Compute Cramer's federal taxable income and regular tax liability. Prepare a Schedule M-1, page 6, Form 1120, reconciling Cramer's book and taxable income.

Compute Cramer's federal taxable income and regular tax liability. Prepare a Schedule M-1, page 6, Form 1120, reconciling Cramer's book and taxable income.

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 47P

Related questions

Question

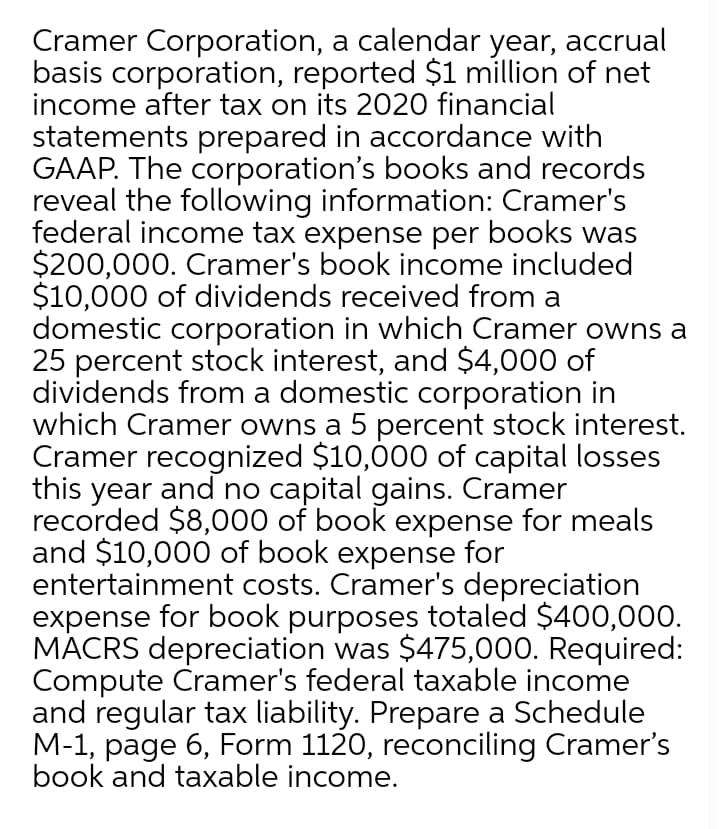

Transcribed Image Text:Cramer Corporation, a calendar year, accrual

basis corporation, reported $1 million of net

income after tax on its 2020 financial

statements prepared in accordance with

GAAP. The corporation's books and records

reveal the following information: Cramer's

federal income tax expense per books was

$200,000. Cramer's book income included

$10,000 of dividends received from a

domestic corporation in which Cramer owns a

25 percent stock interest, and $4,000 of

dividends from a domestic corporation in

which Cramer owns a 5 percent stock interest.

Cramer recognized $10,000 of capital losses

this year and no capital gains. Cramer

recorded $8,000 of book expense for meals

and $10,000 of book expense for

entertainment costs. Cramer's depreciation

expense for book purposes totaled $400,000.

MACRS depreciation was $475,000. Required:

Compute Cramer's federal taxable income

and regular tax liability. Prepare a Schedule

M-1, page 6, Form 1120, reconciling Cramer's

book and taxable income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT