What amount of loss should DEF accrue at December 31, 2021?

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 26CE

Related questions

Question

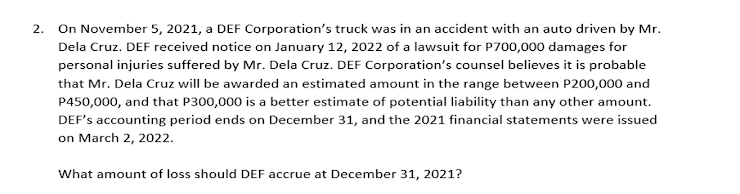

Transcribed Image Text:2. On November 5, 2021, a DEF Corporation's truck was in an accident with an auto driven by Mr.

Dela Cruz. DEF received notice on January 12, 2022 of a lawsuit for P700,000 damages for

personal injuries suffered by Mr. Dela Cruz. DEF Corporation's counsel believes it is probable

that Mr. Dela Cruz will be awarded an estimated amount in the range between P200,000 and

P450,000, and that P300,000 is a better estimate of potential liability than any other amount.

DEF's accounting period ends on December 31, and the 2021 financial statements were issued

on March 2, 2022.

What amount of loss should DEF accrue at December 31, 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT