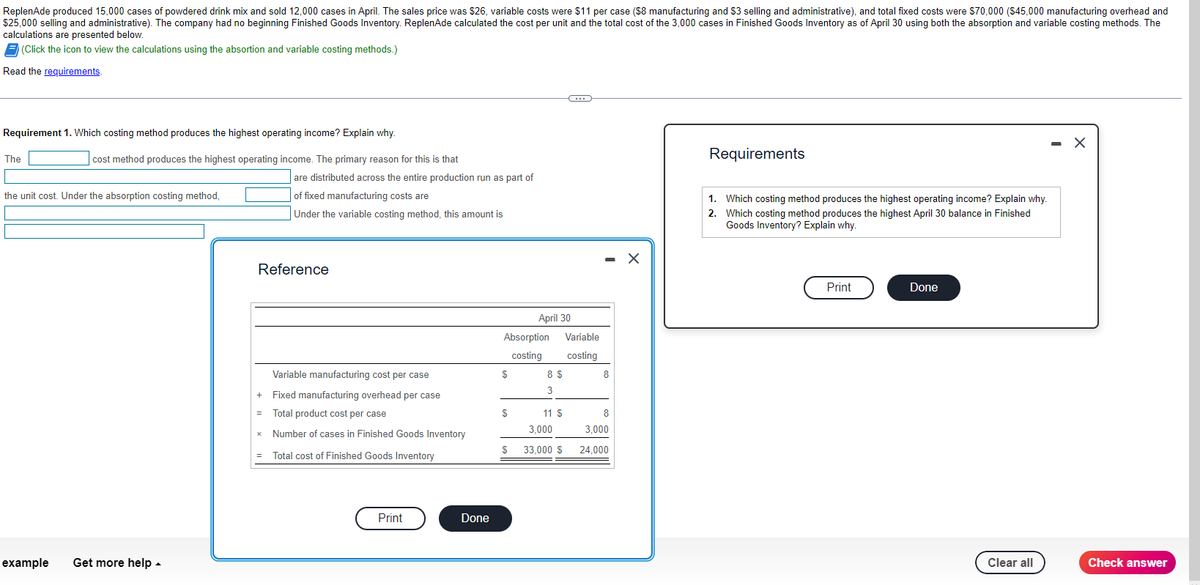

ReplenAde produced 15.000 cases of powdered drink mix and sold 12.000 cases in April. The sales price was $26, variable costs were $11 per case ($8 manufacturing and $3 selling and administrative), and total fixed costs were $70,000 ($45,000 manufacturing overhead and $25,000 selling and administrative). The company had no beginning Finished Goods Inventory. ReplenAde calculated the cost per unit and the total cost of the 3,000 cases in Finished Goods Inventory as of April 30 using both the absorption and variable costing methods. The calculations are presented below. (Click the icon to view the calculations using the absortion and variable costing methods.) Read the requirements. Requirement 1. Which costing method produces the highest operating income? Explain why. The cost method produces the highest operating income. The primary reason for this is that the unit cost. Under the absorption costing method, are distributed across the entire production run as part of of fixed manufacturing costs are Under the variable costing method, this amount is Reference Variable manufacturing cost per case Fixed manufacturing overhead per case + = Total product cost per case x Number of cases in Finished Goods Inventory = Total cost of Finished Goods Inventory Print Done April 30 Absorption Variable costing costing $ $ $ 8 $ 3 11 S 3,000 33,000 $ - X 8 X 8 3,000 24,000 Requirements 1. Which costing method produces the highest operating income? Explain why. 2. Which costing method produces the highest April 30 balance in Finished Goods Inventory? Explain why. Print Done - X

ReplenAde produced 15.000 cases of powdered drink mix and sold 12.000 cases in April. The sales price was $26, variable costs were $11 per case ($8 manufacturing and $3 selling and administrative), and total fixed costs were $70,000 ($45,000 manufacturing overhead and $25,000 selling and administrative). The company had no beginning Finished Goods Inventory. ReplenAde calculated the cost per unit and the total cost of the 3,000 cases in Finished Goods Inventory as of April 30 using both the absorption and variable costing methods. The calculations are presented below. (Click the icon to view the calculations using the absortion and variable costing methods.) Read the requirements. Requirement 1. Which costing method produces the highest operating income? Explain why. The cost method produces the highest operating income. The primary reason for this is that the unit cost. Under the absorption costing method, are distributed across the entire production run as part of of fixed manufacturing costs are Under the variable costing method, this amount is Reference Variable manufacturing cost per case Fixed manufacturing overhead per case + = Total product cost per case x Number of cases in Finished Goods Inventory = Total cost of Finished Goods Inventory Print Done April 30 Absorption Variable costing costing $ $ $ 8 $ 3 11 S 3,000 33,000 $ - X 8 X 8 3,000 24,000 Requirements 1. Which costing method produces the highest operating income? Explain why. 2. Which costing method produces the highest April 30 balance in Finished Goods Inventory? Explain why. Print Done - X

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 3CE: Pattison Products, Inc., began operations in October and manufactured 40,000 units during the month...

Related questions

Question

Complete all requirements

<><>

Transcribed Image Text:ReplenAde produced 15,000 cases of powdered drink mix and sold 12,000 cases in April. The sales price was $26, variable costs were $11 per case ($8 manufacturing and $3 selling and administrative), and total fixed costs were $70,000 ($45,000 manufacturing overhead and

$25,000 selling and administrative). The company had no beginning Finished Goods Inventory. ReplenAde calculated the cost per unit and the total cost of the 3,000 cases in Finished Goods Inventory as of April 30 using both the absorption and variable costing methods. The

calculations are presented below.

(Click the icon to view the calculations using the absortion and variable costing methods.)

Read the requirements.

Requirement 1. Which costing method produces the highest operating income? Explain why.

The

cost method produces the highest operating income. The primary reason for this is that

the unit cost. Under the absorption costing method,

example Get more help.

are distributed across the entire production run as part of

of fixed manufacturing costs are

Under the variable costing method, this amount is

Reference

Variable manufacturing cost per case

Fixed manufacturing overhead per case

+

= Total product cost per case

x

Number of cases in Finished Goods Inventory

=

Total cost of Finished Goods Inventory

Print

Done

April 30

Absorption Variable

costing costing

$

$

$

8 $

3

C

11 S

3,000

33,000 $

- X

8

8

3,000

24,000

Requirements

1. Which costing method produces the highest operating income? Explain why.

2. Which costing method produces the highest April 30 balance in Finished

Goods Inventory? Explain why.

Print

Done

Clear all

X

Check answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,