Compute for the Consolidated Asset for 2018

Chapter14: Property Transact Ions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 75P

Related questions

Question

100%

Compute for the Consolidated Asset for 2018.

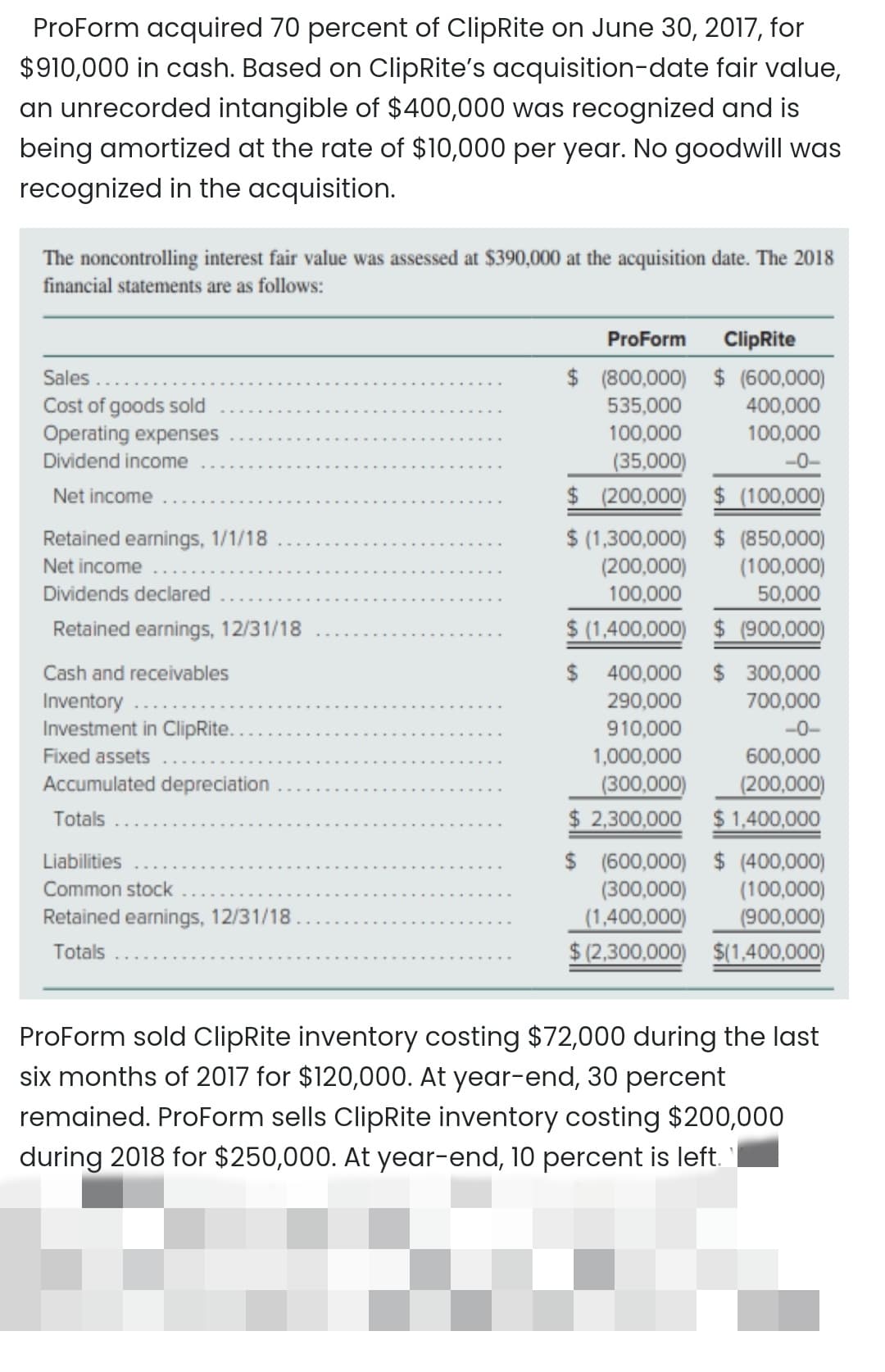

Transcribed Image Text:ProForm acquired 70 percent of ClipRite on June 30, 2017, for

$910,000 in cash. Based on ClipRite's acquisition-date fair value,

an unrecorded intangible of $400,000 was recognized and is

being amortized at the rate of $10,000 per year. No goodwill was

recognized in the acquisition.

The noncontrolling interest fair value was assessed at $390,000 at the acquisition date. The 2018

financial statements are as follows:

ProForm

ClipRite

$ (800,000) $ (600,000)

400,000

Sales

Cost of goods sold

Operating expenses

535,000

100,000

100,000

Dividend income

(35,000)

$ (200,000)

-0-

Net income

(100,000)

$ (1,300,000) $ (850,000)

(100,000)

50,000

Retained earnings, 1/1/18

Net income

(200,000)

Dividends declared

100,000

Retained earnings, 12/31/18

$ (1,400,000) $ (900,000)

$ 400,000

$ 300,000

700,000

Cash and receivables

Inventory ....

Investment in ClipRite.

290,000

910,000

-0-

Fixed assets

1,000,000

600,000

Accumulated depreciation

(300,000)

$ 2,300,000

(200,000)

Totals

$ 1,400,000

$ (600,000) $ (400,000)

(300,000)

Liabilities

(100,000)

(900,000)

Common stock

Retained earnings, 12/31/18

(1,400,000)

$ (2,300,000) $(1,400,000)

Totals

ProForm sold ClipRite inventory costing $72,000 during the last

six months of 2017 for $120,000. At year-end, 30 percent

remained. ProForm sells ClipRite inventory costing $200,000

during 2018 for $250,000. At year-end, 10 percent is left.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning