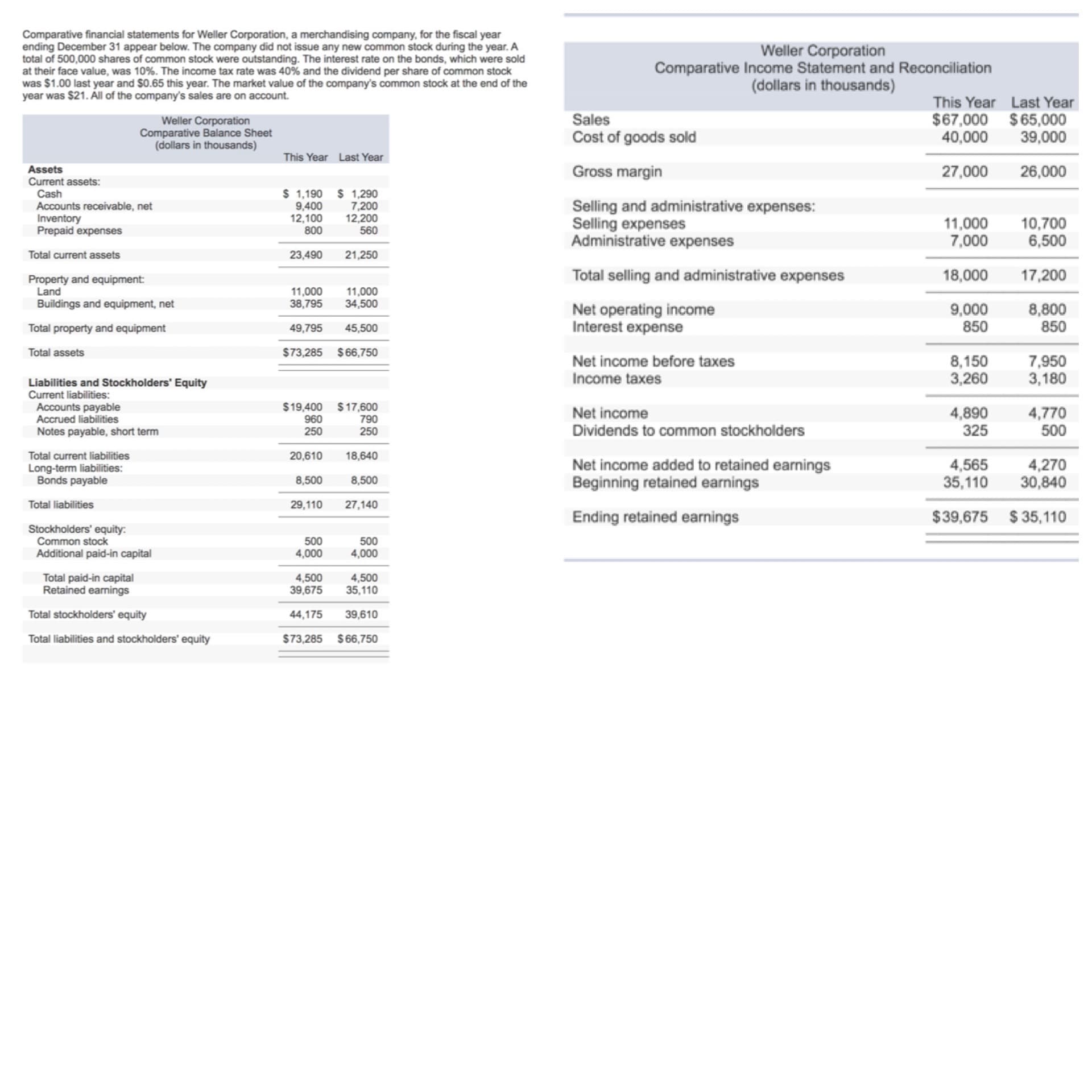

Comparative financial statements for Weller Corporation, a merchandising company, for the fiscal year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 500,000 shares of common stock were outstanding. The interest rate on the bonds, which were sold at their face value, was 10%. The income tax rate was 40% and the dividend per share of common stock was $1.00 last year and $0.65 this year. The market value of the company's common stock at the end of the year was $21. All of the company's sales are on account. Weller Corporation Comparative Income Statement and Reconciliation (dollars in thousands) This Year Last Year Sales Weller Corporation Comparative Balance Sheet (dollars in thousands) $67,000 $65,000 40,000 Cost of goods sold 39,000 This Year Last Year 27,000 26,000 Assets Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Gross margin $ 1,190 9,400 12,100 800 $ 1,290 7,200 12,200 560 Selling and administrative expenses: Selling expenses Administrative expenses 11,000 7,000 10,700 6,500 Total current assets 23,490 21,250 Total selling and administrative expenses 18,000 17,200 Property and equipment: Land Buildings and equipment, net 11,000 38,795 11,000 34,500 Net operating income Interest expense 9,000 850 8,800 850 Total property and equipment 49,795 45,500

Comparative financial statements for Weller Corporation, a merchandising company, for the fiscal year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 500,000 shares of common stock were outstanding. The interest rate on the bonds, which were sold at their face value, was 10%. The income tax rate was 40% and the dividend per share of common stock was $1.00 last year and $0.65 this year. The market value of the company's common stock at the end of the year was $21. All of the company's sales are on account. Weller Corporation Comparative Income Statement and Reconciliation (dollars in thousands) This Year Last Year Sales Weller Corporation Comparative Balance Sheet (dollars in thousands) $67,000 $65,000 40,000 Cost of goods sold 39,000 This Year Last Year 27,000 26,000 Assets Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Gross margin $ 1,190 9,400 12,100 800 $ 1,290 7,200 12,200 560 Selling and administrative expenses: Selling expenses Administrative expenses 11,000 7,000 10,700 6,500 Total current assets 23,490 21,250 Total selling and administrative expenses 18,000 17,200 Property and equipment: Land Buildings and equipment, net 11,000 38,795 11,000 34,500 Net operating income Interest expense 9,000 850 8,800 850 Total property and equipment 49,795 45,500

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 21E

Related questions

Question

Please help me solve questions 1,2, and 3. Thank you

Transcribed Image Text:Comparative financial statements for Weller Corporation, a merchandising company, for the fiscal year

ending December 31 appear below. The company did not issue any new common stock during the year. A

total of 500,000 shares of common stock were outstanding. The interest rate on the bonds, which were sold

at their face value, was 10%. The income tax rate was 40% and the dividend per share of common stock

was $1.00 last year and $0.65 this year. The market value of the company's common stock at the end of the

year was $21. All of the company's sales are on account.

Weller Corporation

Comparative Income Statement and Reconciliation

(dollars in thousands)

This Year Last Year

Sales

Weller Corporation

Comparative Balance Sheet

(dollars in thousands)

$67,000 $65,000

40,000

Cost of goods sold

39,000

This Year Last Year

27,000

26,000

Assets

Current assets:

Cash

Accounts receivable, net

Inventory

Prepaid expenses

Gross margin

$ 1,190

9,400

12,100

800

$ 1,290

7,200

12,200

560

Selling and administrative expenses:

Selling expenses

Administrative expenses

11,000

7,000

10,700

6,500

Total current assets

23,490

21,250

Total selling and administrative expenses

18,000

17,200

Property and equipment:

Land

Buildings and equipment, net

11,000

38,795

11,000

34,500

Net operating income

Interest expense

9,000

850

8,800

850

Total property and equipment

49,795

45,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning