Compute for the Average Sales Period/Average Age of Inventory, use 360 days

Q: Ball Company has the following data: Units Produced: 500 finished goods units Direct Materials: $100...

A: Lets understand the basics. There are two type of costing system are followed by the entities which ...

Q: Required information [The following information applies to the questions displayed below.] Adger Cor...

A: The activity variance is the difference between flexible budget and planning budget of the business....

Q: Information about Orion Industrial's utility cost for the last 6 months of year 2010 follows. The hi...

A: Lets understand the basics. High low method is utilized to separate fixed cost and variable cost fro...

Q: 10 Under IFRS 9, which of the following is correct regarding reclassification of investments? Group...

A: When an entity reclassifies a financial asset so that it is measured at fair value, its fair value i...

Q: For Sheridan Company, sales is $2000000, fixed expenses are $900000, and the contribution margin rat...

A: Solution: Fixed expenses = $900,000 Target net income = $700,000 Contribution margin ratio = 36%

Q: The information below is what is needed to answer the items from the picture. Note: I ONLY NEED HELP...

A: The statement of stockholders' equity is the one prepared as a part of the financial statement by th...

Q: For the current year, the maximum percentage of social security benefits which might be included In ...

A: The question is related to Social Security benefit.

Q: Carla incorporated her sole proprietorship by transferring inventory, a building, and land to the co...

A: A sole proprietorship is an ego business with a sole proprietor who is taxed on earnings on a person...

Q: Alleyway Corp. manufactures two styles of leather bowling bag, the Strike and Turkey. Budgeted produ...

A: Lets understand the basics. Budget is prepared by the management to estimate the future profit and l...

Q: Bruin Wholesale has gathered the foll and the cost of receiving reports for the

A: In this question, there are different cases in which we have yo solve using high low method.

Q: Lemony Lemonade has 3,200 gallons of lemonade in WIP Inventory, with 76% of materials already add...

A: Equivalent units for conversion costs = No. of units in WIP inventory*Degree of completion

Q: LO.2 (Predetermined OH rates and underapplied/overapplied OH) Davidson's Dolls had the following inf...

A: Solution Overhead expenses refer to all indirect expenses which is incurred to carry on business act...

Q: Chapman Company obtains 100 percent of Abernethy Company’s stock on January 1, 2020. As of that date...

A: Eliminating Entries: While consolidating income statements and balance sheet, come entries are accou...

Q: 6. The record of employment is filed with: Multiple Choice Canada Pension Plan Revenue Quebec The Ca...

A: Record of Employment (ROE) is a form that your employer fills in with information like how long you'...

Q: Company cell phone bill received, but not paid, $80 what will be the general entry?

A: The Accrual concept of accounting requires that all transactions should be recorded as and when they...

Q: 7. Received Php20,000 for the sale of a lot a. Debit cash, Credit Commission Income b. Debit Cash, ...

A:

Q: avid Wallace, Olena Dunn, and Danny Lin were partners in a commercial architect firm and showed the ...

A: The running of a partnership business in accordance with the stipulated law prescribed on it. There ...

Q: Beryllium Company had $330,000 sales in December 20X1 and expects total sales of $360,000 in January...

A: Cash receipts is the amount of sales which is received. It shows the amount of sales which is collec...

Q: Prepare journal entries for the following transactions reported by Jet Corporation for the month of ...

A: The equity includes the total capital that belongs to the shareholders of the business.

Q: Glassica, Inc. is a manufacturer of lead crystal glasses. The standard direct materials quantity is ...

A: Material efficiency variance = Standard price × [Actual quantity - Standard quantity]

Q: What is the compound amount and compound interest of $36,000 invested at 12% com- pounded semiannual...

A: The formulas- Compounded amount = P × (1 + rm)m×t where; P = Principal r = Nominal interest rate m =...

Q: Provide examples of critical customer and operational performance metrics that may be included in an...

A: Introduction: The performance measures discussed have exclusively relied on financial accounting mea...

Q: Applegate Industries is planning to expand its production facility in a few years. New plant ...

A: Future Value = Present Value x Future Value Factor

Q: A specific model of computer servers are being sold by Company A for $26,700 each, offering trade di...

A: Solution:- Given, Computer servers sold by Company A = $26,700 Offering trade discounts = 8% and 5% ...

Q: The following data were taken from the accounting records of Biko Lamps, Inc Balance at January 1, 2...

A: Using average method, the cost per unit is calculated as total cost of goods available for sale divi...

Q: Use the Defined Benefit Excel spreadsheet reviewed in class to answer this question. What is a retir...

A: Retirement: Retirement is the scenario when an employed person attained the defined age of retiremen...

Q: 8. Sam and Devon agree to go into business together selling college-licensed clothing. According to ...

A: Stock refers to the ownership stake that is issued by the company to raise funds from the market by ...

Q: Gildan Activewear Inc. reported the following selected financial information (all in U.S. $ millions...

A: The asset turnover ratio assesses a company's assets' ability to create income or sales. Net sales ...

Q: Part 2 of the previously attached question! Thank you for helping! Zing Cell Phone Company entered ...

A: Solution A journal is the company's official book in which companys records all business transaction...

Q: Company sells a product for $90.00 per unit. Variable costs are $50 per unit, and fixed costs are $1...

A: Contribution margin per unit is the amount of sales after deducting variable cost per unit. It is th...

Q: Lance, a single taxpayer, is a teaching assistant at Big State University and has W-2 income of $77,...

A: SE termed as Self employment tax which is the tax imposed on SE individuals as well as small busines...

Q: During May, Bergan Company accumulated 2,500 hours of direct labor costs on Job 200 and 3,000 hours ...

A: Total Labor Cost = Total Labor Cost for Job 200 + Total Labor Cost for Job 305 Total Labor Cost for ...

Q: Following are the estimated values related to Swifi 2023; January OMR April OMR Маy OMR June OMR Feb...

A: Cash budget is the estimation of cash payments and receipts . It is prepared to know the requirement...

Q: Black's budgeted cost of Direct Labor for February is

A: Budgeted Cost of Direct Labor = Expected units to produce * Direct labor hour per finished goods uni...

Q: Company cell phone bill received, but not paid, $80 what will be the general entry?

A: Under generally accepted principals, expenses and losses are debited. Liabilities and revenues were ...

Q: xercise 20-14 (Algo) Warranty expense [LO20-4] Woodmier Lawn Products introduced a new line of comme...

A: Entries are used to record financial transactions. To generate a journal entry, you enter transactio...

Q: The net unrealized loss at December 31, 2020 in accumulated OCI in shareholders' equity is

A: Unrealized loss is the loss which has been recorded by the company due to reason of change in the fa...

Q: er 2

A: Financial statements are those statements which are prepared at the end of accounting period for the...

Q: Included in the December 31, 2018, Jacobi Comapany balance sheet was the following share holders’ eq...

A: Common stock- Common stock is a type of investment that represents ownership in a company. A board o...

Q: Accounting for Income Taxes Cullumber Corporation has one temporary difference at the end of 2020 th...

A: Lets understand the basics. When there is taxable temporary difference between the tax liability as ...

Q: Termination of employment is often a stressful event for an employe True or False True False

A: Termination of employment menas, employee departure from his job and end of employee - employer rela...

Q: MC Packaging Limited ("MC") makes aluminum cans for the food processing industry. It produces the ca...

A: You have posted multiple parts, as per Bartleby policy, only three parts are answered, if you want a...

Q: Jean, Conny, and Sasha decided to put up a meat and potato business so they formed a partnership on ...

A: Solution Partnership is an agreement between two or more persons who are agree to share profit of th...

Q: The NiceWay Corporation's statement of financial position shows the total stockholders' equity of P5...

A: Stockholder's equity: Stockholder's equity refers to the net asset of the company available to the s...

Q: Bramble Company reports the following operating results for the month of August: sales $300,000 (uni...

A: Selling Price Per Unit = $300000 / 5000 = $60 Variable Cost Per Unit = $217000 / 5000 = $43.4 Fixed ...

Q: Secure, Inc. manufactures travel locks. The budgeted selling price is $24 per lock. The variable cos...

A: Sales - variable costs = Contribution margin Contribution margin - Fixed costs = Operating income ...

Q: Proposed Pricing for two models under consideration Selling Price $299.00 Base $399.00 Deluxe Variab...

A: Lets understand the basics. Break even point is a point at which no profit/no loss condition arise. ...

Q: The going concern assumption is the basis for the rule that: Group of answer choices the cost of ins...

A: Going concern assumption is one of the most important assumption while making the accounting records...

Q: Accounting Walmart leases equipment to Staples on Jan 1, 2020. The lease is appropriately recorded a...

A: Solution Computation of the present value of minimum lease payment- Year Annual lease rent Year ...

Q: /hat is the compound amount and compound interest of $36,000 invested at 12% com- ounded semiannuall...

A: The question is based on the concept of Financial Management.

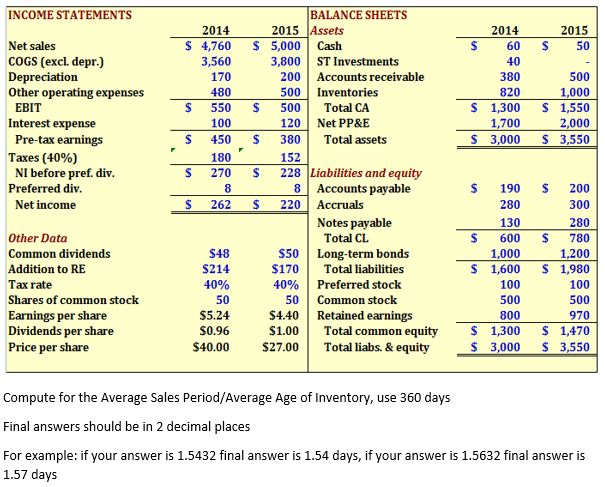

Jinchuriki Inc.'s Financial Statement for years 2014-2015. Compute of the Average Sales Period/ Average Age of Inventory.

Step by step

Solved in 2 steps with 2 images

- Problem BPeter Senen Corporation provided the following account balances as of September 30, 2020: CashP112,000 Accumulated depreciationP 36,000Accounts Receivable64,000Accounts payable 40,000Finished Goods48,000Income tax payable9,000Work in process 36,000 Share Capital500,000Raw materials 52,000 Retained Earnings207,000Property and Equipment480,000The following transactions occurred during October:1. Materials purchased on account, P150,0002. Materials issued to production: direct materials- P90,000, Indirect materials- P10,000.3. Payroll for the month of October 2020 consisted of the following (also paid during the month):Direct labor P62,000Administrative salariesP16,000Indirect Labor 20,000Sales salaries 30,000Payroll deductions were as follows:Withholding taxes P19,800Phil health contributions P2,000SSS contributions 7,100HDMF contributions 2,0004. Employer contributions for the month were accrued:FactorySellingAdministrativeSSS contributionsP5,700P2,000P1,100Philhealth…INCOME STATEMENT Year ended June 30 2022 2021 $'000 $'000Revenue 22450 18675Cost of sales 8475 8055Gross Profit 13975 10620Distribution costs 4245 3120Administrative expenses 1276 2134Selling expenses…2013 2014 Sales$4,500 $4,775 Depreciation7501050COGS24222430Interest180215Cash200400Accts Receivables200300Notes Payable100150Long-term debt29561850Net fixed assets80009200Accounts Payable50100Inventory18001600Dividends225275Tax rate35%35% 1. What is the cash flow from operating activities? 2. What is the cash flow from financing activities? What is the days sales in accounts receivable or the AR period?

- Sales : $250,000Costs : $134,000Depreciation : $10,200Operating expenses : $6,000Interest expenses : $20,700Taxes : $18,420Dividends : $10,600Addition to Retained Earnings : $50,080Long term debt repaid : $9,300New Equity issued : $8,470New fixed assets acquired : $15,000 You are required to:iv) Calculate the cash flow from assets v) Calculate net capital spending vi) Calculate change in NWCSolve for fy22 sales and depreciation a on the 2022 income statement. remember to reference the growth rate provided by Paul.of 0.141 FY21 FY22 Sales $24884886 Blank Cost of Goods Sold $19659044 Other Expenses $2735335 Depreciation $995395 Blank Taxable Income $1493092 Taxes (21%) $313549 Net Income $1179543 Dividends $500,000 Add. to Retained Earnings $679543Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Income Statements for 2020 and 2021 (including dividends paid and retained earnings).

- A2 aii Use the following information for Delta Corporation: Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Account’s receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of goods sold, all assets (current and fixed), and accounts payable will all remain a constant…Consider the following financial information and answer the questionsthat follow:Sales : $250,000Costs : $134,000Depreciation : $10,200Operating expenses : $6,000Interest expenses : $20,700Taxes : $18,420Dividends : $10,600Addition to Retained Earnings : $50,080Long term debt repaid : $9,300New Equity issued : $8,470New fixed assets acquired : $15,000You are required to:iv) Calculate the cash flow from assets v) Calculate net capital spending vi) Calculate change in NWCShafNita Sdn. Bhd. Statement of Financial Position as at 31 December2019 2020RM RM RM RM Non Current AssetsBuilding 100,000 100,000Fixtures less accumulated depreciation 3,600 4,000Van less accumulated depreciation 7,840 14,800111,440 118,800 Current AssetInventory 11,200 24,800Trade account receivable 12,800 16,400Bank 1,800 -Cash 440 400 26,240 41,600Total assets 137,680 160,400Finance by:Capital account:Balance at 1 January 74,080 105,080Add: Net profit for the year 70,400 42,320Cash introduced - 20,000144,480 167,400Less: Drawings (39,400) (43,200)105,080 124,200 Non Current LiabilitiesLoan (repayable in 10 years time) 20,000 30,000Current LiablitiesAccount Payable 12,600 6,012Bank overdraft - 188Retained earnings 32,600 36,200Total liabilities and equity 137,680 160,400 Additional information at 31 December 2020: Fixtures bought in 2020 cost RM800. Van bought in 2020 cost RM11,000. Required: Prepare statement of cash flow for ShafNita Sdn. Bhd. for the year ended 31 December…

- Sales : $250,000Costs : $134,000Depreciation : $10,200Operating expenses : $6,000Interest expenses : $20,700Taxes : $18,420Dividends : $10,600Addition to Retained Earnings : $50,080Long term debt repaid : $9,300New Equity issued : $8,470New fixed assets acquired : $15,000You are required to:i) Calculate the operating cash flow ii) Calculate the cash flow to creditors iii) Calculate the cash flow to shareholders iv) Calculate the cash flow from assets v) Calculate net capital spending vi) Calculate change in NWCTHE ATHLETIC ATTICIncome StatementFor the Year Ended December 31, 2024Net sales $8,900,000Cost of goods sold 5,450,000Gross profit 3,450,000Expenses: Operating expenses $1,600,000 Depreciation expense 210,000 Interest expense 50,000 Income tax expense 360,000 Total expenses 2,220,000Net income $1,230,000 THE ATHLETIC ATTICBalance SheetsDecember 31 2024 2023Assets Current assets: Cash $164,000 Accounts receivable 790,000 Inventory 1,405,000 Supplies 110,000Long-term assets: Equipment 1,150,000 Less: Accumulated depreciation (420,000) Total assets $3,199,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $115,000 Interest payable 0 Income tax payable 40,000 Long-term liabilities: Notes payable 600,000 Stockholders' equity: Common stock 700,000…Orbit Limited : Statement of Financial Position as at 31 December 2022 2021 Non-current Assets R11 810 000 R7 560 000 Property, Plant, Equipment R10 025 000 R6 250 000 Investments R1 785 000 R1 310 000 Current Assets R4 190 000 R4 690 000 Inventories R 1 875 000 R2 350 000 Account Receivable R1 925 000 R2 200 000 Cash R390 000 R140 000 Toatal Assets R16 000 000 R12 250 000 Equities & Liabilities Equity ? ? Oridanary share capital R5 480 000 R3 680 000 Retained earnings ? ? Non-current Liabilities R4 500 000 R3 800 000 Loan (20% p.a) R4 500 000 R3 800 000 Current Liabilities R2 300 000 R1 500 000 Accounts payable? R2 300 000 R1 500 000 Calculate the increase in the retained earnings over the two-year period.