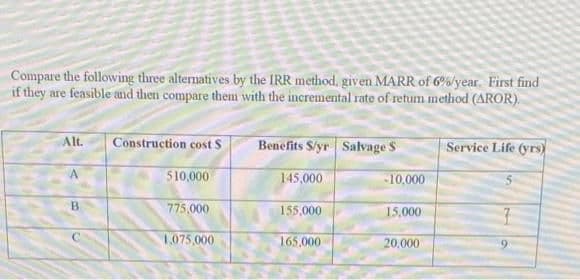

Compare the following three alternatives by the IRR method, given MARR of 6%%/year. First find if they are feasible nd then compare them with the incremental rate of retum method (AROR). Alt. Construction cost S Benefits S/yr Salvage S Service Life (yrs) 510,000 145,000 -10,000 775,000 155,000 15,000 1,075,000 165,000 20,000

Q: Alternative Overall Incremental Rate Of Initial Return in % When Alternative Investment,$ Rate of…

A: please find the answer below.

Q: The CFO for Woodsome Appliance Company Plant #A14 in Mexico City has five independent projects she…

A: a. When there is no limit, select all the bundles that have a positive present worth. Thus, select…

Q: e ore of a gold nine in the Mo ntains, on the average, 0.5 gram of gold per tor thod A of processing…

A: The net value or net profit is the difference between the total profit and the total cost.

Q: new, economic estimates for the two best alternatives are shown in the following table. MARR is at…

A: RORAI - Rate of return on additional investment. According to question, it is given that Capital…

Q: re is a continuing requirement for stand by electrical power at a public utilit ice facility.…

A: *Answer:

Q: Three alternatives to incorporate improved techniques to manufacture computer drives to play HD DVD…

A: The rate of interest is 12% per year. Thus, for quarterly the interest rate would be 3% (12%/4). For…

Q: Locations under consideration for a border patrol station have their costs estimated by the federal…

A: We are going to use incremental benefit cost ratio to answer this question.

Q: Machines that have the following costs are under consideration for a robotized welding process. Use…

A: Present worth = -P+(AR-Am)( P/A,i%,n)+F(P/F,i%,n)where P is the initial cost, AR is the annual…

Q: Compare the alternatives C and D on the basis of a present worth analysis using an interest rate of…

A: Given the interest rate = 9% life of alternative C=10 years life of alternative D = 5 years The…

Q: A company that makes food-friendly silicone (for use in cooking and baking pan coatings) is…

A: Present worth can be calculated as follows: Alternative A present worth:

Q: Iternatives are being considered. Alternative 1 - One-stage construction: Build a four lane bridge…

A:

Q: 1. A municipal police department has decided to acquire an unnamed drone for aerial surveillance of…

A: The correct answer is given in the second step.

Q: An engineer launches a project in the country's top technohub. This involves rental of a computer…

A:

Q: The annual equivalent of three investment (revenue) alternatives are -23,000 for Investment A-21.000…

A: Answer- Answer is (d) Not invest in any of the alternatives if possible since none generate…

Q: 4.39 Three alternatives to incorporate improved tech- niques to manufacture computer drives to play…

A: The gift value technique analysis of the study is an equivalence technique during which the money…

Q: Four different methods of recovering by-products are taken into the consideration. All methods have…

A: Method First Cost Salvage value Annual Income A -110,000 1400 4000 B -110,000 2000 6000 C…

Q: 2. Three mutually exclusive design alternatives are being considered. The estimated sales and cost…

A: Annual Worth (AW) Analysis is characterized as the same uniform annual worth of all assessed…

Q: The capital fund for new investment at Systems Corporation is limited to $75,000 for next year. You…

A: a. By hand, Annual NCF value of A is 6000 Annual NCF value of B is 9000 Annual NCF value of C is…

Q: A small manufacturing company is considering the addition of one or more of four new product lines.…

A: The formula for calculating present worth is given below. P=AP/A, i, n..... (1) By using equation 1,…

Q: An upgraded version of a CNC machine has a first cost of $200,000, an annual operating cost of…

A: Annual worth can be calculated as follows:

Q: Alternative X has a first cost of 34000 an annual operating cost of 6500 , and a salvage value of…

A: Present worth = -P+(AR-Am)( P/A,i%,n)-+F(P/F,i%,n)where, P is the initial cost, AR is the annual…

Q: From the PW, AW, and FW values shown, the conventional B/C ratio is closest to: Ка) 1. 27 (b) 1. 33…

A: B/C analysis i.e. benefit-cost analysis gives the ratio of benefits and costs in the same period. It…

Q: A new highway is to be constructed. Design A calls for a concrete pavement costing $70 per foot with…

A: Given information Design A Concrete pavement costing= $70 per foot Three paved ditches costing= $5…

Q: For the following table, if the MARR is 10% per year and a useful life for each alternative of six…

A: The internal rate of return procedure is one among the fluctuated strategies accessible for…

Q: Complete the following analysis of cost alternatives and select the preferred alternative. The study…

A:

Q: For the following two AW relations, the breakeven point QBE in miles per year is closest to: AW1…

A: Equate two alternatives to get the value of x and this can be calculated as follows:

Q: The Bureau of Public Highways is considering possible types of road surfacing with cost estimates…

A: We are going to use pw approach to answer this question.

