Compute the following: a. Lobo Company purchased equipment for $40,000 with a useful life of five years and no expected salvage value. Prepare the adjusting entry for the first year using the straight-line depreciation method. Omit explanations. If an amount box does not require, leave it blank.

Compute the following: a. Lobo Company purchased equipment for $40,000 with a useful life of five years and no expected salvage value. Prepare the adjusting entry for the first year using the straight-line depreciation method. Omit explanations. If an amount box does not require, leave it blank.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5EA: Steele Corp. purchases equipment for $25,000. Regarding the purchase, Steele recorded the following...

Related questions

Question

Practice Pack

Compute the following:

a. Lobo Company purchased equipment for $40,000 with a useful life of five years and no expected salvage value. Prepare the

Transcribed Image Text:Page: 1

POST.

DATE

DESCRIPTION

DEBIT CREDIT

REF.

1 а.

1.

2

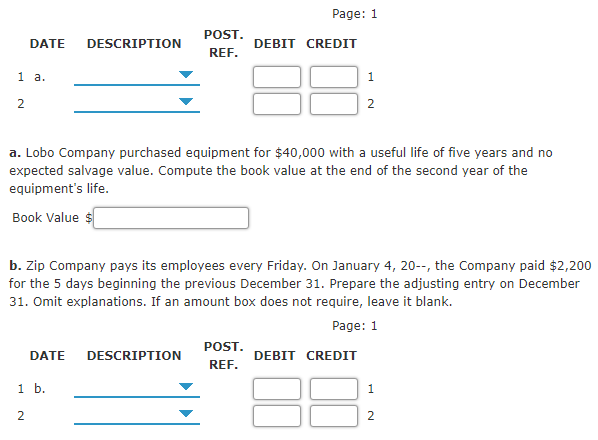

a. Lobo Company purchased equipment for $40,000 with a useful life of five years and no

expected salvage value. Compute the book value at the end of the second year of the

equipment's life.

Book Value $

b. Zip Company pays its employees every Friday. On January 4, 20--, the Company paid $2,200

for the 5 days beginning the previous December 31. Prepare the adjusting entry on December

31. Omit explanations. If an amount box does not require, leave it blank.

Page: 1

POST.

DATE

DESCRIPTION

DEBIT CREDIT

REF.

1 b.

1

2

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub