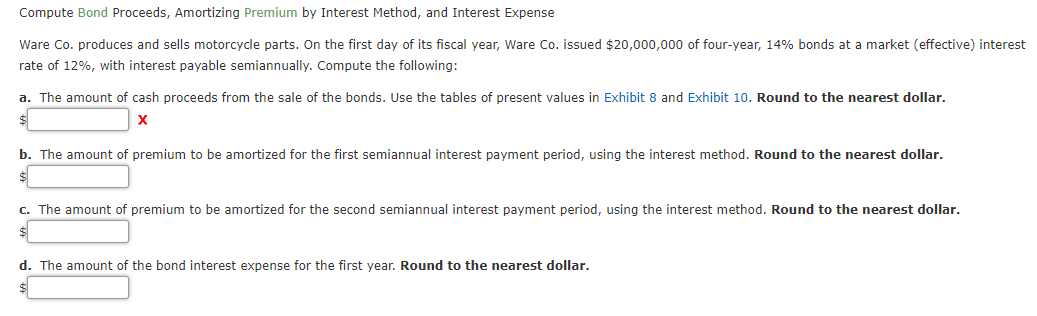

Compute Bond Proceeds, Amortizing Premium by Interest Method, and Interest Expense Ware Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware Co. issued $20,000,000 of four-year, 14% bonds at a market (effective) interest rate of 12%, with interest payable semiannually. Compute the following: a. The amount of cash proceeds from the sale of the bonds. Use the tables of present values in Exhibit 8 and Exhibit 10. Round to the nearest dollar. b. The amount of premium to be amortized for the first semiannual interest payment period, using the interest method. Round to the nearest dollar. c. The amount of premium to be amortized for the second semiannual interest payment period, using the interest method. Round to the nearest dollar. d. The amount of the bond interest expense for the first year. Round to the nearest dollar.

Compute Bond Proceeds, Amortizing Premium by Interest Method, and Interest Expense Ware Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware Co. issued $20,000,000 of four-year, 14% bonds at a market (effective) interest rate of 12%, with interest payable semiannually. Compute the following: a. The amount of cash proceeds from the sale of the bonds. Use the tables of present values in Exhibit 8 and Exhibit 10. Round to the nearest dollar. b. The amount of premium to be amortized for the first semiannual interest payment period, using the interest method. Round to the nearest dollar. c. The amount of premium to be amortized for the second semiannual interest payment period, using the interest method. Round to the nearest dollar. d. The amount of the bond interest expense for the first year. Round to the nearest dollar.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 15MCQ

Related questions

Question

How do i do this?

Transcribed Image Text:Compute Bond Proceeds, Amortizing Premium by Interest Method, and Interest Expense

Ware Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware Co. issued $20,000,000 of four-year, 14% bonds at a market (effective) interest

rate of 12%, with interest payable semiannually. Compute the following:

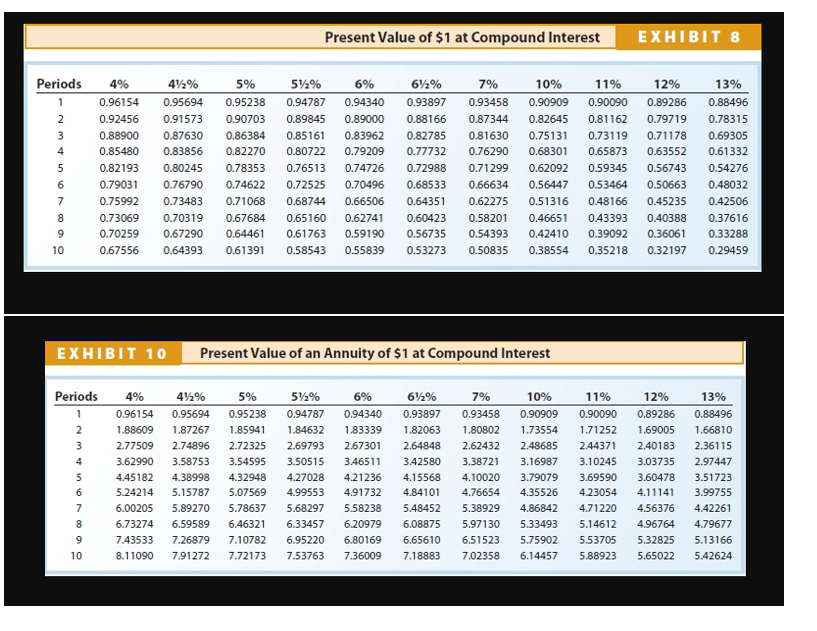

a. The amount of cash proceeds from the sale of the bonds. Use the tables of present values in Exhibit 8 and Exhibit 10. Round to the nearest dollar.

b. The amount of premium to be amortized for the first semiannual interest payment period, using the interest method. Round to the nearest dollar.

c. The amount of premium to be amortized for the second semiannual interest payment period, using the interest method. Round to the nearest dollar.

d. The amount of the bond interest expense for the first year. Round to the nearest dollar.

Transcribed Image Text:Present Value of $1 at Compound Interest

EXHIBIT 8

Periods

4%

42%

5%

52%

6%

6½%

7%

10%

11%

12%

13%

1

0.96154

0.95694

0.95238

0.94787

0.94340

0.93897

0.93458

0.90909

0.90090

0.89286

0.88496

2

0.92456

0.91573

0.90703

0.89845

0.89000

0.88166

0.87344

0.82645

0.81162

0.79719

0.78315

3

0.88900

0.87630

0.86384

0.85161

0.83962

0.82785

0.81630

0.75131

0.73119

0.71178

0.69305

4

0.85480

0.83856

0.82270

0.80722

0.79209

0.77732

0.76290

0.68301

0.65873

0.63552

0.61332

0.82193

0.80245

0.78353

0.76513

0.74726

0.72988

0.71299

0.62092

0.59345

0.56743

0.54276

6

0.79031

0.76790

0.74622

0.72525

0.70496

0.68533

0.66634

0.56447

0.53464

0.50663

0.48032

7

0.75992

0.73483

0.71068

0.68744

0.66506

0.64351

0.62275

0.51316

0.48166

0.45235

0.42506

8

0.73069

0.70319

0.67684

0.65160

0.62741

0.60423

0.58201

0.46651

0.43393

0.40388

0.37616

0.70259

0.67290

0.64461

0.61763

0.59190

0.56735

0.54393

0.42410

0.39092

0.36061

0.33288

10

0.67556

0.64393

0.61391

0.58543

0.55839

0.53273

0.50835

0.38554

0.35218

0.32197

0.29459

EXHIBIT 1о

Present Value of an Annuity of $1 at Compound Interest

Periods

4%

42%

5%

52%

6%

6½%

7%

10%

11%

12%

13%

1

0.96154

0.95694

0.95238

0.94787

0.94340

0.93897

0.93458

0.90909

0.90090

0.89286

0.88496

2

1.88609

1.87267

1.85941

1.84632

1.83339

1.82063

1.80802

1.73554

1.71252

1.69005

1.66810

3

2.77509

2.74896

2.72325

2.69793

2.67301

2.64848

2.62432

2.48685

2.44371

2.40183

2.36115

3.62990

3.58753

3.54595

3.50515

3.46511

3.42580

3.38721

3.16987

3.10245

3.03735

2.97447

5

4.45182

4.38998

4.32948

4.27028

4.21236

4.15568

4.10020

3.79079

3.69590

3.60478

3.51723

6

5.24214

5.15787

5.07569

4.99553

4.91732

4.84101

4.76654

4.35526

4.23054

4.11141

3.99755

7

6.00205

5.89270

5.78637

5.68297

5.58238

5.48452

5.38929

4.86842

4.71220

4.56376

4.42261

6.73274

6.59589

6.46321

6.33457

6.20979

6.08875

5.97130

5.33493

5.14612

4.96764

4.79677

7.43533

7.26879

7.10782

6.95220

6.80169

6.65610

6.51523

5.75902

5.53705

5.32825

5.13166

10

8.11090

7.91272

7.72173

7.53763

7.36009

7.18883

7.02358

6.14457

5.88923

5.65022

5.42624

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College