Q: First cost, $ Annual cost, $ per year -33,000 -8,000 -51,000 -3,500

A: Annual Worth (AW) Analysis is characterized as the same uniform annual worth of all assessed…

Q: Compare the alternatives C and D on the basis of a present worth analysis using an interest rate of…

A: Given the interest rate = 10% life of alternative C = 10 years life of alternative D = 5 years

Q: Compare the alternatives shown on the basis of their capitalized costs using an erest rate of 10%…

A: As per the questions alternatives need to be evaluated based on Capitalized cost (CC), which refers…

Q: pool will cost $2.5 million to construct and will cost $300 000 per year to operate, but willbi…

A: A and B part solved below,

Q: Compare the following alternatives on the basis c heir capitalized costs at i= 8% per year and selec…

A: Salvage value is the estimated resale value of an asset at the end of its useful life. It is…

Q: A new highway is to be constructed. Design A calls for a concrete pavement costing $80 per foot with…

A: The measure that depicts the uniform worth of receipts and expenditures being estimated during the…

Q: Required information One of two methods must be used to produce expansion anchors. Method A costs…

A: The present worth technique of analysis is an equivalence method in which the cash flows of a…

Q: Compare three alternatives on the basis of their capitalized costs at i = 10% per year. Alternative…

A:

Q: An alternative has the following cash flows: a. Benefit . . b. Disbenefit. . c. Initial Cost .. d.…

A: Given: Benefit=P50000 per year Disbenefit=P27000 per year Initial cost=P 250000 M&O cost=P 10000…

Q: It is proposed to place a cable on existing pole line along the shore of a lake to connect two…

A: Given that; By the rate of return on an additional investment method Land route Depreciation…

Q: d on PW values, determine which of the following independent projects should be selected for stment…

A: Present worth (PW) can be calculated by using the following formula. Time period is indicated by…

Q: Blue Whale Moving and Storage recently purchased a warehouse building in Santiago. The manager has…

A: Given, Capacity = 4000-pound Electricforklift P = $−30,000 n = 12 years AOC =$−1000 per year; S =…

Q: Two machines can be used to produce a part from titanium. The costs and other cash flows associated…

A: The cost semiautomatic machine = $40000 Annual income in the case of semiautomatic machine = $10000…

Q: Compare three mutually exclusive alternatives on the basis of their capitalized costs at i =10% per…

A: A capitalized cost is an expense added to the cost basis of a fixed asset on a company's balance…

Q: Compare two alternatives for a physical security system surrounding a power distribution substation…

A: Annual worth = -P( A/P,i%,n)+(AR-Am)+F(A/F,i%,n)where, P is the initial cost, AR is the annual…

Q: The alternatives are mutually exclusive and the MARR is 6% per year. Vendor 1 Vendor 2 Vendor 3 -…

A: please find the answer below.

Q: • MARR is 12% per year. Select the more economical vendor bid. Initial cost. S -8,000 -13.000 Annual…

A:

Q: The alternatives shown are to be compared on the basis of their present worth values. At an interest…

A: The present worth analysis is one of the analyses which helps in finding out the economic viability…

Q: The Briggs and Stratton Commercial Division designs and manufacturers small engines for golf turf…

A: Given; Pull System:- First cost= -$1300000AOC per year=-$720000Salvage value=$110000Estimated life=…

Q: An oil company is planning to install a new 80 mm pipeline to connect storage tanks to a processing…

A: Given: Initial cost: RM15,000 annual pump operation hours: 450 hourspump cost per hours: RM2.50…

Q: Compare the alternatives shown on the basis of their capitalized costs using a MARR of 10% per year.…

A: Given; For alternative M:- First cost= -$140000 Annual cost= -$70000 Salvage value= $8000 Life= 5…

Q: Compare two alternatives, A and B, on the basis of a present worth evaluation using i= 13% per year…

A: Given the interest rate = 13% life of alternative A = 4 years life of alternative B = 8 years The…

Q: ther building air exhausts. can be made by two different methods. Method X will have a first cost of…

A: interest rate = 10% Method X: First cost = $75000 Operating cost (annual) = $32000 Salvage value =…

Solve it correctly please. I

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

- Two machines can be used to produce a part from titanium. The costs and other cash flows associated with each alternative are estimated. The salvage values are constant regardless of when the machines are replaced. Determine which alternative(s) should be selected for further analysis if alternatives must have a payback of 5 years or less. Perform the analysis with (a) i = 0%, and (b) i = 10% per year. Machine Semiautomatic Automatic First cost, $ −40,000 −90,000 Net annual income, $ per year 10,000 15,000 Maximum life, years 10 10 Salvage value, $ 0 0Compare three alternatives on the basis of their capitalized costs at i = 10% per year. Alternative E F G First cost, $ −50,000 −300,000 −900,000 AOC, $ per year −30,000 −10,000 −3,000 Salvage value, $ 5,000 70,000 200,000 Life, years 2 4 ∞Compare two alternatives for a physical security system surrounding a power distribution substation using annual worth analysis and a MARR of 10% per year. System Condi Torro First cost, $ −25,000 −130,000 M&O cost, $ per year −9,000 −2,500 Salvage value, $ 3,000 100,000 Life, years 3 ∞

- You have been asked to evaluate two alternatives, X and Y, that may increase plant capacity for manufacturing high-pressure hydraulic hoses. The parameters associated with each alternative have been estimated. Which one should be selected on the basis of a present worth comparison at an interest rate of 11% per year? Why is yours the correct choice? Alternative X Y First Cost $-30,000 $-60,000 Maintenance cost, per year $-9000 $-3000 Salvage Value $1,500 $2,500 Life 5 years 5 years The present worth of alternative X is $ __ and that of alternative Y is$ __. Alternative __ is selected by the company.You have been asked to evaluate two alternatives, X and Y, that may increase plant capacity for manufacturing high-pressure hydraulic hoses. The parameters associated with each alternative have been estimated. Which one should be selected on the basis of a present worth comparison at an interest rate of 15% per year? Why is yours the correct choice? Alternative X Y First Cost $-25,000 $-80,000 Maintenance cost, per Year $-13000 $-7000 Salvage Value $3,500 $4,500 Life 5 years 5 years The present wortMachines that have the following costs are under consideration for a robotized welding process. Use an interest rate of 10% per year and PW analysis to determine which machine should be selected. Machine X Machine Y First cost, $ −250,000 −430,000 AOC, $ per year −60,000 −40,000 Salvage value, $ 70,000 95,000 Life, years 3 6

- 1. Two methods can be used for producing expansion anchors. Method A costs $70,000 initially and will have a $15,000 salvage value after 3 years. The operating cost with this method will be $30,000 per year. Method B will have a first cost of $135,000, an operating cost of $8,000 per year, and a $40,000 salvage value after its 3-year life. At the MARR of 12% per year, which method should be used on the basis of a present worth analysis?You have been asked to evaluate two alternatives, X and Y, that may increase plant capacity for manufacturing high-pressure hydraulic hoses. The parameters associated with each alternative have been estimated. Which one should be selected on the basis of a present worth comparison at an interest rate of 12% per year? Why is yours the correct choice? Alternative X Y First cost, $ −45,000 −58,000 Maintenance cost, $/year −8,000 −4,000 Salvage value, $ 2,000 12,000 Life, years 5 5Solve all this question......you will not solve all questions then I will give you down?? upvote.... Jenny is an engineer for a municipal power plant. The plant uses natural gas, which is currently provided from an existing pipeline at an annual cost of $10000 per year. Jenny is considering a project to construct a new pipeline. The initial cost of the new pipeline would be $35000, but it would reduce the annual cost to $5000 per year. Assume an analysis period of 20 years and no salvage value for either the new or existing pipeline. The interest rate is 6%. Show work a) Determine the equivalent uniform annual cost (EUAC) for the new pipeline. b) Should the new pipeline be built?

- A company that makes food-friendly silicone (for use in cooking and baking pan coatings) is considering the independent projects shown, all of which can be considered to be viable for only 10 years. If the company’s MARR is 15% per year, determine which should be selected on the basis of a present worth analysis. Financial values are in $1000 units. A B C D First cost, $ −1,200 −2,000 −5,000 −7,000 Annual net income, $/year 200 400 1100 1300 Salvage value, $ 5 6 8 7A newly proposed project has a first cost of $ 211962 and estimated annual income of $46410 per year for 10 years. Determine the PW value if the MARR is 10.4% per year.2. Two methods can be used for injection molding insulin injection pens. Method A Molding costs $120,000 initially and will have a $30,000 salvage value after 5 years. The operating cost with this method will be $20,000 per year. Method B Molding will have a first cost of $150,000, an operating cost of $15,000 per year, and a $40,000 salvage value after its 6 - year life. Determine which method should be selected at a MARR of 10%. - Use Present Worth Analysis Solve in Excel