Compute the expected value and the variance for x and y. Develop a probability distribution for x + y. Using the result of part (b), compute E(x + y) and Var (x + y). Compute the covariance and correlation for x and y. Are x and y positively related, negatively related, or unrelated?

Compute the expected value and the variance for x and y. Develop a probability distribution for x + y. Using the result of part (b), compute E(x + y) and Var (x + y). Compute the covariance and correlation for x and y. Are x and y positively related, negatively related, or unrelated?

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Concept explainers

Equations and Inequations

Equations and inequalities describe the relationship between two mathematical expressions.

Linear Functions

A linear function can just be a constant, or it can be the constant multiplied with the variable like x or y. If the variables are of the form, x2, x1/2 or y2 it is not linear. The exponent over the variables should always be 1.

Question

100%

Could you help me with those tasks? I have no clue what to do

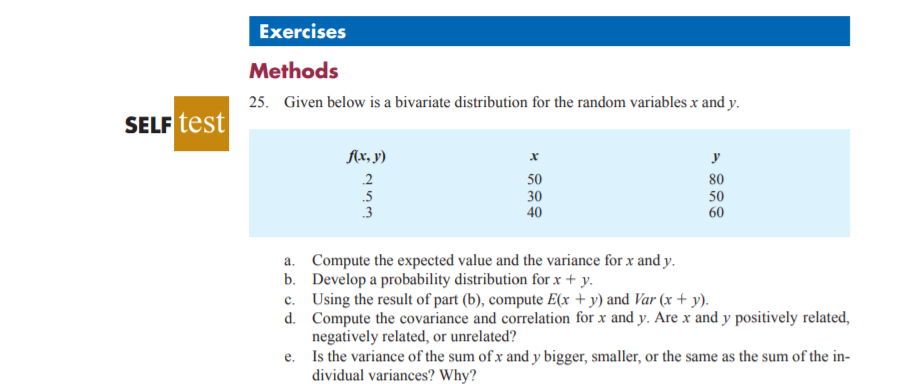

Transcribed Image Text:Exercises

Methods

25. Given below is a bivariate distribution for the random variables x and y.

SELF test

Ax, y)

2

50

80

.5

3

30

50

60

40

a. Compute the expected value and the variance for x and y.

b. Develop a probability distribution for x + y.

c. Using the result of part (b), compute E(x + y) and Var (x + y).

d. Compute the covariance and correlation for x and y. Are x and y positively related,

negatively related, or unrelated?

e. Is the variance of the sum of x and y bigger, smaller, or the same as the sum of the in-

dividual variances? Why?

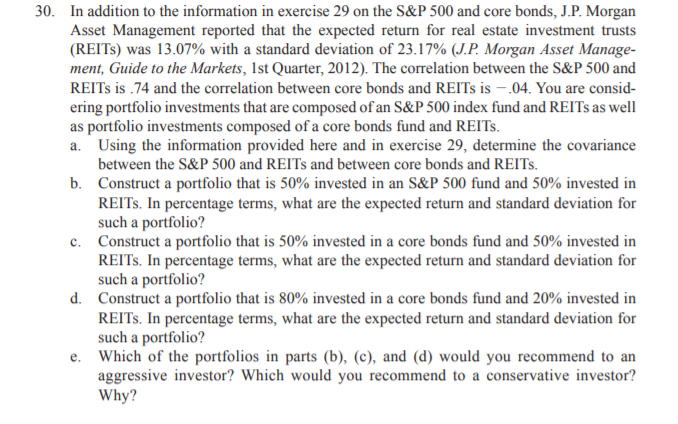

Transcribed Image Text:30. In addition to the information in exercise 29 on the S&P500 and core bonds, J.P. Morgan

Asset Management reported that the expected return for real estate investment trusts

(REITS) was 13.07% with a standard deviation of 23.17% (J.P. Morgan Asset Manage-

ment, Guide to the Markets, 1st Quarter, 2012). The correlation between the S&P 500 and

REITS is .74 and the correlation between core bonds and REITS is – .04. You are consid-

ering portfolio investments that are composed of an S&P 500 index fund and REITS as well

as portfolio investments composed of a core bonds fund and REITS.

a. Using the information provided here and in exercise 29, determine the covariance

between the S&P 500 and REITS and between core bonds and REITS.

b. Construct a portfolio that is 50% invested in an S&P 500 fund and 50% invested in

REITS. In percentage terms, what are the expected return and standard deviation for

such a portfolio?

c. Construct a portfolio that is 50% invested in a core bonds fund and 50% invested in

REITS. In percentage terms, what are the expected return and standard deviation for

such a portfolio?

d. Construct a portfolio that is 80% invested in a core bonds fund and 20% invested in

REITS. In percentage terms, what are the expected return and standard deviation for

such a portfolio?

e. Which of the portfolios in parts (b), (c), and (d) would you recommend to an

aggressive investor? Which would you recommend to a conservative investor?

Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman