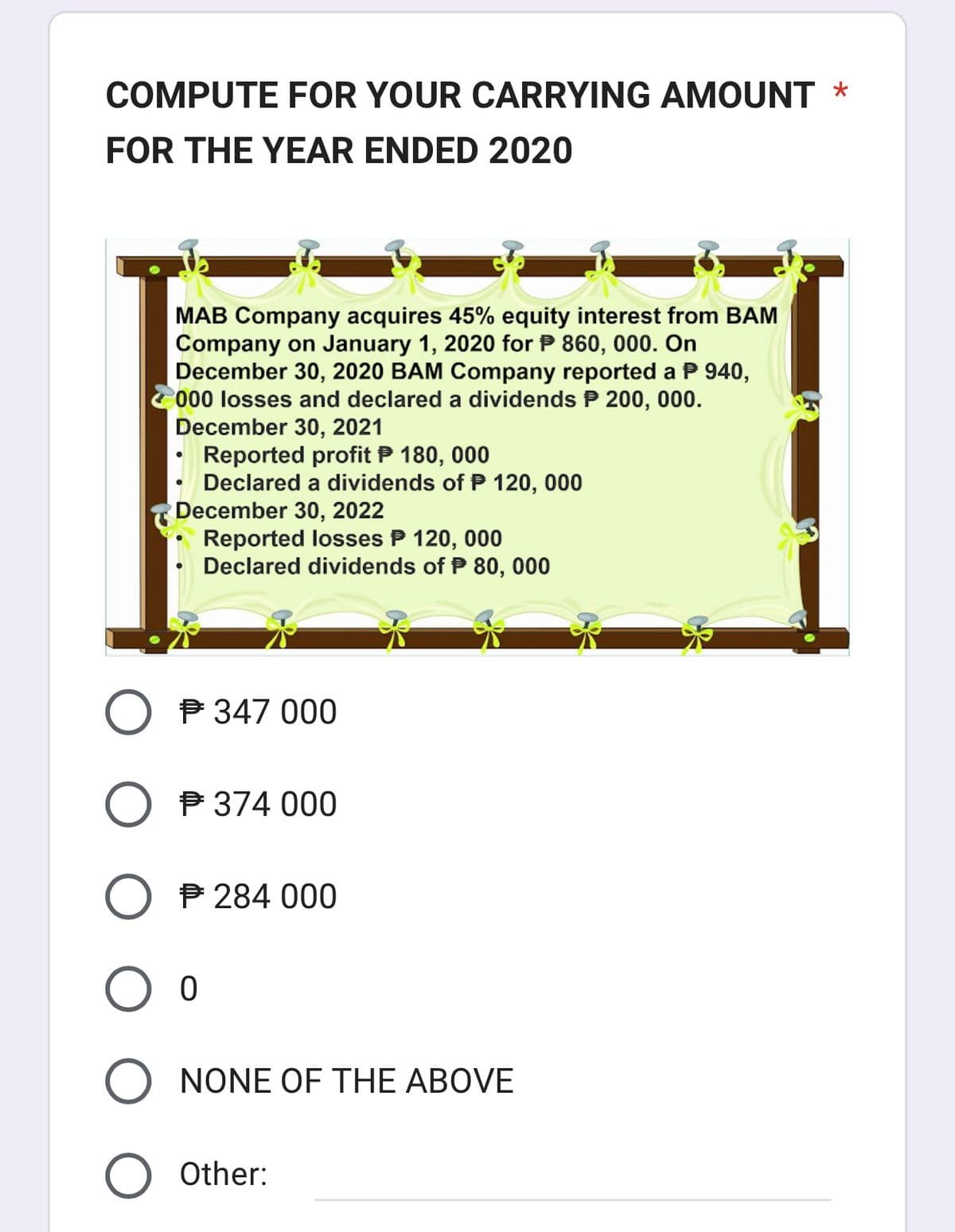

COMPUTE FOR YOUR CARRYING AMOUNT * FOR THE YEAR ENDED 2020 16,3 MAB Company acquires 45% equity interest from BAM Company on January 1, 2020 for 860, 000. On December 30, 2020 BAM Company reported a P 940, 000 losses and declared a dividends P 200, 000. December 30, 2021 Reported profit P 180, 000 Declared a dividends of P 120, 000 December 30, 2022 ● Reported losses P 120, 000 Declared dividends of P 80, 000 O € 347 000 O € 374 000 O € 284 000 O O O NONE OF THE ABOVE Other:

Q: The following is list of accounts each represented by letter(s). A Accounts Payable U Loss from…

A: The bonds are financial instruments that are used to raise money from the market or investors. The…

Q: On January 1, Year 1, Marino Moving Company paid $48,000 cash to purchase a truck. The truck was…

A: Depreciation Expense: Depreciation Expense is a expense charged to assets of the company. It is…

Q: I Can't Think of a Company Name (CTCN) manufacturers products. They had 6,200 physical units that…

A: The equivalent units are calculated on the basis of percentage of the work completed during the…

Q: 3. Which among these alternatives would you prefer, assumi the payout period is 10 years and your…

A: Present value is the equivalent value of money today to be received in the future based on the time…

Q: The management of Cook is considering the elimination of the West Division. If the West Division…

A: Introduction:- Net Operating Income indicates the health and viability of a business by showing its…

Q: Alto Leases a car on 1st Jan 2020 for 2 years Option to extend 1 more year (reasonably certain to…

A: The lease can be defined as a contract where the lessor provides the right to use the asset to the…

Q: A manufacturer uses activity-based costing to assign overhead costs to products. Budgeted cost…

A: Activity-based costing (ABC): It is a costing method in which overhead and indirect costs are…

Q: Finch Company is considering the replacement of some equipment and the potential replacement…

A: A replacement decision refers to a business decision where a company must decide whether to replace…

Q: The Field, Brown & Snow are partners and share income and losses equality. The partner decide to…

A: Liquidation is the process of closing down a business or a formation by selling all of its property…

Q: Identify each of the following accounts as a revenue (R), expense (E), asset (A), liability (L), or…

A: Assets: Assets means anything that is owned by the company and has value. Assets are shown in the…

Q: (17,500 units, 10% complete with respect to Refining costs) Transferred-in costs (from Mixing) $…

A: Equivalent units of production arises in case of process costing . In most cases,not all units are…

Q: X ltd manufactures a product incurring variable cost 200$ per unit fixed cost $100000 per month.…

A: Break-even point (BEP): Breakeven is the point where total expenses are equal to total revenue. at…

Q: es are un creul, All Lacuidus assume au-uay year. The payaures penou Round your answers to the…

A: As per the information provided: Collection period - 62 daysDays sales in cash - 35 daysCurrent…

Q: Calculate the Predetermined Overhead Rate (round to two decimal places $ X.XX). The company…

A: PREDETERMINED OVERHEAD RATE Predetermined rate means an indirect cost rate. predetermined overhead…

Q: displayed below.] The following data were provided by Mystery Incorporated for the year ended…

A: Lets understand the basics. Income statement can be prepared using either single step method or…

Q: On January 1, Year 1, Marino Moving Company paid $48,000 cash to purchase a truck. The truck was…

A: Depreciation as per straight line method = (Cost - salvage value) /useful life

Q: Exercise 11-2 (Algorithmic) (LO. 2) Mio was transferred from New York to Germany. He lived and…

A: Foreign earned income exclusion limit means how much amount earned on account of foreign, country…

Q: Gage Co. purchases land and constructs a service station and car wash for a total of P540,000. At…

A: leasing can be a useful tool for businesses that need to acquire used assets but want to avoid the…

Q: Labor-hours (q) Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory…

A: The variance is the difference between the actual and budgeted production data. The flexible budget…

Q: The research, based on 63 patients, showed the following regression results: R-squared: 56%…

A: According to the regression model, It's important to note that this is an estimate based on the…

Q: Swiftly Company prepares its statement of cash flows using the direct method for operating…

A: Cash payment to suppliers means the amount of cash paid to the suppliers for purchasing the…

Q: Pace Corporation acquired 100 percent of Spin Company's common stock on January 1, 20X9. Balance…

A: Stockholders' equity is the amount which represents the amount of ownership of the shareholders in…

Q: The following is list of accounts each represented by letter(s). A Accounts Payable U Loss from…

A: Interest expense refers to the cost of borrowing money from creditors or lenders. It is an expense…

Q: COMPUTE FOR YOUR BASIC EARNING PER SHARE * BASIC EARNINGS PER SHARE Entity A had 50, 000, P15 PAR,…

A: Answer:- Formula:- BEPS = (Net income - Preferred dividends) / Weighted average of common shares…

Q: Which of the following is true regarding capital deficiencies? O a Ob Oc d The partners do not have…

A: In a partnership, each partner contributes capital to the partnership, and this capital is used to…

Q: Tamarisk Corporation purchased a computer on December 31, 2024, for $138,600, paying $39,600 down…

A: Solution: Equipment value = cash paid + Installment * Cumulative PV of $1@ 9% for 5 Years =…

Q: The adjusted trial balance for Tybalt Construction on December 31 of the current year follows.…

A: In this question, we need to : Prepare the income statement for the current year ended December…

Q: The budget director of Heather's Florist has prepared the following sales budget. The company had…

A: Cash will be reported on collection basis and Accounts receivable will be collected by one month…

Q: Daosta Inc. uses the FIFO method in its process costing system. The following data concern the…

A: Using FIFO method, the inventory in beginning is completed at first and assumed to be sold at first.…

Q: Sales and purchase-related transactions using perpetual inventory system The following were selected…

A: Since the requirement for the second sub-part is incomplete we will solve the first sub-part for…

Q: Q5. A property comparable to the single-family home you are appraising sold three months ago for…

A: The sequence of adjusting prices is the same as given in the question. First, we will adjust the…

Q: On January 5, 2019, Minjin Company acquired 30% of the ordinary shares that carry voting rights at a…

A: Investment is defined as an act by which a person who owns the money or has surplus funds available,…

Q: Compute the inventory at April 30 on each of the following bases. Assume that perpetual inventory…

A: LIFO stands for last in first out. Here the latest inventory are assumed to be sold first.

Q: On the basis of the data shown below: Inventory Quantity Cost per Unit 1,700 $163 Dove 23 9,200 30…

A: The ending inventory comprises the goods that are finished but not sold yet. Using lower of cost or…

Q: Daosta Inc. uses the FIFO method in its process costing system. The following data concern the…

A: The equivalent units are calculated on the basis of the percentage of the work completed during the…

Q: Presented below are items taken from the unadjusted trial balance of the Company and its branch on…

A: Goods are sent to the branches by the head office, which regards them as investments. The head…

Q: Piedmont Company segments its business into two regions-North and South. The company prepared the…

A: Break even point in dollar sales =Total Fixed cost/Contribution margin ratio

Q: Also calculate his employers contributions in each of the above. How much in total does his employer…

A: The question is asking for a calculation of Pierre's deductions and his employer's contributions for…

Q: Nelter Corporation, which has only one product, has provided the following data concerning its most…

A: Variable costing is a management accounting method that only considers variable costs, such as…

Q: Required: Compute the ending inventory for the years 2018, 2019, 2020, and 2021, using the…

A: Hey dear student, I'm hereby answering the detailed solution & working note with required…

Q: Consider the following statements concerning the payback method of investment appraisal. 1. It…

A: The payback method of investment appraisal is a simple technique that calculates the amount of time…

Q: Dairymaid processes organic milk into plain yogurt. Dairymaid sells plain yogurt to hospitals,…

A: Differential analysis: Differential analysis refers to the analysis of differential revenue that…

Q: On January 1, 2020, Northeast USA Transportation Company purchased a used aircraft at a cost of…

A: The depreciation is provided to match the revenues with the expenses. The depreciation can be…

Q: Paynesville Corporation manufactures and sells a preservative used in food and drug manufacturing.…

A: Cost accounting is a mechanism adopted by entities to find out the true cost of a specific service,…

Q: Sheffield Inc. purchased 30% of Nadal Corporation's 31,000 outstanding common shares at a cost of…

A: The journal entry was used by commercial organizations to keep track of their financial transactions…

Q: At the beginning of Year 1, Sophie Mopey Company buys a truck for $100,000 and estimates it has a…

A: DEPRECIATION EXPENSE Depreciation means gradual decrease in the value of an asset due to normal wear…

Q: mitiating a new project may require to set up a new organization, although temporarily

A: Initiating a new project can be done in various ways, depending on the nature, scope, and complexity…

Q: On October 1, 2020, Haroon Limited (HL) acquired 85% of the share capital of Safeer Limited (SL).…

A: Net assets are calculated as the difference between total assets and total liabilities. It…

Q: What is the breakeven point, in dollars, for Zippy Dippy Swimwear, maker of bathing suits and…

A: Break even is the point at which the entity is in a position of no profit and no loss. At this…

Q: The Affordable Care Act (ACA) requires large employers to provide a minimum level of health…

A: The Affordable Care Act is popularly known as the ACA. This act contains benefits and…

Please help me answer this with compl Solution. Thank you

Step by step

Solved in 3 steps

- Net Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as follows: During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of 108,000. It incurred cost of goods sold of 62,000 and operating expenses of 12,000, 2. JR issued 1,000 shares of its 5 par common stock for 14 per share. 3. JR invested 30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of 35,000. 4. JR paid dividends of 6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income ignore earnings per share). 2. For 2016 prepare a separate (a) income statement (ignore earnings per share) and (b) statement of comprehensive income.Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. Calculate the corporation's dividends received deduction for 2019. $_____________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000. Calculate the corporation's dividends received deduction for 2019. $___________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000. Calculate the corporation's dividends received deduction for 2019. $_____________On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.

- Cumulative Preferred Dividends Capital stock of Barr Company includes: As of December 31, 2018, 2 years dividends are in arrears on the preferred stock. During 2019, Barr plans to pay dividends that total S360.000. Required: Determine the amount of dividends that will be paid to Barrs common and preferred stockholders in 2019. If Barr paid $280,000 of dividends, determine how much each group of stockholders would receive.Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.Income Statement and Retained Earnings Huff Company presents the following items derived from its December 31, 2019, adjusted trial balance: The following information is also available for 2019 and is not reflected in the preceding accounts: 1. The common stock has been outstanding all year. A cash dividend of 1.28 per share was declared and paid. 2. Land was sold at a pretax gain of 6,300. 3. Division X (a major component of the company) was sold at a pretax gain of 4,700. It had incurred a 9,500 pretax operating loss during 2019. 4. A tornado, which is an unusual event in the area, caused a 5,400 pretax loss. 5. The income tax rate on all items of income is 30%. 6. The average shareholders equity is 90,000. Required: 1. Prepare a 2019 multiple-step income statement for Huff. 2. Prepare a 2019 retained earnings statement. 3. Compute the 2019 return on common equity (Net Income 4 Average Shareholders Equity).During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 loss

- Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Haley engaged in the following transactions involving its equity accounts: Sold 5,000 shares of common stock for $19 per share. Sold 1.200 shares of 12%, $50 par preferred stock at $75 per share. Declared and paid cash dividends of $22,000. Repurchased 1,000 shares of treasury stock (common) for $24 per share. Sold 300 of the treasury shares for $26 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $123,700. Prepare a statement of stockholders equity at December 31, 2020.Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Stanley Utilities engaged in the following transactions involving its equity accounts: Sold 3,300 shares of common stock for $15 per share. Sold 1,000 shares of 12%, $100 par preferred stock at $105 per share. Declared and paid cash dividends of $8,000. Repurchased 1,000 shares of treasury stock (common) for $38 per share. Sold 400 of the treasury shares for $42 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $87,000. Prepare a statement of stockholders equity at December 31, 2020.