1. What is the Journal Entry for: August 4,20X5 purchased fabric and aluminum to be used in the manufacturing process. The purchase price was $4000 on account. A. Raw Materials Inventory 4,000 Cash 4000 B. Accounts Payable 4000 Raw Materials Inventory 4000 C. Raw Materials Inventory 4000 Accounts Payable. 4000 D. Cash 4000 Raw Materials Inventory 4000 2. How much do you need to DEBIT the work-in-Process account for the following transaction? Aug 8,20X5 - Transferred 60% of the raw materials purchased on August 4 into production:

1. What is the Journal Entry for: August 4,20X5 purchased fabric and aluminum to be used in the manufacturing process. The purchase price was $4000 on account. A. Raw Materials Inventory 4,000 Cash 4000 B. Accounts Payable 4000 Raw Materials Inventory 4000 C. Raw Materials Inventory 4000 Accounts Payable. 4000 D. Cash 4000 Raw Materials Inventory 4000 2. How much do you need to DEBIT the work-in-Process account for the following transaction? Aug 8,20X5 - Transferred 60% of the raw materials purchased on August 4 into production:

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter2: Accounting For Materials

Section: Chapter Questions

Problem 15E: Kenkel, Ltd. uses backflush costing to account for its manufacturing costs. The trigger points are...

Related questions

Question

100%

1. What is the

August 4,20X5 purchased fabric and aluminum to be used in the manufacturing process. The purchase price was $4000 on account.

A. Raw Materials Inventory 4,000

Cash 4000

B. Accounts Payable 4000

Raw Materials Inventory 4000

C. Raw Materials Inventory 4000

Accounts Payable. 4000

D. Cash 4000

Raw Materials Inventory 4000

2. How much do you need to DEBIT the work-in-Process account for the following transaction?

Aug 8,20X5 - Transferred 60% of the raw materials purchased on August 4 into production:

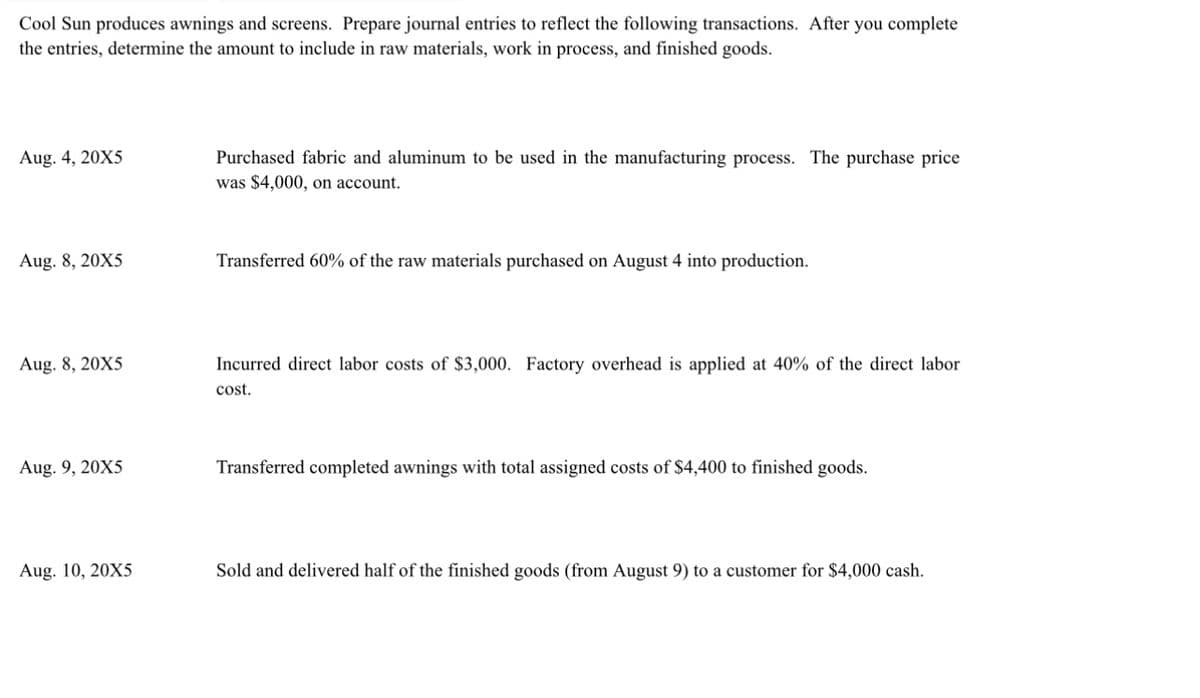

Transcribed Image Text:Cool Sun produces awnings and screens. Prepare journal entries to reflect the following transactions. After you complete

the entries, determine the amount to include in raw materials, work in process, and finished goods.

Aug. 4, 20X5

Aug. 8, 20X5

Aug. 8, 20X5

Aug. 9, 20X5

Aug. 10, 20X5

Purchased fabric and aluminum to be used in the manufacturing process. The purchase price

was $4,000, on account.

Transferred 60% of the raw materials purchased on August 4 into production.

Incurred direct labor costs of $3,000. Factory overhead is applied at 40% of the direct labor

cost.

Transferred completed awnings with total assigned costs of $4,400 to finished goods.

Sold and delivered half of the finished goods (from August 9) to a customer for $4,000 cash.

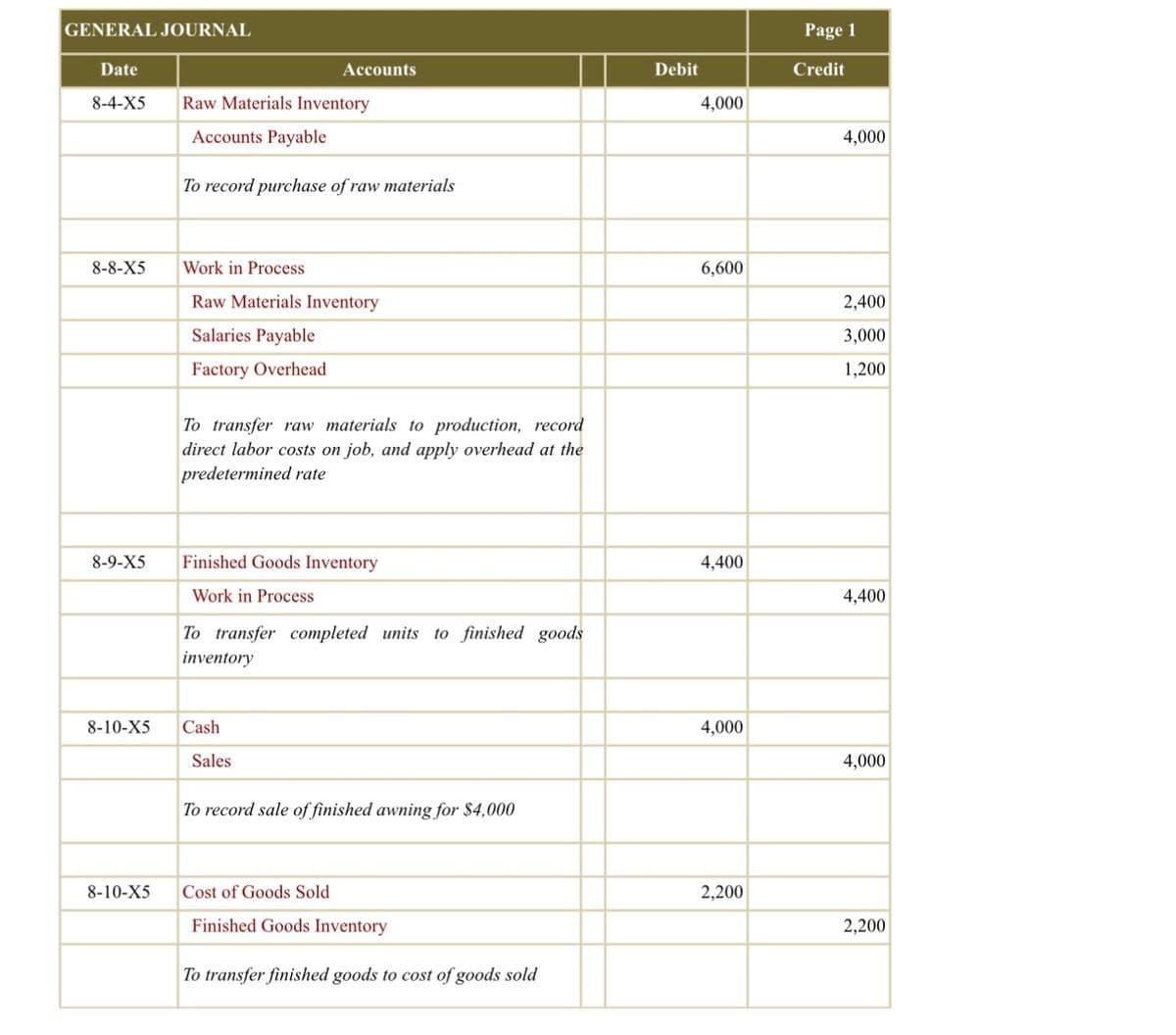

Transcribed Image Text:GENERAL JOURNAL

Date

8-4-X5

8-8-X5

8-9-X5

8-10-X5

Raw Materials Inventory

Accounts Payable

To record purchase of raw materials

Accounts

Work in Process

Raw Materials Inventory

Salaries Payable

Factory Overhead

To transfer raw materials to production, record

direct labor costs on job, and apply overhead at the

predetermined rate

Finished Goods Inventory

Work in Process

8-10-X5 Cash

Sales

To transfer completed units to finished goods

inventory

To record sale of finished awning for $4,000

Cost of Goods Sold

Finished Goods Inventory

To transfer finished goods to cost of goods sold

Debit

4,000

6,600

4,400

4,000

2,200

Page 1

Credit

4,000

2,400

3,000

1,200

4,400

4,000

2,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning