comparative income statement with horizontal analysis for the two-year period, using 20Y1 as the base year. Use the minus sign to indicate a decrease in the "In - equired, round percentages to one decimal place. Macklin Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 Increase/ Increase/ (Decrease) (Decrease) 20Υ2 20Υ1 Amount Percent Sales $483,672 $408,000 % Cost of goods sold (358,800) (260,000) Gross profit $124,872 $148,000 Selling expenses $(50,150) $(34,000) Administrative expenses (29,520) (22,000) Total operating expenses $(79,670) $(56,000) Operating income $45,202 $92,000 Other revenue 2,166 1,700 Income before income tax expense $47,368 $93,700 Income tax expense (13,300) (28,100) Net income $34,068 $65,600 20x1 to 20x2 Sales ha ve however the cost of goods sold bas rate tha

comparative income statement with horizontal analysis for the two-year period, using 20Y1 as the base year. Use the minus sign to indicate a decrease in the "In - equired, round percentages to one decimal place. Macklin Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 Increase/ Increase/ (Decrease) (Decrease) 20Υ2 20Υ1 Amount Percent Sales $483,672 $408,000 % Cost of goods sold (358,800) (260,000) Gross profit $124,872 $148,000 Selling expenses $(50,150) $(34,000) Administrative expenses (29,520) (22,000) Total operating expenses $(79,670) $(56,000) Operating income $45,202 $92,000 Other revenue 2,166 1,700 Income before income tax expense $47,368 $93,700 Income tax expense (13,300) (28,100) Net income $34,068 $65,600 20x1 to 20x2 Sales ha ve however the cost of goods sold bas rate tha

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 1PA

Related questions

Question

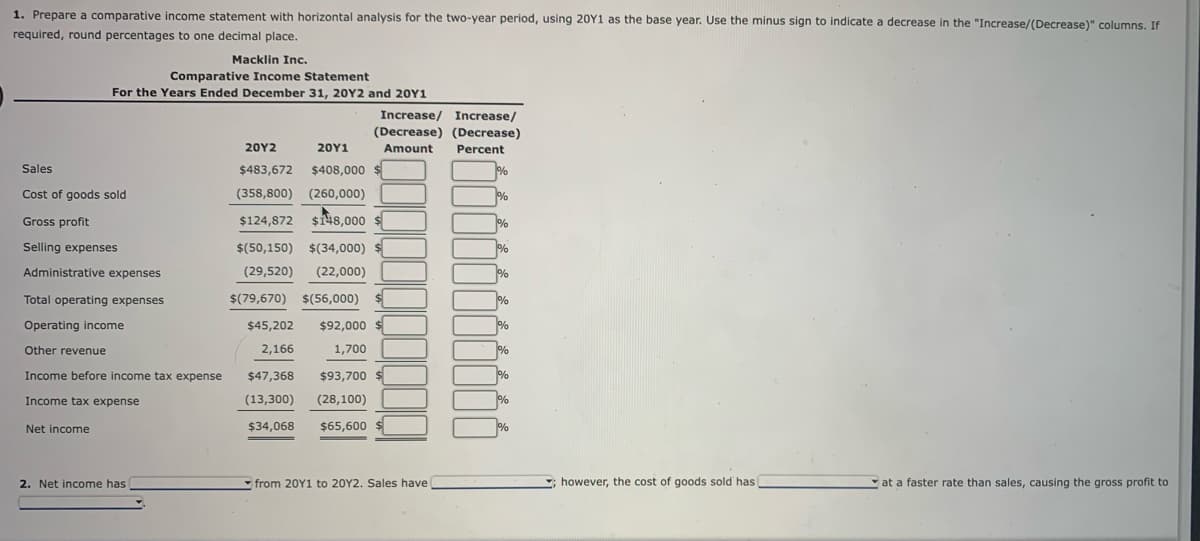

Transcribed Image Text:1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y1 as the base year. Use the minus sign to indicate a decrease in the "Increase/(Decrease)" columns. If

required, round percentages to one decimal place.

Macklin Inc.

Comparative Income Statement

For the Years Ended December 31, 20Y2 and 20Y1

Increase/ Increase/

(Decrease) (Decrease)

20Υ2

20Υ1

Amount

Percent

Sales

$483,672

$408,000 $

%

Cost of goods sold

(358,800) (260,000)

%

Gross profit

$124,872

$148,000

Selling expenses

$(50,150) $(34,000)

%

Administrative expenses

(29,520)

(22,000)

%

Total operating expenses

$(79,670) $(56,000)

%

Operating income

$45,202

$92,000 $

%

Other revenue

2,166

1,700

%

Income before income tax expense

$47,368

$93,700 $

%

Income tax expense

(13,300)

(28,100)

%

Net income

$34,068

$65,600

%

2. Net income has

from 20Y1 to 20Y2. Sales have

*; however, the cost of goods sold has

at a faster rate than sales, causing the gross profit to

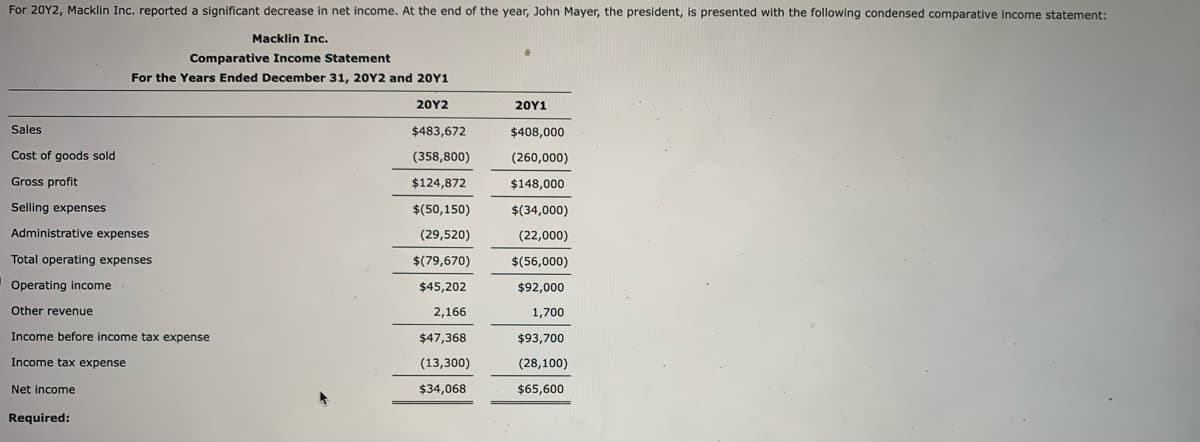

Transcribed Image Text:For 20Y2, Macklin Inc. reported a significant decrease in net income. At the end of the year, John Mayer, the president, is presented with the following condensed comparative income statement:

Macklin Inc.

Comparative Income Statement

For the Years Ended December 31, 20Y2 and 20Y1

20Υ2

20Y1

Sales

$483,672

$408,000

Cost of goods sold

(358,800)

(260,000)

Gross profit

$124,872

$148,000

Selling expenses

$(50,150)

$(34,000)

Administrative expenses

(29,520)

(22,000)

Total operating expenses

$(79,670)

$(56,000)

Operating income

$45,202

$92,000

Other revenue

2,166

1,700

Income before income tax expense

$47,368

$93,700

Income tax expense

(13,300)

(28,100)

Net income

$34,068

$65,600

Required:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning