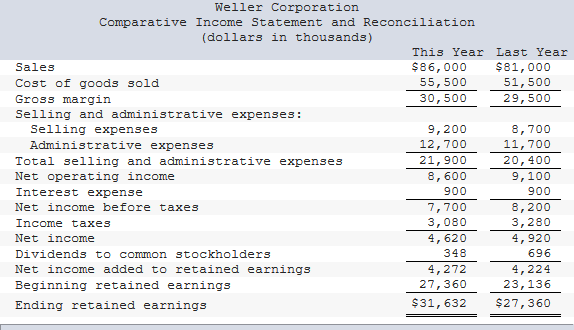

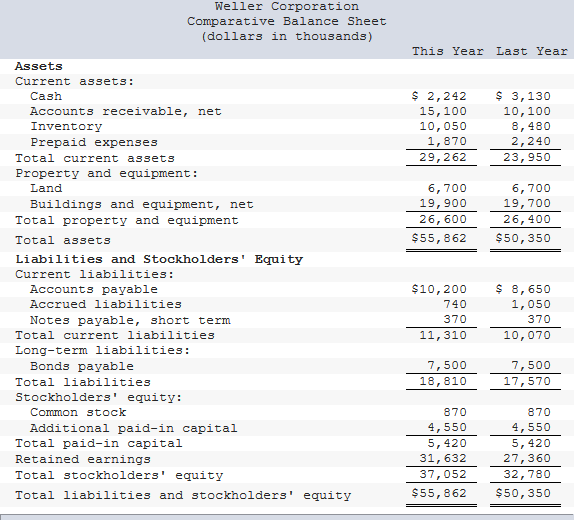

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 870,000 shares of common stock were outstanding. The interest rate on the bond payable was 12%, the income tax rate was 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this year. The market value of the company's common stock at the end of this year was $21.50. All of the company's sales are on account. Required: Compute the following financial data for this year: 1. Earnings per share. (Round your answer to 2 decimal places.) 2. Price-earnings ratio. (Round your intermediate calculations and final answer to 2 decimal places.) 3. Dividend payout ratio. (Round your intermediate calculations and final answer to 2 decimal places.) 4. Dividend yeild ratio. (Round your intermediate calculatioms and final answer to 2 decimal places.) 5. Book value per share. (Round your answer to 2 decimal places.)

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 870,000 shares of common stock were outstanding. The interest rate on the bond payable was 12%, the income tax rate was 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this year. The market value of the company's common stock at the end of this year was $21.50. All of the company's sales are on account.

Required:

Compute the following financial data for this year:

1. Earnings per share. (Round your answer to 2 decimal places.)

2. Price-earnings ratio. (Round your intermediate calculations and final answer to 2 decimal places.)

3. Dividend payout ratio. (Round your intermediate calculations and final answer to 2 decimal places.)

4. Dividend yeild ratio. (Round your intermediate calculatioms and final answer to 2 decimal places.)

5. Book value per share. (Round your answer to 2 decimal places.)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps