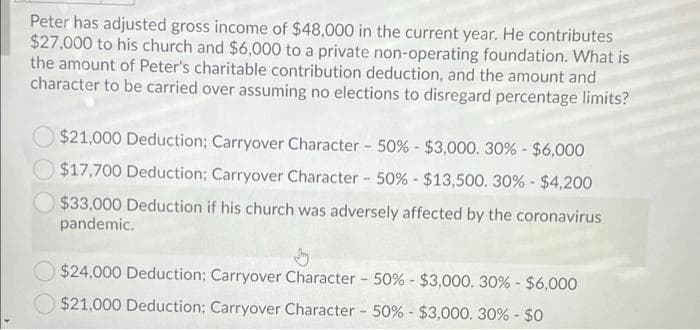

Peter has adjusted gross income of $48,000 in the current year. He contributes $27,000 to his church and $6,000 to a private non-operating foundation. What is the amount of Peter's charitable contribution deduction, and the amount and character to be carried over assuming no elections to disregard percentage limits? $21,000 Deduction; Carryover Character - 50% - $3,000. 30% - $6,000 $17,700 Deduction; Carryover Character 50% - $13,500. 30% - $4,200 $33,000 Deduction if his church was adversely affected by the coronavirus pandemic. $24,000 Deduction; Carryover Character 50% - $3,000. 30% - $6,000 $21,000 Deduction; Carryover Character 50% - $3,000. 30% - $0

Peter has adjusted gross income of $48,000 in the current year. He contributes $27,000 to his church and $6,000 to a private non-operating foundation. What is the amount of Peter's charitable contribution deduction, and the amount and character to be carried over assuming no elections to disregard percentage limits? $21,000 Deduction; Carryover Character - 50% - $3,000. 30% - $6,000 $17,700 Deduction; Carryover Character 50% - $13,500. 30% - $4,200 $33,000 Deduction if his church was adversely affected by the coronavirus pandemic. $24,000 Deduction; Carryover Character 50% - $3,000. 30% - $6,000 $21,000 Deduction; Carryover Character 50% - $3,000. 30% - $0

Chapter10: Deductions And Losses: Certain Itemized Deductions

Section: Chapter Questions

Problem 3CPA

Related questions

Question

Transcribed Image Text:Peter has adjusted gross income of $48,000 in the current year. He contributes

$27,000 to his church and $6,000 to a private non-operating foundation. What is

the amount of Peter's charitable contribution deduction, and the amount and

character to be carried over assuming no elections to disregard percentage limits?

$21,000 Deduction; Carryover Character - 50% - $3,000. 30% - $6,000

$17,700 Deduction; Carryover Character 50% - $13,500. 30% - $4,200

$33,000 Deduction if his church was adversely affected by the coronavirus

pandemic.

$24,000 Deduction; Carryover Character 50% - $3,000. 30% - $6,000

O $21,000 Deduction; Carryover Character - 50% - $3,000. 30% - $0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT