyond the 20 years originally estimated.

1. Determine the building's age (plant asset age) as of the prior year-end balance sheet date.

2. Prepare the entry to record the cost of the structural repairs that are paid in cash.

3. Determine the book value of the building immediately after the repairs are recorded.

4. Prepare the entry to record the current calendar year's depreciation.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Required p Required 4

Required 3

Determine the book value of the buildingmely after the repairs are recorded.

Cost of building

Less accumulated depreciation

Revised book value of building

Show Transcribed Text

Martinez Company owns a building that appears on its prior year-end balance sheet at its original $540,000 cost less $405,000

accumulated depreciation. The building is depreciated on a straight-line basis assuming a 20-year life and no salvage value. During

the first week in January of the current calendar year, major structural repairs are completed on the building at a $54,000 cost. The

repairs extend its useful life for 5 years beyond the 20 years originally estimated.

Required 11

< Required 2

1. Determine the building's age (plant asset age) as of the prior year-end balance sheet date

2. Prepare the entry to record the cost of the structural repairs that are paid in cash.

3. Determine the book value of the building immediately after the repairs are recorded.

4. Prepare the entry to record the current calendar year's depreciation.

Complete this question by entering your answers in the tabs below.

Required 2 Required 31 Required 4

View transaction list

Required 4 >

< A

3

Prepare the entry to record the current calendar year's depreciation.

Journal entry worksheet

Note: Feter debts bat

Record the year-end adjusting entry for the depreciation expense of the

building.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College