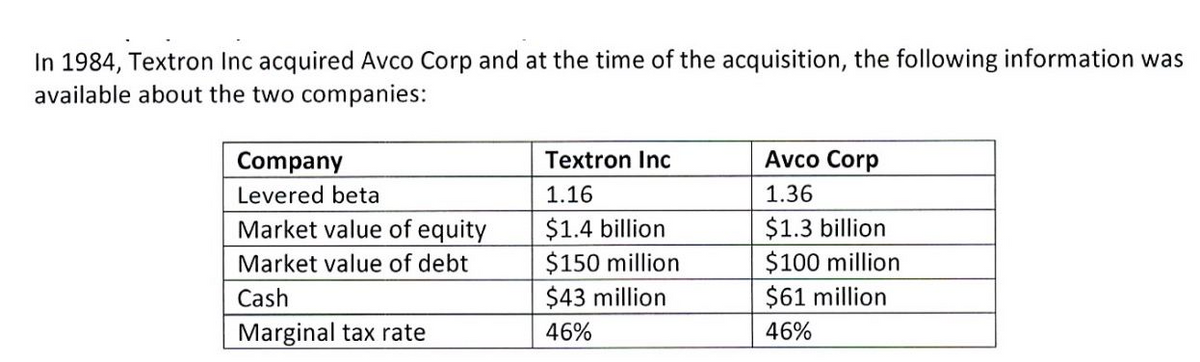

Compute the unlevered beta corrected for cash for each firm. B. Using the unlevered beta corrected for cash, calculate the unlevered beta of Textron after the acquisition. C.Using the unlevered beta corrected for cash, calculate the unlevered beta of Textron after the acquisition.

Q: Ann got a 15 year Fully Amortizing FRM for $1,500,000 at an annual interest rate of 7% compounded mo...

A: Here, Present value = $1,500,000 Number of years = 15 years Rate of interest = 7% compounded monthly...

Q: In the credit market model with asymmetric information, determine how a consumer will respond to an ...

A: Asymmetric information In credit market, asymmetric information means the lenders or the borrowers h...

Q: nie purchases a television from a salesman who promises her 25,000 if she returns it in 61 days. Ann...

A: The simple interest is interest without the impact of the compounding that is the plain interest wit...

Q: * Erika Lagliva borrows 35,000 to be repaid for 9 years. (1) Find the total annual cost under the fo...

A: Loan Repayment: A loan once taken can be repaid either by making constant periodic payments throu...

Q: QUESTION 12 THIS IS A MANDATORY SUBMISSION Calculate the number of compounding periods for an ordina...

A: Since, specifically Question 12 is asked, so the following solution is for Question 12 only. Solutio...

Q: EMC Corporation's current free cash flow of $370,000 and is expected to grow at a constant rate of 6...

A: Value of operations = FCF*(1+g)/(k-g) Where FCF = Free cash flow current g = growth rate k = Cost ...

Q: their payment every year. Compute the annual payment to settle their debt if the rate of interest is...

A: A stream of equal cash flows paid or received periodically is termed as annuity. Annuity is either r...

Q: What is the equivalent simple interest (yield) for an investment of 8 % compounded quarterly? Round ...

A: Effective Annual Rate The effective annual rate of interest is the actual or the real rate of intere...

Q: Tom plans to save $2,000 for each of the next ten years, starting tonight when he will write his fin...

A: Future value can be calculated using FV (rate, nper, pmt, [Pv], [type]) Rate The interest rate Nper...

Q: A bank makes a 30 year Fully Amortizing FRM for $2,000,000 at an annual interest rate of 4.125% comp...

A: Here, Annual Interest Rate on Loan is 4.125% Time Period of Loan is 30 years FRM Amount is $2,000,00...

Q: hedge

A: “Since you have posted a question with multiple sub-parts, we will solve the first three subparts ...

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery w...

A: Formula's Calculations: Therefore; Cost of Debt is 5.53%

Q: 8. An education fund will offer a P40, 000 annual scholarship for the first five years, a P60, 000 s...

A: Present value (PV) of all the cash flows is the sum of the money deposited now. It is an example of ...

Q: Yawi has a medium-size trucking company that distributes appliances within Metro Manila. Fuel consum...

A: The discounted cash inflows or outflows of future payments or receipts are known as the equivalent p...

Q: Compute the future amount of the money which has annuity of 888 in 5 years if it is compounded month...

A: Monthly payment (P) = 888 Interest rate = 11% Monthly interest rate (r) = 11%/12 = 0.916666666666667...

Q: Eight years ago, Ohio Valley Trucking purchased a large-capacity dump truck for $110,000 to provide ...

A: Purchase price of truck is $110,000 Time period 8 years Per year maintainance cost is $12,200 Resale...

Q: Jim has an annual income of $300,000. Jim is looking to buy a house that has monthly property taxes ...

A: Here,

Q: Annette has just inherited $180,000. She invests this money at a rate of return of 6.47% per year co...

A: Given: Present value $180,000 Rate 6.47% Another annuity $2,851 Years 20 Compounding Quar...

Q: A loan in the amount of $10,000 is being paid back with monthly payments of $1800. Determine the fol...

A: Here, Loan Amount is $10,000 Monthly Payments is $1,800

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery w...

A: Given: Cost of machine = $80 Million Working capital = $20 Million Tax rate = 30%

Q: Consider a bond with a coupon of 5.8 percent, eleven years to maturity, and a current price of $1,06...

A: Yield to maturity (YTM) is the total return expected on the bond if the bold is held till maturity. ...

Q: 3. Use an external investing rate of 12% and an external borrowing rate of 6%. Compute the rate of r...

A: The rate of return: The discount rate that equates the initial investment to the present value of al...

Q: In the Middle Ages, goldsmiths took in customers’ deposits (gold coins) and issued receipts that fun...

A: Customers find goldsmiths to be extremely convenient when conducting a large number of gold transact...

Q: Question 2 Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the min...

A: Since specifically Question 1,2 and 3 are asked, so the following solutions are also for the same. S...

Q: Determine the amount of P 45000 after 9 years if the rate is 7% compounded continuously. O 86412 O 8...

A: Amount after 9 years can be calculated with the help of future value function with continuous compou...

Q: If you invest your P3,000 every year at 4% interest rate, how many months does it take to be worth P...

A: Future Value: The future value is the amount that will be received at the end of a certain period. T...

Q: Why should company managers or investors pay attention to macroeconomic indicators? Is it a good ide...

A: A macroeconomic indicator is one that is used to measure the economic state of a country. Macroecono...

Q: Discuss three key characteristics of active fund management and three of passive fund management, fo...

A: Fund management refers to management of funds in such a manner that the funds provide the highest po...

Q: 13. Calculating Profitability Index following set of cash flows if the relevant discount rate is 10 ...

A: Profitability Index = (NPV + Initial Investment ) / Initial Investment NPV can be calculated by ...

Q: You work for a logistics company, which considers to invest in a computerized system to improve effi...

A: Here, Initial cost = $90,000 Additional expenses = $25,000 Savings in operating cost = $65,000 Addit...

Q: A salesman earns P2,500 on the 1st month, P2,800 on the 2nd month, P3,100 on the 3rd month and so on...

A: Since you have posted a multiple question then we will be solving the first question only as per the...

Q: the cash flows for this project be?

A: Cash flow shows the amount of cash inflow and outflow from the company. The cash flow statement repr...

Q: Markowitz Portfolio Theory

A: Modern portfolio theory states that the investor can choose the mix of low-risk and riskier investme...

Q: Consider a portfolo consisting of the following three stocks: E The volatility of the market portfol...

A: Beta is used as a measure of systematic risk in the CAPM model. It provides a direct relation betwee...

Q: Ann got a 30 year Fully Amortizing FRM for $1,000,000 at an annual interest rate of 6% compounded mo...

A: it is given that Loan amount - $ 1,000,000 Interest – 6% Payment frequency – 12 – monthly Time – 30 ...

Q: Rachel's health insurance policy has a monthly premium of $500. She has a $1,000 annual deductible, ...

A: Out-of-pocket costs are the costs incurred by the insured and include all deductibles, coinsurance, ...

Q: 1. Discuss: Firms often involve themselves in projects that do not result directly in profits. For e...

A: Direct profit is defined as the amount of money earned from sales after deducting direct costs. This...

Q: Asa Khumalo purchased a vehicle to the value of R224987 today and expects to make repayments for the...

A: Mortgage (X) = R 224987 n = 7 years = 84 months r = 12% per annum = 1% per month Let M = Initial mon...

Q: Imagine that you are trying to evaluate the economics of purchasing a condominium to live in during ...

A: Here, Property taxes and maintenance expenditure = $6,000 per year, Annual savings = $10,000 per ...

Q: Given the below assumptions, what is the level of sales required for a two department (food and beve...

A: The Return on Investment or ROI is a measure of profitability which shows the returns which is earne...

Q: Krell Industries has a share price of $21.88 today. If Krell is expected to pay a dividend of $1.1...

A: The stock price which is the maximum price to be paid for share consists of dividends and terminal v...

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery w...

A: Given: Cost of machine = $80 Million Working capital = $20 Million Tax rate = 30%

Q: You just received an inheritance of $123,456. How long would you need to leave it in an RRSP earning...

A: Here, Inheritance Amount is $123,456 Monthly Payment for 20 years is $800 Interest Rate is 2.5% Comp...

Q: Describe how NPV is calculated and describe the information this measure provides about a sequence o...

A: NPV net present value is very important factor in deciding the feasibility analysis of projects. It ...

Q: Galleon Industries is building a temporary manufacturing plant which will be completely removed afte...

A: Cash flow from a project includes all its cash income less cash expenses. It does not include any no...

Q: Task 4. Compute the present value of the following single amount: 1. P250,000 in 8 years compounded ...

A: 1) Future value (F) = P 250000 n = 8 years r = 8%

Q: LO 1 8.3 Payback Period Concerning payback: Describe how the payback period is calculated and descri...

A: Cash flow statement is referred as the summarized cash and cash equivalents amount that enters as we...

Q: 6. Given a nominal rate of 15% čómpounde for 12 years in an ordinary annuity. Determine the followin...

A: The factor is calculated using the required rate of return and for the given period. The factor is d...

Q: A building cost P8.5 million and the salvage value is P50,000 after 23 years. The annual maintenance...

A: The present worth analysis is an analysis where all the present values are calculated. All the disco...

Q: If there is no asymmetric information problem from the perspective of lenders and borrowers, is the ...

A: Financial market is the place where investors invest their funds in various securities and companies...

A. Compute the unlevered beta corrected for cash for each firm.

B. Using the unlevered beta corrected for cash, calculate the unlevered beta of Textron

after the acquisition.

C.Using the unlevered beta corrected for cash, calculate the unlevered beta of Textron

after the acquisition.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

- On January 1, 2001, X.Co purchased marketable equity securities at its market value of P5,000,000, while the company also paid commission, taxes and other transaction costs amounting to P200,000. The securities had the following market value on the these dates: December 31, 2001 4,700,000 December 31, 2002 5,300,000 No securities were sold during 2001 and 2002. What amount of unrealized gain or loss should be reported in the 2002 income statement if the securities were held for trading?You're given the following details of an acquisition of Target Co. by Acquirer Ltd.. What is the transaction value for this acquisition of Target Co.? Acquisition of Target Co. by Acquirer Ltd. Target Share Price ($/sh.) $85.40 Acquisition Premium 15% Diluted Shares Outstanding (MM) 670 Target Total Debt $3,562 Target Cash and Cash Equivalents $5,147 % Debt Financing 40% % Equity Financing 60% Equity Financing Fees 4.0% Debt Financing Fees 1.5% Other Transaction Costs $800Safety Development Corporation had relatively large idle cash balances and invested them as follows in securities to be held as non-strategic investments: 2020 Feb. 7 Purchased 3,700 common shares of Royal Bank at $28.00, plus $500 in transaction fees. 19 Purchased 2,700 common shares of Imperial Oil at $55.50, and paid $250 in transaction fees. Apr. 1 Paid $103,069 plus $500 in transaction fees for a 7.40%, four-year, $105,000 Minco Inc. bond that pays interest quarterly beginning June 30. The market rate of interest on this date was 7.80%. Sellers Corporation plans to hold this investment for the duration of the bond’s contract life. May 26 Purchased 3,500 common shares of BCE at $14.88, plus $200 in transaction fees. June 1 Received a $0.25 per share cash dividend on the Royal Bank common shares. 17 Sold 2,700 Royal Bank common shares at $28.50. 30 Received interest on the Minco Inc. bond. Aug. 5 Received a $0.50 per share cash dividend on the…

- Here are book- and market-value balance sheets of the United Frypan Company (figures in $ millions): Book-Value Balance Sheet Net working capital $ 25 Debt $ 60 Long-term assets 75 Equity 40 $ 100 $ 100 Market-Value Balance Sheet Net working capital $ 25 Debt $ 60 Long-term assets 180 Equity 145 $ 205 $ 205 Assume that MM’s theory holds except for taxes. There is no growth, and the $60 of debt is expected to be permanent. Assume a 21% corporate tax rate. a. How much of the firm's market value is accounted for by the debt-generated tax shield? (Enter your answer in million rounded to 2 decimal places.) b. What is United Frypan’s after-tax WACC if rDebt = 6.7% and rEquity = 16.3%? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. Now suppose that Congress passes a law that eliminates the deductibility of interest for tax purposes after a grace period of 5 years. What will be…Bombay Company's book and market value balance sheets are as follows: (NWC = net working capital; LTA = long term assets; D = debt; E = equity; V = firm value): Book Values Market Values NWC 200 500 D NWC 200 500 D LTA 2,300 2,00 E LTA 2,800 2,500 E 2,500 2,500 V 3,000 3,000 V According to MM's Proposition I corrected for taxes, what will be the change in company value if Bombay issues $200 of equity and uses it to make a permanent reduction in the company's debt? Assume a 21 percent marginal corporate tax rate. Multiple Choice A) +$70 B) −$42 C) $0 D) +$140 Please show your workFounded on January 1, 20X1, Gehl Company had the following passive investments in equity securities at the end of 20X1 and 20X2: Equity Security Cost 12/31/X2 Fair Value A $ 96,000 $ 94,000 B 184,000 162,000 C 126,000 136,000 Required: If the company recorded a $4,000 debit to its Fair value adjustment account as its 20X2 fair value adjustment, what must have been the unrealized gain or loss reported at the end of 20X1?

- Continental Bank, a nationwide banking company, owns many types of investments.Continental paid $550,000 for equity securities on December 5. Continental owns less than10% of the stock of the companies in which it invests. Two weeks later, Continental received a$37,000 cash dividend. On December 31, these equity securities were quoted at a market priceof $554,000. Continental’s December income statement would include ana. unrealized loss of $4,000.b. unrealized gain of $41,000.c. unrealized gain of $4,000.d. unrealized loss of $41,000.Continental Bank, a nationwide banking company, owns many types of investments.Continental paid $550,000 for equity securities on December 5. Continental owns less than10% of the stock of the companies in which it invests. Two weeks later, Continental received a$37,000 cash dividend. On December 31, these equity securities were quoted at a market priceof $554,000. Continental’s December income statement would include ana. unrealized loss of $4,000.b. unrealized gain of $41,000.c. unrealized gain of $4,000.d. unrealized loss of $41,000.E-Q-33. Refer to the Continental data in E-Q-32. On December 31, Continental’s balancesheet should reporta. dividend revenue of $37,000.b. investment in equity securities of $554,000.c. investment in equity securities of $550,000.d. an unrealized gain of $4,000.ABC Company is experiencing financial difficulty and is negotiating debt restructuring with its creditors to relieve its financial stress. ABC has a P2,500,000 noted payable to XYZ Bank. The bank is considering acceptance of an equity interest in ABC Company in the form of 200,000 ordinary shares valued at P12 per share. The par value is P10 per share. How much share premium should be recognized from the debt restructuring? Group of answer choices a. 500,000 b. 100,000 c. 400,000 d. 0

- Here are book- and market-value balance sheets of the United Frypan Company (figures in $ millions): Book-Value Balance Sheet Net working capital $ 50 Debt $ 70 Long-term assets 50 Equity 30 $ 100 $ 100 Market-Value Balance Sheet Net working capital $ 50 Debt $ 70 Long-term assets 160 Equity 140 $ 210 $ 210 Assume that MM’s theory holds except for taxes. There is no growth, and the $70 of debt is expected to be permanent. Assume a 21% corporate tax rate. a. How much of the firm's market value is accounted for by the debt-generated tax shield? (Enter your answer in million rounded to 2 decimal places.) b. What is United Frypan’s after-tax WACC if rDebt = 6.3% and rEquity = 16.7%? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. Now suppose that Congress passes a law that eliminates the deductibility of interest for tax purposes after a grace period of 5 years. What will be…Seal Company is experiencing financial difficulty and is negotiating debt restructuring with its creditor to relieve its financial stress. Seal has a P2,500,000 note payable to United Bank. The bank accepted an equity interest in Seal Company in the form of 200,000 ordinary shares quoted at P12 per share. The par value is P10 per share. The fair value of the note payable on the date of restructuring is P2,200,000. What amount should be recognized as share premium from the issuance of the shares? a. 500,000 b. 100,000 c. 400,000 d. 200,0004. Baguio Company is experiencing financial difficulty and is negotiating debt restructuring with its creditor to relieve its financial stress. Baguio company has a P2,000,000 note payable to First Bank. The bank is considering two alternatives. 1. Acceptance of land owned by Baguio company valued at P1,600,000 and carried at its historical cost of P1,120,000. 2. Acceptance of an equity interest in Baguio company in the form of 16,000 shares with fair value of P120 per share. The share capital has a par value of P100 per share. Under the first alternative, what is the amount of gain/(loss) on extinguishment of debt?