Compute the amount of charitable contribution deduction for the current year for the following taxpayers. Ignore any percentage limitations. a. Pritizo Corporation owns inventory with a basis of $30,000 and a fair market value of $24,000. A charitable contribution af the Inventory results in a deduction of $ b. During the current year, Lasso Corporation donates a capital asset to Midlands College. Lasso acquired the asset three years ago for $18,000, and the fair market value on the date of the contribution is $32,000. The corporation's charitable contribution deduction is c. Nate Corporation donates a sculpture worth $130,000 to a local museum (a qualified organization), which exhibits the sculpture. Nate had acquired the sculpture in 2005 for $55,000. Nate is allowed to deduct S

Compute the amount of charitable contribution deduction for the current year for the following taxpayers. Ignore any percentage limitations. a. Pritizo Corporation owns inventory with a basis of $30,000 and a fair market value of $24,000. A charitable contribution af the Inventory results in a deduction of $ b. During the current year, Lasso Corporation donates a capital asset to Midlands College. Lasso acquired the asset three years ago for $18,000, and the fair market value on the date of the contribution is $32,000. The corporation's charitable contribution deduction is c. Nate Corporation donates a sculpture worth $130,000 to a local museum (a qualified organization), which exhibits the sculpture. Nate had acquired the sculpture in 2005 for $55,000. Nate is allowed to deduct S

Chapter3: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 45P

Related questions

Question

Transcribed Image Text:Corporation

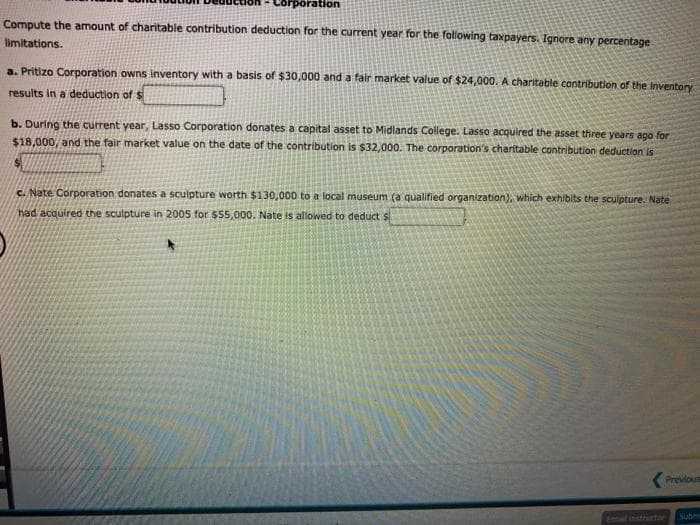

Compute the amount of charitable contribution deduction for the current year for the following taxpayers. Ignore any percentage

limitations.

a. Pritizo Corporation owns inventory with a basis of $30,000 and a fair market value of $24,000. A charitable contribution of the Inventory

results in a deduction of $S

b. During the current year, Lasso Corporation donates a capital asset to Midlands College. Lasso acquired the asset three years ago for

$18,000, and the fair market value on the date of the contribution is $32,000. The corporation's charitable contribution deduction is

c. Nate Corporation donates a sculpture worth $130,000 to a local museum (a qualified organization), which exhibits the sculpture. Nate

had acquired the sculpture in 2005 for $55,000. Nate is allowed to deduct $

Previous

Subm

Emtal thsfreuctar

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you