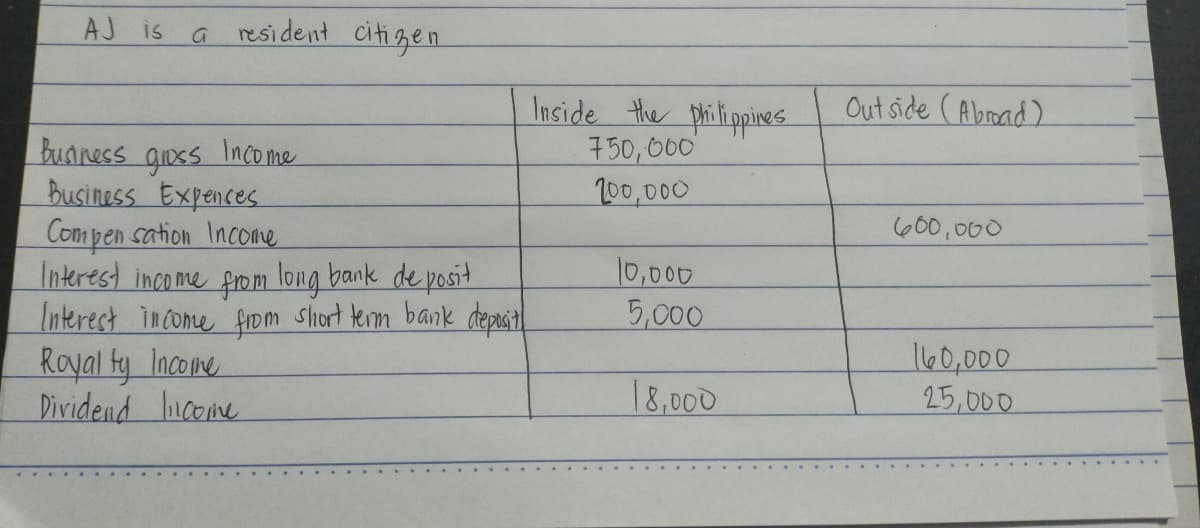

Compute the taxable income subject to regular income tax

Q: at type of tax. ommon carrier's tax value added tax

A: Taxes are the legal obligation of a individual or a corporation towards the government. They are the…

Q: Find the gross income, the adjusted gross income, and the taxable income.

A: Answer: Gross income is the total earned income. When any exempt income is adjusted in gross income,…

Q: Rate of income derived by the assessed is taxable under the head of ?

A: The income which a person can earn during the period or even during the lifetime as per income tax…

Q: current and deferred tax expense

A: Option A is correct because deferred tax expense is recognized if there is a change in the deferred…

Q: How do I calculate the taxable income?

A: The IRS allows businesses to carry forward their net operating losses for a time period of 20 years…

Q: Explain and what is the calculation of the following. Total Assessable income Deductions Total…

A: Tax has to be paid by all people and entities whose income or earnings crosses that minimum tax…

Q: How are deferred tax assets and deferred tax liabilities reported in a classified balance sheet?

A:

Q: Define Income tax paid

A: Income tax paid is a charge or payment made to the government by the individual or the firms in a…

Q: Use the Tax Rate Tables, Exhibit 18-3, to calculate the tax liability (in $) for the taxpayer.…

A: Up to $14,200 10% $14,201 to $54,200 $1,420 + 12% of the amount over $14,200 $54,201 to $86,350…

Q: Income tax is levied on all of the following taxable items except: O Wages O Interest and dividends…

A: Income tax is levied on Wages, Interest and dividends from moeny invested and Capital gains from…

Q: Which of the following is added to a taxpayer’s gross income from business in computing the total…

A: Gross Income - It is the amount of total income earned during the particular period from all sources…

Q: Distinguish between exemptions and deductions in determining taxable income

A: The determination of taxable income has a structured and tax laws guided process, this…

Q: Define taxable income

A: Taxable Income: The amount of adjusted gross income that is liable to be taxed is known as taxable…

Q: How are deferred tax assets and deferred tax liabilitiesreported on the balance sheet?

A:

Q: What is the name of the amount of money that can bededucted directly from the computed tax, instead…

A: Tax or Taxes: Tax is an amount paid by the persons (individuals and business entities) to a…

Q: Determine the types of payment made to non-resident person which is subject to withholding tax and…

A: Hi student Since there are multiple questions, we will answer only first question. If you want…

Q: Income Tax Due

A: To find income tax due on Income we need to prepare Income statement of Mica thok enterprise. Income…

Q: Compute the additional tax due or refund they have when filing their tax return.

A: It has been given in the question that the withholding tax has been $11,000 and there is a gross tax…

Q: Compute Volunteer's taxable income and federal income tax.

A: Taxable income is the income on which taxes are to be paid by company. The income tax amount depends…

Q: What are some of the other types of income that must be reported on an taxpayer's tax return? How is…

A: Taxable income is any remuneration received by a person or corporation that is utilized to evaluate…

Q: How are deferred tax assets and deferred tax liabilities reported on the statement of financial…

A: Deferred tax accounts has to be reported on the balance sheet of a business. It must be classified…

Q: Use the Tax Rate Tables, Exhibit 18-3, to calculate the tax liability (in $) for the taxpayer. Name…

A: (a) Filing Status - Head of the Household (b) Taxable Income - $ 195,300 (c) Since Taxable Year is…

Q: deferred tax asset and deferred tax liability

A: Deferred tax is the tax arises due to the differences between accounting income and taxable income.…

Q: how to calculate someones adjusted basis in tax

A: Adjusted basis refers to the amount of gain or loss earned on selling the property. It includes the…

Q: Use the Tax Rate Tables, Exhibit 18-3, to calculate the tax liability (in $) for the taxpayer. Name…

A: Taxes are the main sources of revenue for the government. Every government imposes tax on the basis…

Q: Calculate the net income after tax

A: Net profit is also called the profit available to the shareholders or Profit available after meeting…

Q: peg. on to view the additional information.) e Income and Part I Federal Tax Payable for the Sebago…

A: Taxable income refers to the total sum of money earned by an entity that is subject to the mandatory…

Q: distinguish between temporary and permanent diff erences in pre-tax accounting incomeand taxable…

A: Taxable income is the income on which the assessee is liable to pay Income tax. It is the base upon…

Q: The tax that takes into account the status of the taxpayer

A: Status of the taxpayer means the classification of the taxpayers into groups based on age, structure…

Q: describe the diff erences between accounting profi t and taxable income, and defi ne key…

A: The temporary difference between taxes as per accounting income and taxes asper tax regulation is…

Q: What formula is used to “gross-up” supplementalpayments in order to cover the taxes on the…

A: The term "gross-up payroll" indicates a rise in basic pay that is done on purpose in order to lower…

Q: What is the definition of 'taxable income'?

A: Income: Income includes the income of an individual in the form of wages, salary, pension, etc. The…

Q: Define Deferred Tax Liabilities.

A: Definition: Income tax expense: The expenses which are related to the taxable income of the…

Q: Compute Cramer's federal taxable income and regular tax liability. Prepare a Schedule M-1, page 6,…

A: C Corporation Amount ($) Net Income after Tax 10,00,000 Add: Federal…

Q: What aree the procedures in the computation of gross taxable income and tax due in the situation or…

A: Compensation is the income which is earned by the person from the employment work means the…

Q: How are deferred tax assets classified as current or non-current on the balance sheet?

A: As per U.S. GAAP the companies that classifies its balance sheet, need to divide deferred taxes into…

Q: What is the permanent difference between pretax accounting income and taxable income?

A: A permanent difference is a difference between pretax financial income and taxable income in an…

Q: current tax and deferred tax.

A: First option is wrong because deferred tax expense does not include current tax. Third option is…

Q: Explain the federal estate tax.

A: Federal Estate Tax: A tax on the transfer of property after death is called Estate tax. Federal…

Q: List expenses that will be deductible for normal or income tax purpose

A: The above question mainly deals with expenses that will be deductible…

Q: Compute for the taxable income

A: Tax is paid by the company on the taxable income earned during the relevant period by the taxpayer.…

Q: You pay personal taxes on your calculated ____ income. a. adjusted gross b. marginal c. taxable d.…

A: Explanation: Gross income is the sum of all the income an individual earns in a given financial year…

Q: How are deferred tax assets and deferred tax liabilities classified and reported in the financial…

A: Deferred tax asset is the balance sheet item, which results from the advance or overpayment payment…

Q: what are the differences between the following components of taxable income o…

A: Difference between the Deductions for AGI and Deductions from AGI: Deductions for AGI are also…

Q: Explain Residence and domicile for tax purposes

A: Tax is the liability that has to be paid by the individual and the corporation to the federal…

Step by step

Solved in 2 steps with 2 images

- X, a resident citizen had the following data in the year 2021:Gross income from the practice of profession, P1,590,000Gross income from business, P3,500,000Interest income from currency bank deposit at Metro Bank, P8,300Interest income on private securities, P24,000Dividend income from domestic corporation, P26,000Interest income on loans to friends, P13,000Winnings from raffle draws, P2,000Sale of a land in Marikina not used in business (with a FMV of P2,900,000), P3,300,000Deductible business and professional expenses, P3,842,000How much should X report as his gross income?problem 2 Ana, a self-employed resident citizen provided the following data for 2018 taxable year:Sales P2,800,000Cost of sales 1,125,000Business expenses 650,000Interest income from peso bank deposit 80,000Interest income from bank deposit under FCDS 120,000Gain on sale of land in the Philippines held as capital asset with cost P1.5M when zonal is P1.2M 500,000 How much is the total income tax of Ana assuming she opted to be taxed at 8%?The following are relevant information pertaining to the results of the business operations for Maisarah Islamic Window for the year 2020: Income from Operations2600000Expenses from Operations1180000Indirect Income (Fee Based)300000Indirect Expenses260000The above profit from operation is prior to the distribution of profit to mudharabah depositors. The agreed profit sharing ratio between the Bank and mudharabah depositors is 60:40 respectively.Required:Assuming that the Separate Investment Account Method SIAM is used, calculate the net profit/loss to the Islamic Bank (Before Tax and Zakat)

- If a branch of a foreign corporation (resident foreign corporation) derives net income of P20,000,000.00 to be remitted to the foreign head office, how much is the branch profits remittance tax? Group of answer choices P1,500,000.00 P2,000,000.00 P3,000,000.00 P2,250,000.00On May 1, 20x1, the statement of financial position of Juan and Pablo appear below:Juan PabloCash 22,000 44,708Accounts receivable 469,072 1,135,780Inventories 240,070 520,204Land 1,206,000Building 856,534Furniture and fixtures 100,690 69,578Other assets 4,000 7,200Total assets 2,041,832 2,634,004Accounts payable 357,880 487,300Notes payable 400,000 690,000Juan, Capital 1,283,952Pablo, Capital 1,456,704Total liabilities and equity 2,041,832 2,634,004Juan and Pablo agreed to form a partnership contributing their respective assets and equities subject to thefollowing adjustments:a. Accounts receivable of P40,000 in Juan’s books and P70,000 in Pablo’s books are uncollectible.b. Inventories of P11,000 and P13,400 are worthless in Juan’s and Pablo’s respective books.c. Other assets of P4,000 and P7,200 in Juan’s and Pablo’s respective books are to be written off. 3. Prepare journal entry to record Pedro’s admission. 4. During the first year of operations, the partnership earned P650,000.…On May 1, 20x1, the statement of financial position of Juan and Pablo appear below:Juan PabloCash 22,000 44,708Accounts receivable 469,072 1,135,780Inventories 240,070 520,204Land 1,206,000Building 856,534Furniture and fixtures 100,690 69,578Other assets 4,000 7,200Total assets 2,041,832 2,634,004Accounts payable 357,880 487,300Notes payable 400,000 690,000Juan, Capital 1,283,952Pablo, Capital 1,456,704Total liabilities and equity 2,041,832 2,634,004Juan and Pablo agreed to form a partnership contributing their respective assets and equities subject to thefollowing adjustments:a. Accounts receivable of P40,000 in Juan’s books and P70,000 in Pablo’s books are uncollectible.b. Inventories of P11,000 and P13,400 are worthless in Juan’s and Pablo’s respective books.c. Other assets of P4,000 and P7,200 in Juan’s and Pablo’s respective books are to be written off.Required:1. What are the adjusted capital balances of the partners after formation? 2. Pedro offered to join for a 20% interest in…

- Australia Company has three business segments with the following Information: One Two Three Sales to outsiders P8,000,000 P4,000,000 P6,000,000 Intersegment transfers 600,000 1,000,000 1,400,000 Interest income - outsiders 400,000 500,000 600,000 Interest income - intersegment loans 300,000 400,000 500,000 What is the minimum amount of revenue that each of those segments must have to be considered reportable?Capital 1 January 2019 350 000Drawings 20 000Sales (70% on credit) 950 000Gross profit 250 000Total expenses 80 000Bank favourable 26 000Net profit 74 000Trade creditors 26 000Property, plant and equipment 350 000Fixed deposit 20 000Inventory 72 000Trade Debtors 80 000Mortgage Loan 100 000 Additional InformationThe opening balance of the inventory, debtors and creditors was R50 000, R60 000 and R30 000respectively. Assume a 365 day year. Calculate the following ratios and explain what each ratio means in relation to theindustry average given in brackets. Show your calculations as marks will be awardedfor these. Round off to 2 decimal places. Q.2.1.3 Average creditors settlement period (60 days). Assume purchases are equalto cost of sales and 60% of all purchases are on credit. Q.2.2 Discuss how the solvency ratio is calculated and what is measured by this ratio. Please help with the both questions mentionedCapital 1 January 2019 350 000Drawings 20 000Sales (70% on credit) 950 000Gross profit 250 000Total expenses 80 000Bank favourable 26 000Net profit 74 000Trade creditors 26 000Property, plant and equipment 350 000Fixed deposit 20 000Inventory 72 000Trade Debtors 80 000Mortgage Loan 100 000 Additional InformationThe opening balance of the inventory, debtors and creditors was R50 000, R60 000 and R30 000respectively. Assume a 365 day year. Calculate the following ratios and explain what each ratio means in relation to theindustry average given in brackets. Show your calculations as marks will be awardedfor these. Round off to 2 decimal places. Q.2.1.3 Average creditors settlement period (60 days). Assume purchases are equalto cost of sales and 60% of all purchases are on credit. Q.2.2 Discuss how the solvency ratio is calculated and what is measured by this ratio.

- LENI Lugawan Corp has the following data for the year ended December 31, 2021: PH USA Gross Income: P6,000,000.00 $50,000.00 Deductions: P4,000,000.00 $20,000.00 Dollar Rate P45:$1 Determine income tax due assuming the company is a resident corporation. Group of answer choices P600,000.00 P1,500,000.00 P500,000.00Use the following information for Smith Brothers, Inc: EBIT / Revenue 15.00% Government Tax Rate 35.00% Revenue / Assets 1.80 times Current Ratio 2.40 times EBT / EBIT 0.80 times Assets / Equity 1.90 times Smith Brothers, Inc.'s return on assets (ROA) is closest to: A. 14.04%. B. 14.82%. C. 24.71%. D. 26.68%.From the following particulars, prepare a balance sheet of HME Sdn Bhd as at 30Jun 2022Capital RM80,000Goodwill RM20,000Prepaid Expenses RM10,000Investment RM20,000Debtors RM6,400Creditors RM14,200Loan from bank RM20,000Cash at bank RM17,200Furniture RM5,665 mango and oil RM50,000Outstanding Expenses RM10,000Net profit RM21,300General reserve RM1,000Closing stock RM14,800Bills Receivable RM25,000Bills Payable RM20,000Advance Income RM5,000Drawings RM4,400