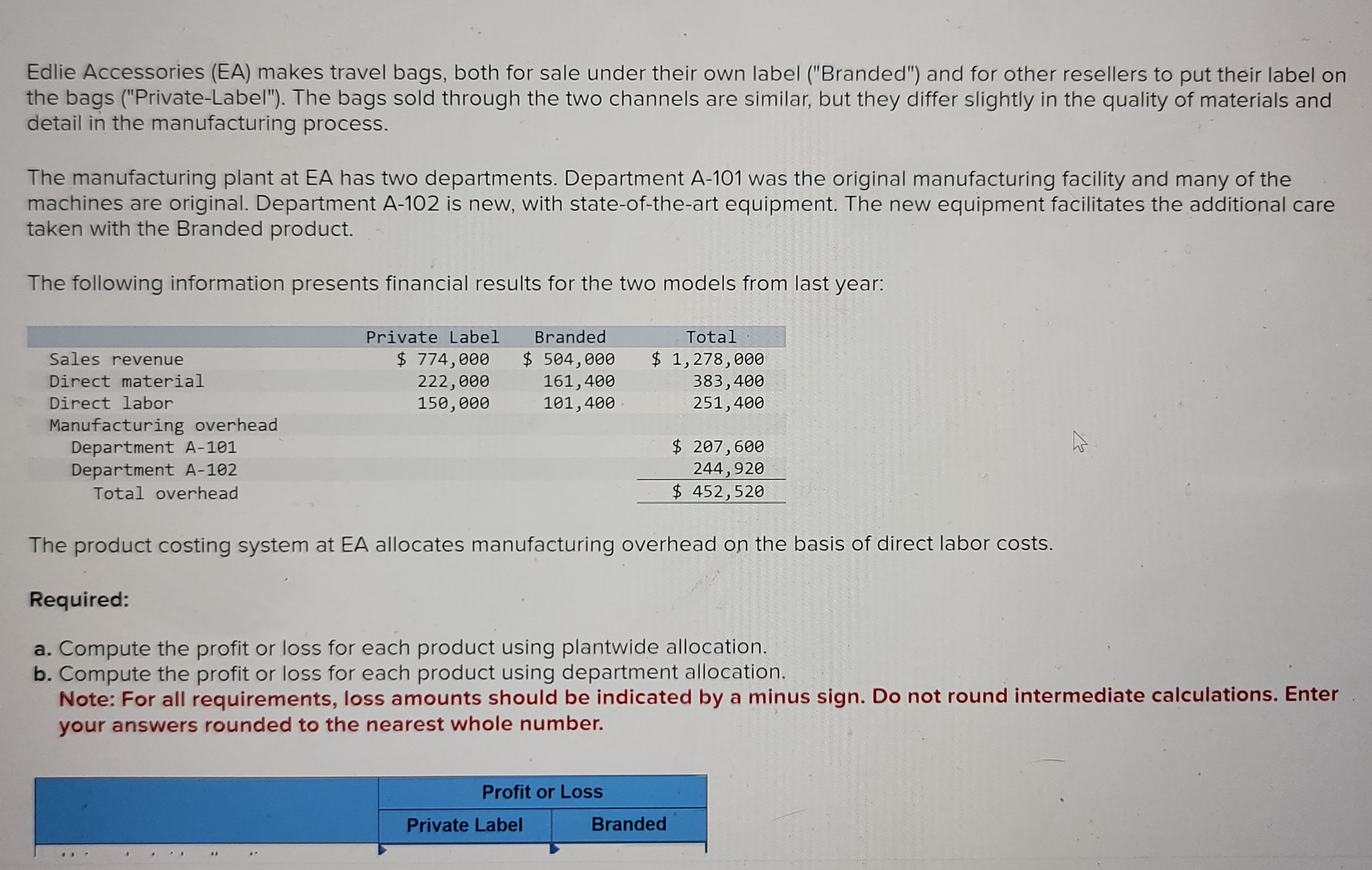

Edlie Accessories (EA) makes travel bags, both for sale under their own label ("Branded") and for other resellers to put their label on the bags ("Private-Label"). The bags sold through the two channels are similar, but they differ slightly in the quality of materials and detail in the manufacturing process. The manufacturing plant at EA has two departments. Department A-101 was the original manufacturing facility and many of the machines are original. Department A-102 is new, with state-of-the-art equipment. The new equipment facilitates the additional care taken with the Branded product. The following information presents financial results for the two models from last year:

Edlie Accessories (EA) makes travel bags, both for sale under their own label ("Branded") and for other resellers to put their label on the bags ("Private-Label"). The bags sold through the two channels are similar, but they differ slightly in the quality of materials and detail in the manufacturing process. The manufacturing plant at EA has two departments. Department A-101 was the original manufacturing facility and many of the machines are original. Department A-102 is new, with state-of-the-art equipment. The new equipment facilitates the additional care taken with the Branded product. The following information presents financial results for the two models from last year:

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter5: Support Department And Joint Cost Allocation

Section: Chapter Questions

Problem 6E: Davis Snowflake Co. produces Christmas stockings in its Cutting and Sewing departments. The...

Related questions

Question

100%

Transcribed Image Text:Edlie Accessories (EA) makes travel bags, both for sale under their own label ("Branded") and for other resellers to put their label on

the bags ("Private-Label"). The bags sold through the two channels are similar, but they differ slightly in the quality of materials and

detail in the manufacturing process.

The manufacturing plant at EA has two departments. Department A-101 was the original manufacturing facility and many of the

machines are original. Department A-102 is new, with state-of-the-art equipment. The new equipment facilitates the additional care

taken with the Branded product.

The following information presents financial results for the two models from last year:

Branded

$ 504,000

161,400

101,400

Sales revenue

Direct material

Direct labor

Manufacturing overhead

Department A-101

Department A-102

Total overhead

Private Label

$ 774,000

222,000

150,000

Required:

$ 207,600

244,920

$452,520

The product costing system at EA allocates manufacturing overhead on the basis of direct labor costs.

Total

$ 1,278,000

Profit or Loss

Private Label

383,400

251,400

a. Compute the profit or loss for each product using plantwide allocation.

b. Compute the profit or loss for each product using department allocation.

Note: For all requirements, loss amounts should be indicated by a minus sign. Do not round intermediate calculations. Enter

your answers rounded to the nearest whole number.

Branded

K

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning