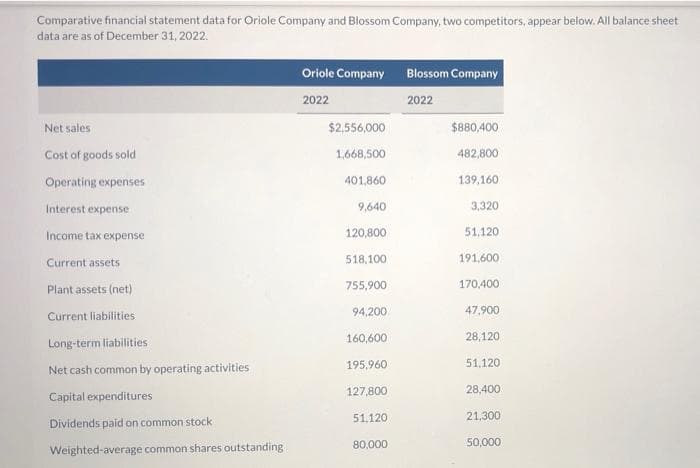

Comparative financial statement data for Oriole Company and Blossom Company, two competitors, appear below. All balance sheet data are as of December 31, 2022. Net sales. Cost of goods sold Operating expenses Interest expense Income tax expense Current assets Plant assets (net) Current liabilities Long-term liabilities. Net cash common by operating activities Capital expenditures Dividends paid on common stock Weighted-average common shares outstanding Oriole Company Blossom Company 2022 2022 $2,556,000 1,668,500 401,860 9,640 120,800 518,100 755,900 94,200 160,600 195,960 127,800 51,120 80,000 $880,400 482,800 139,160 3,320 51,120 191,600 170,400 47,900 28,120 51,120. 28,400 21,300 50,000

Comparative financial statement data for Oriole Company and Blossom Company, two competitors, appear below. All balance sheet data are as of December 31, 2022. Net sales. Cost of goods sold Operating expenses Interest expense Income tax expense Current assets Plant assets (net) Current liabilities Long-term liabilities. Net cash common by operating activities Capital expenditures Dividends paid on common stock Weighted-average common shares outstanding Oriole Company Blossom Company 2022 2022 $2,556,000 1,668,500 401,860 9,640 120,800 518,100 755,900 94,200 160,600 195,960 127,800 51,120 80,000 $880,400 482,800 139,160 3,320 51,120 191,600 170,400 47,900 28,120 51,120. 28,400 21,300 50,000

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 21BEA: The income statement, statement of retained earnings, and balance sheet for Somerville Company are...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:Comparative financial statement data for Oriole Company and Blossom Company, two competitors, appear below. All balance sheet

data are as of December 31, 2022.

Net sales

Cost of goods sold

Operating expenses

Interest expense

Income tax expense

Current assets

Plant assets (net)

Current liabilities

Long-term liabilities.

Net cash common by operating activities

Capital expenditures

Dividends paid on common stock

Weighted-average common shares outstanding

Oriole Company

2022

$2,556,000

1,668,500

401,860

9,640

120,800

518,100

755,900

94,200

160,600

195,960

127,800

51.120

80,000

Blossom Company

2022

$880,400

482,800

139,160

3,320

51,120

191,600

170,400

47,900

28,120

51,120

28,400

21,300

50,000

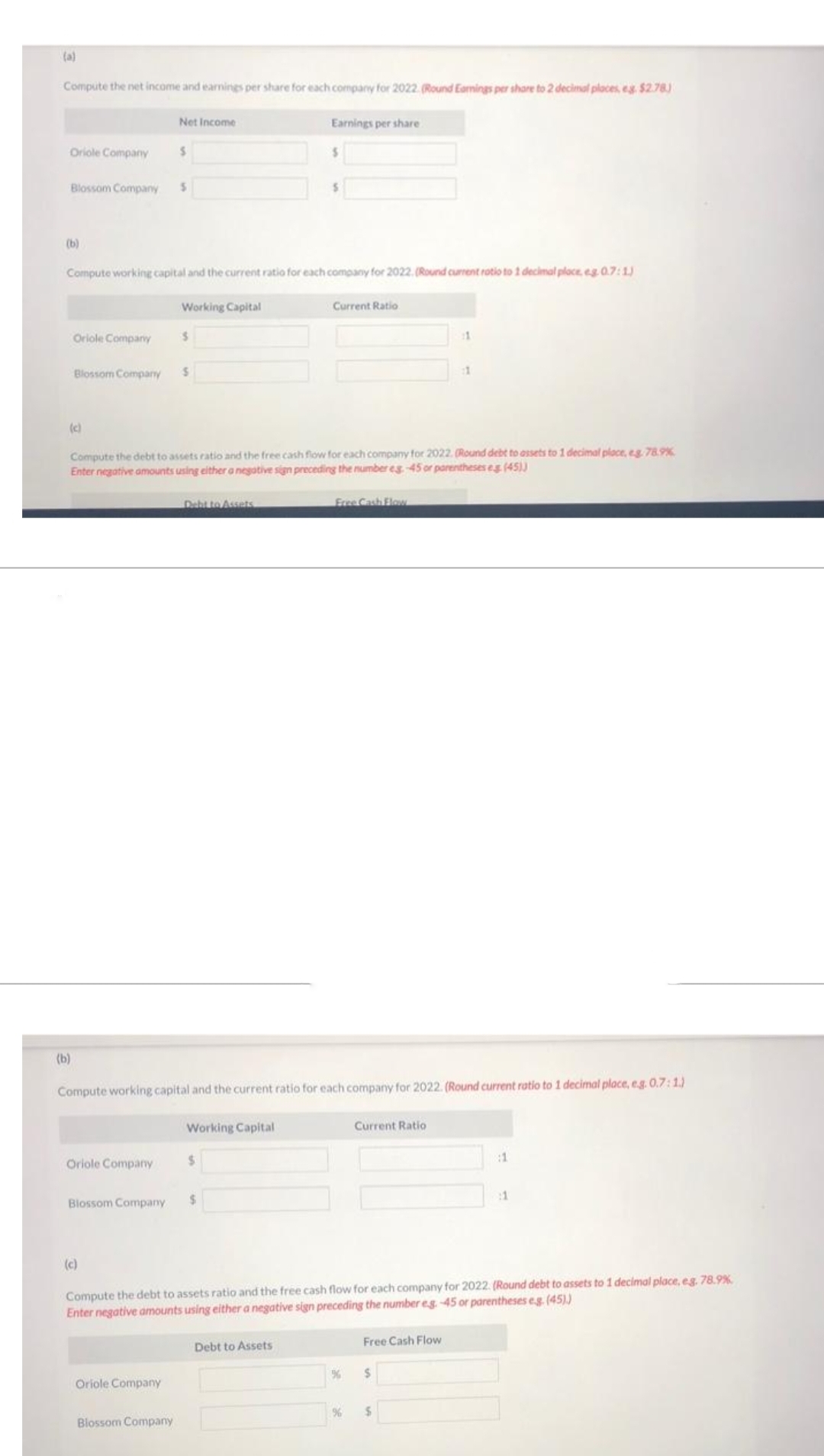

Transcribed Image Text:(a)

Compute the net income and earnings per share for each company for 2022. (Round Earnings per share to 2 decimal places, eg. $2.78)

Earnings per share

Oriole Company

(b)

Blossom Company 5

Compute working capital and the current ratio for each company for 2022. (Round current rotio to 1 decimal place, eg. 07:1)

Working Capital

Oriole Company

Blossom Company

(c)

(b)

Oriole Company

Net Income

Blossom Company

S

(c)

Compute the debt to assets ratio and the free cash flow for each company for 2022. (Round debt to assets to 1 decimal place, e.g. 78.9%

Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg (45))

Oriole Company

$

Blossom Company

$

Compute working capital and the current ratio for each company for 2022. (Round current ratio to 1 decimal place, e.g. 0.7: 1.)

Debt to Assets

Working Capital

$

Current Ratio

$

Free Cash Flow

Debt to Assets

Current Ratio

Compute the debt to assets ratio and the free cash flow for each company for 2022. (Round debt to assets to 1 decimal place, eg. 78.9%.

Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45))

%

11

Free Cash Flow

$

% $

:1

2:1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning