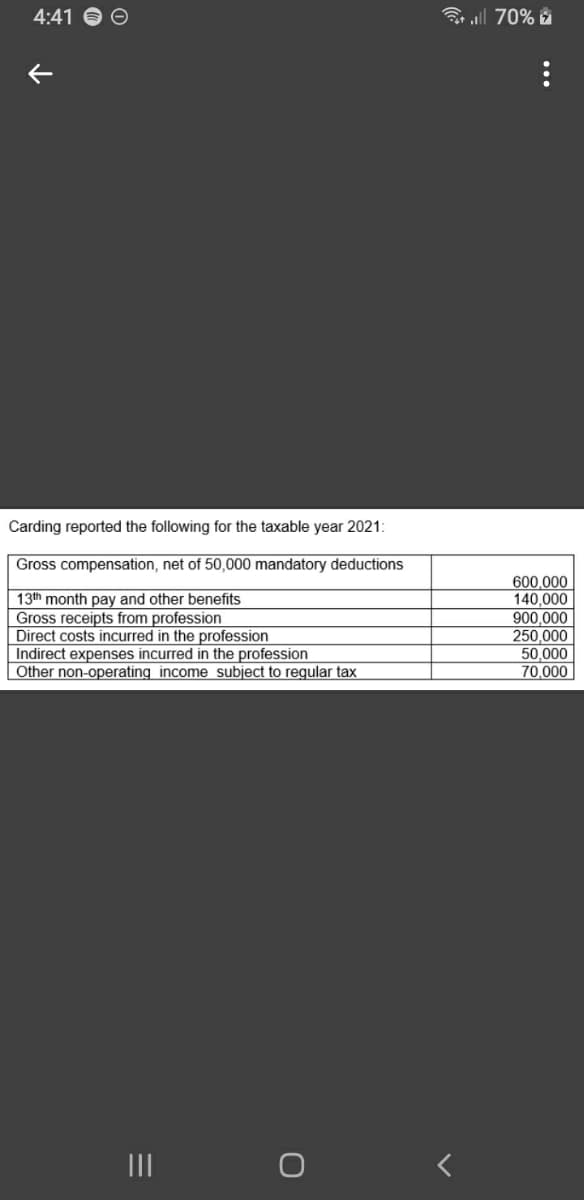

Compute the total income tax due on the income of Carding in 2021.

Q: Bobbi Clothing manufactures clothing. Information about a production week is as follows: Standard…

A: Time variance (Actual hours worked - standard hours) * standard rate per hour

Q: The February contribution format income statement of Mcabier Corporation appears below: Sales $…

A: Degree of operating leverage (DOL): DOL reflects variable and fixed cost relationship of an…

Q: Prepare the journal entry for (a) materials and (b) labor, based on the following: Raw materials…

A: Raw Material: The input commodities or inventories that a firm requires in order to make its…

Q: What principal will make a profit of $71.99 at 8 ½% in 200 days?

A: The question is related to the Simple Interest and Principal Simple Interest = P × R × T P =…

Q: The fiscal year of the business is June 1 to May 31

A: FUTA- The Federal Unemployment Tax Act (FUTA) is a regulation that applies to professions or…

Q: H has a 75% owned subsidiary S. During the year ending 31 December 2021 H sold inventory to S for an…

A: Consolidated financial statements are the financial statements of an entity that has a subsidiary or…

Q: Entries for Cash Dividends The declaration, record, and payment dates in connection with a cash…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: B (ii) and (iii) only

A: Monetary items include all types of current assets is also not true because monetary items may also…

Q: Provide an example of why a trial balance may not balance.

A: A trial balance is a statement that shows the balances in all of a corporation's general ledger…

Q: The following is partial information for Charleston Company’s most recent year of operation. It…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: If a company chooses a price to charge for its product by adding up all the expenses necessary to…

A: Solution: There are various method of pricing the product such as: 1. Target costing 2. Skimming…

Q: On May 1, Splish Brothers Corporation purchased 3.200 shares of its $10 par value common stock at a…

A: Treasury stock: Shares that are bought back by the company from the open market but not retired from…

Q: What is EE Taxable Wages FUTA in quater 3? Emloyee Q1 Q2 Q3 Q4 EE 3500 3500 3200 3200

A: FUTA is an abbreviation for Federal Unemployment Tax Act. FUTA Tax is a United States federal tax…

Q: Required information [The following information applies to the questions displayed below.] Oslo…

A: Break-even point is that point at which a company is making no profit no loss. In other words at…

Q: Pearl Products Limited of Shenzhen, China, manufactures and distributes toys throughout South East…

A: Budgeting is the process of reporting the estimated or future costs. These are the statements…

Q: Delta Plc has an 80% subsidiary Golf Ltd, which has been a subsidiary of Delta for the whole of the…

A: In the context of the given question, we are required to compute the non-controlling interest in…

Q: Required: Prepare all journal entries for the 21st Century Corporation in connection with the…

A: Here discuss about the details of the Foreign exchange currency transaction which are incurred for…

Q: Marin Company uses a perpetual inventory system. Beginning inventory is 5,000 T-shirts at a cost…

A: Under Weighted Average method, using perpetual inventory system, value of ending inventory and Cost…

Q: Please explain above answer how these Factors Influencing The Role Of a Management Accountant.?

A: Every business requires the accountants so that the proper recording and decision making can be made…

Q: Concord Corporation's comparative balance sheets are presented below. Cash Accounts receivable Land…

A: Introduction: A cash flow statement is a financial statement that sums up all cash inflows from…

Q: How does Poland's culture impact the ethical reasoning of its people? Describe how the country's…

A: In a variety of ethical situations, the ability to assess, identify and develop ethical arguments.…

Q: Waterways Corporation mass-produces a simple water control and timer set. To produce these units,…

A: As per the honor code of Bartleby we are bound to give the answer of first three sub part only, we…

Q: Direct Materials Direct labor (2 per hour) Variable overhead Rectang ind Chelsea. Camden 2 8 1 11…

A: Variable costs are costs which changes directly with change in activity level. For example, direct…

Q: Calculate the following: 1. The revenue per Mix of X and Z The Contribution per mix 3. Average c/s…

A: Under CVP Analysis, various costs, revenues, sales and production volumes are analyzed by the…

Q: Darth Vader lightsaber is a depreciable asset. He uses the straight-line depreciation method. He…

A: Depreciation is considered an operating expense, which is charged on the value of the Asset. It can…

Q: On January 1, 2024, Jackson purchased ABC Company for $900,000. At the time, ABC Company had assets…

A: In case of analysis of valency it is important to understand the assets value and liabilities value…

Q: During the year ended 30 September 2021 Hanlon Plc entered into two lease transactions. On 1…

A: Leases are agreements whereby the owner of a property or asset grants another party the right to use…

Q: Paradise Corp. has determined a standard labor cost per unit of $14 (0.50 hour × $28 per hour). Last…

A: Direct labour costs is cost of labour directly used for production and manufacturing activity.…

Q: Rachel current year: Fair value of plan assets-January 1 Projected benefit obligation-January 1…

A: IFRS 19 defines the scope for recognition of employee benefit asset and lability. It calculated as…

Q: Should the company buy or manufacture?

A: Make or buy is a strategical decision making process about benefit a company can make by make the…

Q: LITTwing van appics won your display U ULIUN.J The following transactions apply to Walnut…

A: Financial Statements - The financial Statement includes Income Statement, Balance Sheet, and Cash…

Q: Ice Cool produces two different models of air conditioners. The activities, costs, and cost drivers…

A: Activity-based costing is used to distribute the overhead. This method is used to allocate the…

Q: Minion, Inc., has no debt outstanding and a to before interest and taxes, EBIT, are projected to…

A: EPS=Earnings attributable to Equity shareholders/ Number of shares Earnings attributable to…

Q: Janie graduates from high school in 2021 and enrolls in college in the fall. Her parents (who file a…

A: American Opportunity Tax Credit: The American opportunity tax credit (AOTC) is a credit for…

Q: If demand for one year is 25,000 units, relevant ordering cost for each purchase order is $210 and…

A: The economic order quantity (EOQ) is a quantity that a company should buy to minimize its cost of…

Q: The following balances were obtained from the books of Tim Curry plc as at December 31,…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: What is the net book value of asset

A: Calculation given in next step Net book value is the historical cost of an asset minus the amount…

Q: Use the information above to determine the following: the total amount your liability insurance…

A: Insurance policy = insurance policy is a contract between insurer and the policy holder. It is an…

Q: P8-6B Betterdorf Company's bank statement from the National Bank at August 31, 2003, shows the…

A: Financial Statement- The procedure of combining financial data in a specific standardized financial…

Q: In preparation for developing its statement of cash flows for the year ended December 31, 2021,…

A: In the context of the given question, we are required to show the statement of investing activities…

Q: equired: repare the following: • Statement of profit and loss o Statement of changes in equity •…

A: Statement of Profit and loss The purpose of preparing the statement of profit and loss account which…

Q: Sarah purchases a set of furniture for RM3956.52 and sells it at X ringgit. If the operating…

A: Lets Assume Sales Price is RM X. Profit Margin is 35% on sales, hence it will be 0.35X We know that…

Q: What differences besides the names and contents of the three basic statements would a financial…

A: It is as same as public company private company & non profit organisation in accounting terms.…

Q: P21-14. Please answer c,d,e, and SHOW ALL WORKINGS CLEARLY. Also, please indicate whether they are a…

A: Disclaimer As Per Question instruction we have to solve Part c,d,e Note : A journal entry is the…

Q: Mr. Amit owns a flat. On 5-4-2020, he decides and starts a business of dealing in sale and purchse…

A: As per section 45 (2) of the income tax act 1961 when the Capital Asset is converted into Stock the…

Q: Quick Study Solutions QS 13-1 Characteristics of corporations LO¹ Of the following statements, which…

A: Lets understand the basics. Corporation form of entity is very useful in current business scenario.…

Q: Our Business Issued 10,000 shares of $1 Par value common stock for a total of $50,000, The Journal…

A: Common stock is issued for raising capital for the company. Other than common stock, the company…

Q: Data of an individual taxpayer for the current taxable period: Gross sales Cost of sales Sales…

A: In the context of the given question, we are required to compute the net taxable income using the…

Q: senior citizen or PWDs? a. 20,000 b. 25,000 c. 30,000 d. 40,000

A: Taxpayer reported gross non-VAT sales of P100,000 to a senior citizen who is at the same time a…

Q: Identify six examples of areas that the auditor will likely to consider in trying to obtain good…

A: Obtaining an understanding of company's environment, its internal control is a continuous process.…

Step by step

Solved in 2 steps with 2 images

- LO.5 Beige Corporation has a fiscal year ending April 30. For the year ending April 30, 2018, Beige generated taxable income of 1,200,000. What is Beige Corporations tax liability for this period?LO.3, 4, 5 Using the legend provided below, classify each statement under 2019 tax law. a. A foreign tax credit is available. b. The deduction of charitable contributions is subject to percentage limitation(s). c. Excess charitable contributions can be carried forward for five years. d. On the contribution of inventory to charity, the full amount of any appreciation can be claimed as a deduction. e. Excess capital losses can be carried forward indefinitely. f. Excess capital losses cannot be carried back. g. A net short-term capital gain is subject to the same tax rate as ordinary income. h. The deduction for qualified business income may be available. i. A dividends received deduction is available. j. The like-kind exchange provisions of 1031 are available. k. A taxpayer with a fiscal year of May 1April 30 has a due date for filing a Federal income tax return of July 15. l. Estimated Federal income tax payments may be required.[8:50 PM, 2/23/2022] Veron Walker Uwi: Grace Corporation's pretax financial income is $600,000 and taxable income is $550,000 for year 2020.Its beginning deferred tax liability account has a balance of $75,000. Its cumulative temporarydifferences for year-end 2020 is equal to $300,000 and will reverse and result in taxable amounts as follows: Year Taxable Amount2021 $100,0002022 $ 75,0002023 $125,000The tax rate is 30% for all years.[8:50 PM, 2/23/2022] Veron Walker Uwi: Required:(i) Calculate the taxes payable for the year 2020(ii) Calculate the deferred tax liability for the year 2020(iii) Calculate the total tax expense for 2020(iv) Prepare the journal entry to record the tax expense for 2020(v) Prepare the income statement presentation of the tax amoun

- 10. Sheridan Corp. prepared the following reconciliation of income per books with income per tax return for the year ended December 31, 2021: Book income before income taxes $ 2630000 Add temporary difference Construction contract revenue which will reverse in 2022 233000 Deduct temporary difference Depreciation expense which will reverse in equal amounts in each of the next four years ( 943200) Taxable income $ 1919800 Sheridan's effective income tax rate is 25% for 2021. What amount should Sheridanreport in its 2021 income statement as the current provision for income taxes? A) $ 479950 B) $ 657500 C) $ 715750 D) $ 5825039. Wright Co., organized on January 2, 2021, had pretax accounting income of $960,000 and taxable income of $3,120,000 for the year ended December 31, 2021. The only temporary difference is accrued product warranty costs which are expected to be paid as follows: 2022 $720,000 2023 360,000 2024 360,000 2025 720,000 The enacted income tax rates are 25% for 2021, 20% for 2022 through 2024, and 15% for 2025. If Wright expects taxable income in future years, the deferred tax asset in Wright's December 31, 2021 balance sheet should be a. $288,000. b. $360,000. c. $396,000. d. $540,000.25. The estimated taxable income for Chicken Wings Corporation on January 1, 2021, was P80,000, P100,000, P100,000, and P120,000, respectively, for each of the four quarters of 2021. Chicken Wings estimated annual effective tax rate was 30%. During the second quarter of 2021, the estimated annual effective tax rate was increased to 34%. Given only this information, Chicken Wings’s second quarter income tax expense was

- SUPPLEMENTAL PROBLEM 19-2 Meyer reported the following pretax financial income (loss) for the years 2019-2022: 2019 $350,000 2020 120,000 2021 (570,000) 2022 180,000 Pretax financial income (loss) and taxable income (loss) were the same for all years involved. The enacted tax rate is 21% for all years. REQUIRED: Prepare journal entries for 2021 and 2022 to record the current portion and the deferred portion of income taxes, assuming that based on the weight of available evidence, it is more likely than not that one-fifth of the benefits of the loss carryforward will not be realized. Prepare the income tax section of the 2021 income statement beginning with the line “Income (loss before income taxes.”Problem 19-05 a, c-d Crane Inc. reported the following pretax income (loss) and related tax rates during the years 2019–2022. Pretax Income (loss) Tax Rate 2019 $37,700 40 % 2020 (181,000) 40 % 2021 231,000 20 % 2022 76,800 20 % Pretax financial income (loss) and taxable income (loss) were the same for all years since Crane began business. The tax rates from 2019–2022 were enacted in 2019. Prepare the journal entries for the years 2020–2022 to record income taxes payable (refundable), income tax expense (benefit), and the tax effects of the loss carryforward. Assume that Crane expects to realize the benefits of any loss carryforward in the year that immediately follows the loss year. Date Account Titles and Explanation Debit Credit 2020 2021 2022…1.The Mosaic Company organized on January 2, 2021, had pretax accounting income of $8,000,000 and taxable income of $11,600,000 for the year ended December 31, 2021. The 2021 tax rate was 25%. The only difference between book and taxable income is estimated warranty costs. Expected payments and scheduled enacted tax rates are as follows: 2022 $ 1,200,000 30 % 2023 600,000 30 % 2024 600,000 30 % 2025 1,200,000 35 % Required:Prepare one compound journal entry to record Mosaic's provision for taxes for the year 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

- 32 - As of the end of 2019, the status of the 690 Period Profit or Loss Account of our business and other issues are as follows: Its legally unacceptable expenses are 300.000 TL, and its tax exemption earnings are 80.000 TL. The corporate tax rate is 22%. What is the Corporate Tax Amount of the Business? a) 325,600 TL B) 259,600 TL NS) 308,000 TL D) 1,029,600 TL TO) 770.000 TL59. GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor, a Filipino Citizen residing in Manila, had the following data for the taxable year 2021: Gross income from rent of commercial spaces,net of P 60,000 withholding tax P 1,140,000 Dividend income From domestic corporation 50,000 From resident foreign corporation 60,000 From…