Comprehensive Problem 3 Part 1: Selected transactions completed by Komett Company during its first fiscal year ended December 31, 20Y8, were as follows: 1. Joumalize the selected transactions. Assume 360 days per year. If no entry is required, select "No Entry Requiredď" from the dropdown and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. Jan. 3: Issued a check to establish a petty cash fund of $4,500. Description Debit Credit Petty Cash Cash Feb. 26: Replenished the petty cash fund, based on the following summary of petty cash receipts: office supplies, $1,680; miscellaneous seling expense, $570; miscellaneous administrative expense, $880. Description Debit Credit Office Supplies Miscellaneous Selling Expense MiecellaneoUE Administratiue Exnense

Comprehensive Problem 3 Part 1: Selected transactions completed by Komett Company during its first fiscal year ended December 31, 20Y8, were as follows: 1. Joumalize the selected transactions. Assume 360 days per year. If no entry is required, select "No Entry Requiredď" from the dropdown and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. Jan. 3: Issued a check to establish a petty cash fund of $4,500. Description Debit Credit Petty Cash Cash Feb. 26: Replenished the petty cash fund, based on the following summary of petty cash receipts: office supplies, $1,680; miscellaneous seling expense, $570; miscellaneous administrative expense, $880. Description Debit Credit Office Supplies Miscellaneous Selling Expense MiecellaneoUE Administratiue Exnense

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 20E

Related questions

Question

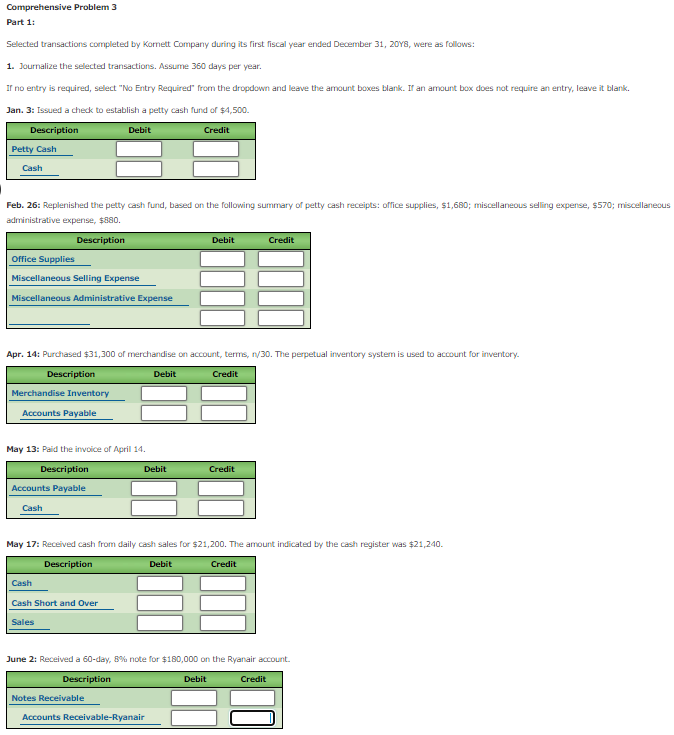

Transcribed Image Text:Comprehensive Problem 3

Part 1:

Selected transactions completed by Komett Company during its first fiscal year ended December 31, 20Y8, were as follows:

1. Journalize the selected transactions. Assume 360 days per year.

If no entry is required, select "No Entry Required" from the dropdown and leave the amount boxes blank. If an amount box does not require an entry, leave it blank.

Jan. 3: Issued a check to establish a petty cash fund of $4,500.

Description

Debit

Credit

Petty Cash

Cash

Feb. 26: Replenished the petty cash fund, based on the following summary of petty cash receipts: office supplies, $1,680; miscellaneous selling expense, $570; miscellaneous

administrative expense, $880.

Description

Debit

Credit

Office Supplies

Miscellaneous Selling Expense

Miscellaneous Administrative Expense

Apr. 14: Purchased $31,300 of merchandise on account, terms, n/30. The perpetual inventory system is used to account for inventory.

Description

Debit

Credit

Merchandise Inventory

Accounts Payable

May 13: Paid the invoice of April 14.

Description

Debit

Credit

Accounts Payable

Cash

May 17: Received cash from daily cash sales for $21,200. The amount indicated by the cash register was $21,240.

Description

Debit

Credit

Cash

Cash Short and Over

Sales

June 2: Received a 60-day, 8% note for $180,000 on the Ryanair accOunt.

Description

Debit

Credit

Notes Receivable

Accounts Receivable-Ryanair

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning