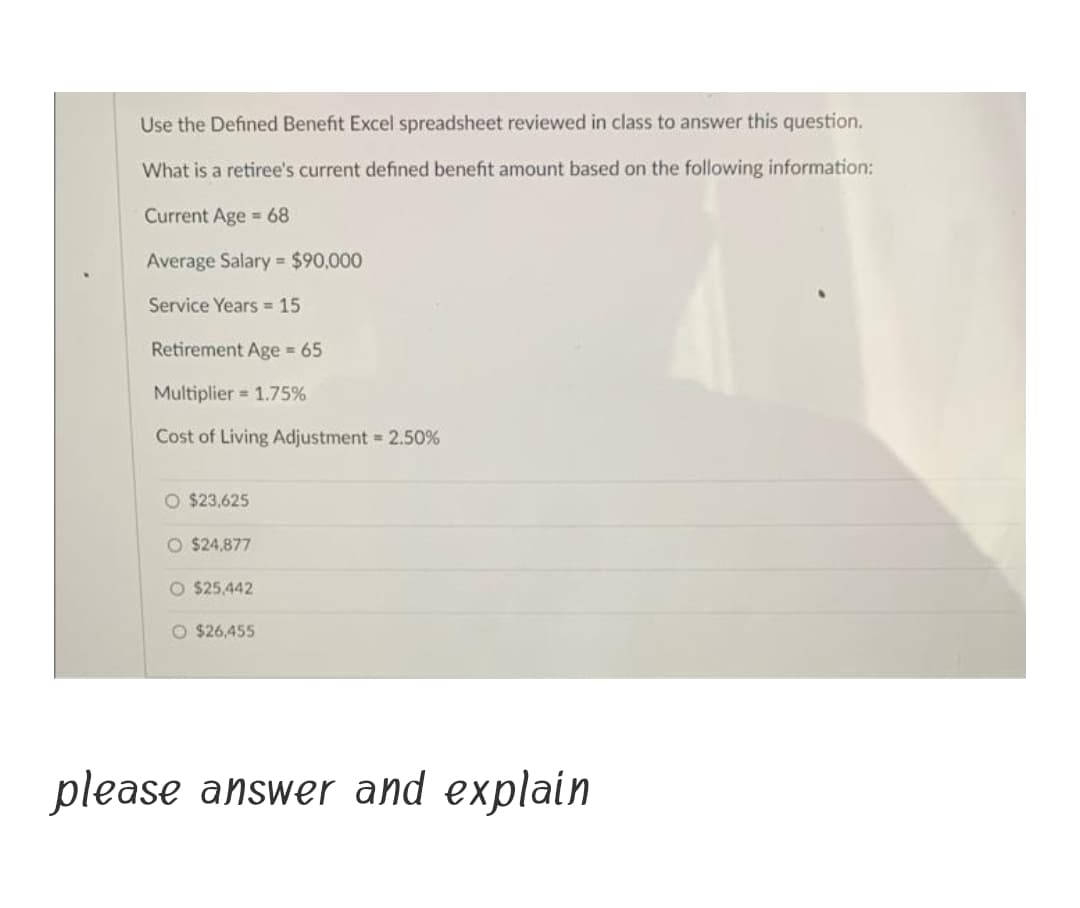

Use the Defined Benefit Excel spreadsheet reviewed in class to answer this question. What is a retiree's current defined benefit amount based on the following information: Current Age 68 Average Salary = $90,000 Service Years = 15 Retirement Age 65 Multiplier = 1.75% Cost of Living Adjustment 2.50% O $23,625 $24,877 O $25,442 O $26,455

Q: The company has a maximum production capacity of 100,000 units per year. Operating at normal capacit...

A: Solution Note- In that question nothing is mention what to calculate . I solve the same question bef...

Q: Superior Skateboard Company, located in Ontario, is preparing to adjust entries on December 31, 2020...

A: An adjusting journal entry is a journal entry made in a company's general ledger at the end of an ac...

Q: On December 2, 2022, Pancit Manufacturing Company purchased goods with a cash price of P1,600,000. S...

A: Inventory is one of the important current asset being held by the business. This is reported under a...

Q: A record of employment must be issued when an employee with a regular work schedule is expecled to I...

A: In the Given case scenario, This statement is false: A record of employment must be issued when an ...

Q: Given the following list of accounts with normal ba Cash Accounts Receivable Capital Withdrawals $1,...

A: A trial balance is a mix of balance sheet items and P&L items and hence all accounts that are us...

Q: You are given the following information relating to Exodus Trading: Gross profit rate based on cost...

A: W.N.1: Calculation of Credit Sales in 2022: Cost of Sales = Cost of goods available for ...

Q: On January 2, 2021, Tripod Company receives a government loan of P2,000,000 paying a coupon interest...

A:

Q: Proposed Pricing for two models under consideration Selling Price $299.00 Base $399.00 Deluxe Variab...

A: Lets understand the basics. Break even point is a point at which no profit/no loss condition arise. ...

Q: 3) Misnap is a manufacturing firm. In April, it had a beginning inventory balance in its raw materia...

A: Calculation of material used in april are as follows.

Q: The following are several transactions for Halpin Advertising Company.a. Purchased $1,000 of supplie...

A: Revenue and costs are recognized and documented as they occur under accrual accounting, but cash bas...

Q: Bounce Back Insurance Company carries three major lines of insurance: auto, workers' compensa- tion,...

A: The process of relating a firm's revenue profit to the profit of a single product is known as produc...

Q: 2021 2022 Units produced 60,000 50,000 Units sold 54,000 54,000 Selling price per unit Variable cost...

A: In variable costing, only fixed manufacturing and other indirect costs are expensed in the period th...

Q: Becton Labs, Incorporated, produces various chemical compounds for industrial use. One compound, cal...

A: The question is based on the concept of Cost Accounting.

Q: Given the following list of accounts with normal balances, what are the trial balance totals of the ...

A: Trial balance is a method of confirming that the debit and credit amounts recorded in the different ...

Q: Magic Realm, Incorporated, has developed a new fantasy board game. The company sold 60,000 games las...

A: Formula: Net income = Revenues - Expenses.

Q: Sycamore, Inc. purchased P100,000 of 8 percent bonds of Alvarado Industries on January 1, 2022, at a...

A: Bond Valuation In the bond valuation it uses either in par value or in discount or in premium on bon...

Q: The manufacturing company of Wellington has collected the given information to develop predetermined...

A: Lets understand the meaning of plantwide overhead rate and departmental overhead rate. In plantwide ...

Q: Account DR Cash $40,000 A/R 20,000 Rent Exp 12,000 Dividends 5,000 Sales Return 8,000 Wage Exp 15,00...

A: The income statement is one of the financial statements of the business which tells about the profit...

Q: The following information is available for Dennehy Company: $390,000 Sales Revenue Freight-in $30,00...

A: Cost of goods sold = Beginning inventory + Purchases - Purchase returns and allowances + Freight-i...

Q: Beginning inventory, purchases, and sales for Item Copper are as follows: Mar. 1 Inventory 450 units...

A: Inventory valuation method includes: FIFO Method LIFO Method Weighted average Method FIFO Method...

Q: A customer of Mutare paid for merchandise originally purchased on account with a check thathas been ...

A: Adjusting journal entry: At year-end when the company finalizes its accounts then any unrecognized i...

Q: Required: 1. Indicate the effects of each transaction on the accounting equation. (Enter decreases t...

A: Solution:- Given, New delivery purchased = $58,000 Sales tax = $4,900 Paid cash on van = $14,000 Due...

Q: ected operating data for two divisions of Outback Brewing, Ltd., of Australia are given below:

A: In this question, we have to calculate the ROI

Q: amount of gain or loss should Fortune Company recognize as a result of change in fair value on Decem...

A: Fair Value of dairy cattle as on July 1,2022: Purchase price : P400,...

Q: Part III Record the following T Accounts 1. Recorded revenue from cash patients of $30,000.00 2. Pai...

A: The T-accounts are prepared to post the transactions from the journal book to specific accounts.

Q: The Lessor Corporation leases equipment to Lessee Corporation beginning January 1, 2022. The followi...

A: Lessee refers to the person who has taken any assets on lease.

Q: .Piedmont Company segments its business into two regions-North and South. The company prepared the c...

A: Break-even sale is the dollar sale of an entity whereby the business is neither in profits nor in lo...

Q: Example 4-12 GROSSING-UP. Cotter Company wants to award a $4,000 bonus to Donna D'Amico. In additio...

A: In this question, we have to find out the gross Bonus and net bonus amount and the blanks given to ...

Q: 16. Revenue cannot be recognized unless delivery of goods has occurred or services have been rendere...

A: Since you have posted multiple questions we will do the first one for you. To get the other questio...

Q: Erie Company reported the following comparative balance sheets: ...

A: Statement of cash flows forms a part of financial statements and is prepared with a view to ascertai...

Q: Required: 1. What is the company's contribution margin (CM) ratio?

A: In this question, we have to compute the company's CM ratio

Q: Accounting Budget Fixed FOH=800 Actual HRS=120 Stand HRS=150 Norm HRS= 100 Actual Fixed FOH=815 1.Fi...

A: 1) Fixed Overhead Rate is derived by dividing the total cost pool by unit of basis of allocation us...

Q: On April 1, 2020, Quicke Mart issued $1,000,000, 9% bonds at par plus accrued interest dated January...

A: Bond is the debt security that investors uses to reduce the risk and increase stable return from the...

Q: You have just signed a retail lease with an $18 per square foot base rent annually and a percentage ...

A: Natural breakpoint refers to the sales amount till which lessee is required to make only basic renta...

Q: Which of the following statements is true?a. The outstanding number of shares is the maximum number ...

A: Shares outstanding allude to a corporation's stock that is currently occupied by all of its stockhol...

Q: On July 1, 2021, Darrell Company purchased as debt investments at fair value through profit or loss,...

A: As per conservatism principle we can anticipate losses and provide for it but we ...

Q: The purpose of schedule M-1 is to reconcile net income per tax return with net income per books

A: As per our guidelines we provide solution to one question only but you have asked four multiple choi...

Q: 6 Landis Co. purchased P500,000 of 8%, 5-year bonds (DI@FVTOCI) from Ritter, Inc. on January 1, 202...

A: Solution:- Given, Landis Co. Purchased = P500,000 of 8%, 5 year bonds. Bonds sold = P520,790 Interes...

Q: Accounting Walmart leases equipment to Staples on Jan 1, 2020. The lease is appropriately recorded a...

A: Solution Computation of the present value of minimum lease payment- Year Annual lease rent Year ...

Q: Part VI Prepare a Cash Flow Statement using the DIRECT Method. DO NOT use the INDIRECT Metho...

A: Solution Cash flow statement is the statement which provides the data regarding all cash inflow and ...

Q: 982 PE 20-6B lost of units transferred out and ending work in process OBJ. 2 The costs per equivalen...

A: Solution 1- Equivalent unit of production - Material and conversion cost- Material Conversion...

Q: On October 1, 2021, Neon Company purchased a P2,000,000 face value 10% debt instrument paying a tota...

A: One of the source used by the business organization in order to raise the capital is Issue of Debt s...

Q: McKendrick Shoe Store has a beginning inventory of $45,000. During the period, purchases were $195,0...

A: Cost of goods available for sale = Beginning inventory + Purchases - Purchase returns + Freight-in B...

Q: McKenzie purchased qualifying equipment for his business that cost $212,000 in 2021. The taxable inc...

A: Deduction- A deduction is an outflow that can be deducted from a taxpayer's gross income in order to...

Q: When debt investment was sold, total cash received is always equals to the sum of the selling price,...

A: Debt Investment: Assumption that the borrower will repay the investment with interest (debt investme...

Q: eremiah Sugar Company has the policy of valuing inventory at lower of cost and net realizable value....

A: Inventory is value at lower of cost or net realizable value (NRV). NRV is calculated as selling pric...

Q: Which type of stock pays a fixed dividend? A. common B. preferred C. debenture D. convertible

A: Introduction:- Shares are mainly classified into two types. Preference shares:- This type of share ...

Q: When adjusting entries were made at the end of the year, the accountant for Parker Companydid not ma...

A: Adjusting entries refer to the the journal entries which are passed at the end of accounting period ...

Q: eston Products manufactures an industrial cleaning compound that goes through three process- ing dep...

A: Process costing is a costing method which is mainly used where similar goods are produced in a mass ...

Q: Steve’s Outdoor Company purchased a new delivery van on January 1 for $58,000 plus $4,900 in sales t...

A: In this question, There are 4 requirements : 1.Indicate the effects of each transaction on the accou...

Step by step

Solved in 2 steps

- Joshua Company has a define contribution plan that covers its existing employees. The terms of the plan require Joshua to contribute 5% of the annual employee salaries to the retirement plan each year. The payroll shows the annual salaries and contributions made as follows: Year Gross Payroll Contributions made 2021 P670,000 670,000 2022 12.200,000 430,000 How much is the benefit expense in 2022 profit or loss and the amount of prepaid (accrued) benefit as of December 31, 2022? O P610,000 and P10,000 prepaid O P610,000 and P180,000 accrued OP430,000 and P10.000 prepaid OP430,000 and P180,000 accruedCHOOSE THE LETTER OF THE CORRECT ANSWER What is the employee benefit expense for the current year? a. 1,180,000b. 2,100,000c. 1,850,000d. 1,050,000 What is the remeasurement gain or loss on plan assets on Dec. 31? a. 670,000 gainb. 670,000 lossc. 650,000 gaind. 650,000 lossFind the net pay for each of the following employees after FICA, Medicare, federal withholding tax, state disability insurance, and other deductions have been taken out. Assume that none has earned over $130,000 so far this year. Assume a FICA rate of 6.2%, Medicare rate of 1.45%, and a state disability insurance rate of 1%. Use the percentage method of withholding. L. Soltero: $5410 monthly earnings, 1 withholding allowance, single, $47.80 in other deductions Mike Jennings: $4147.38 monthly earnings, 5 withholding allowances, married, union dues of $15, charitable contributions of $41.65, state withholding of $25.70 Carla Lorenz: $1468.25 weekly earnings, 4 withholding allowances, married, credit union savings of $18, charitable contributions of $10

- Calculate the Social Security and Medicare deduction for the following employee (assume a tax rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare): (round your answer to the nearest cent.) Employee Cumulative Earnings before this pay period Pay Amount this Period Social Security Medicare Logan $128,300 $3,000An employer uses a career average formula to determine retirement payments to its employees. The annual retirement payout is 8 percent of the employees’ career average salary times the number of years of service. Calculate the annual benefit payment under the following scenarios. Years Worked Career Average Salary 27 $ 68,000 30 70,500 32 72,000Company A has established a defined benefit plan indicating a plan formula for annual benefit equal to 2% multiplied by the number of years in service multiplied by the final year’s salary. The annual benefit is payable at the end of each year. An employee was hired by the entity on January 1,2000 and expected to retire on December 31, 2044. The employee’s retirement is expected to span 21 years. The employee’s final salary at retirement is expected to be P800,000 and the appropriate discount rate is 8%. On January 1, 2020, the plan formula was amended by increasing the percentage from 2% to 3%. The amendment was made retroactive to consider past service years. Compute for the ff: 1)PBO, Jan 1, 2020 (before amendment), Jan 1, 2020 (after amendment), Dec. 31,2020, Dec. 31, 2021 and Dec. 31 2022 2)Past service cost, 2020, 2021 and 2022 3)Current service cost, 2020, 2021 and 2022 4)Interest expense, 2020, 2021 and 2022

- FMC Inc. provides its employees with a defined benefit pension plan. Details are as follows: Present value defined benefit obligation (DBO) — December 31, 2020 $7,000,000 Plan assets — December 31, 2020 $5,900,000 Plan’s actuary confirmed that 4% is the appropriate interest rate to use. Current service costs (CSC) for the year $590,000 Past service costs (PSC) (improvement in benefits) — January 1, 2020 $60,000 Expected ending DBO — December 31, 2020 $7,200,000 Expected ending plan assets — December 31, 2020 $6,500,000 Remitted to pension trustee — evenly throughout year $670,000 Payments to retirees — evenly throughout year $640,000 What journal entry should FMC prepare to record the remeasurement gains/losses and actuarial gains/losses for the year? Assume FMC reports under IFRS. Question 18 options: a) DR OCI — actuarial losses 200,000 DR OCI — losses on remeasurement of plan assets 600,000 CR Net defined benefit liability…Find the net pay for each of the following employees after FICA, Medicare, federal withholding tax, state disability insurance, and other deductions have been taken out. Assume that none has earned over $130,000 so far this year. Assume a FICA rate of 6.2% Medicare rate of 1.45% and a state disability insurance rate of 1%. Use the percentage method of withholding. 8. L. Soltero: $5410 monthly earnings, 1 withholding allowance, single, $47.80 in other deductions 9. Mike Jennings $4147.38 monthly earnings, 5 withholding allowances, mareied, union dues of $15, charitable contributions of $41.65, state withholding of $25.70 10. Carla Lorenz: $1468.25 weekly earnings, 4 withholding allowances, married, credit union savings of $18, charitable contributions of $10 Complete the following payroll ledger. Find the total gross earnings for each employee.he following information relates to the pension plan for the employees of Cullumber Co.: (See Image) Cullumber estimates that the average remaining service life is 16 years. Cullumber's contribution was $ 1213000 in 2021 and benefits paid were $ 877000.The actual return on plan assets in 2021 is a. $ 2011000. b. $ 1134000. c. $ 798000. d. $ 336000.

- Q1. Your employer uses a flat benefit formula to determine retirement payments to its employees. The fund pays an annual benefit of $2,500 per year of service. Calculate your annual benefit payment for 25, 28 and 30 years of service.The following data are available pertaining to Household Appliance Company's retiree health care plan for 2021: Number of employees covered 2 Years employed as of January 1, 2021 3 [each] Attribution period 20 years Expected postretirement benefit obligation, Jan. 1 $ 60,000 Expected postretirement benefit obligation, Dec. 31 $ 63,000 Interest rate 5 % Funding none Required:1. What is the accumulated postretirement benefit obligation at the beginning of 2021?2. What is interest cost to be included in 2021 postretirement benefit expense?3. What is service cost to be included in 2021 postretirement benefit expense?4. Prepare the journal entry to record the postretirement benefit expense for 2021.Teddy’s earned income was $54,000 in 2021 and $57,000 in 2022. How much can he contribute to his RRSP in 2022 given the following? Carry forward contribution room: $25,000 Pension adjustment: $6,000 Annual maximum: $29,210 Select one: a. $54,210 b. $28,720 c. $29,260 d. $48,210