QUESTION 12 THIS IS A MANDATORY SUBMISSION Calculate the number of compounding periods for an ordinary annuity with a future value of $16681 and payments of $448, The nominal rate is 5%/year compounded semi- annually. Note: this is a simple annuity, which means the payments occur semi-annually as well. Write your final answer as an integer.

QUESTION 12 THIS IS A MANDATORY SUBMISSION Calculate the number of compounding periods for an ordinary annuity with a future value of $16681 and payments of $448, The nominal rate is 5%/year compounded semi- annually. Note: this is a simple annuity, which means the payments occur semi-annually as well. Write your final answer as an integer.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 12E

Related questions

Question

solve question 12 with complete explanation asap

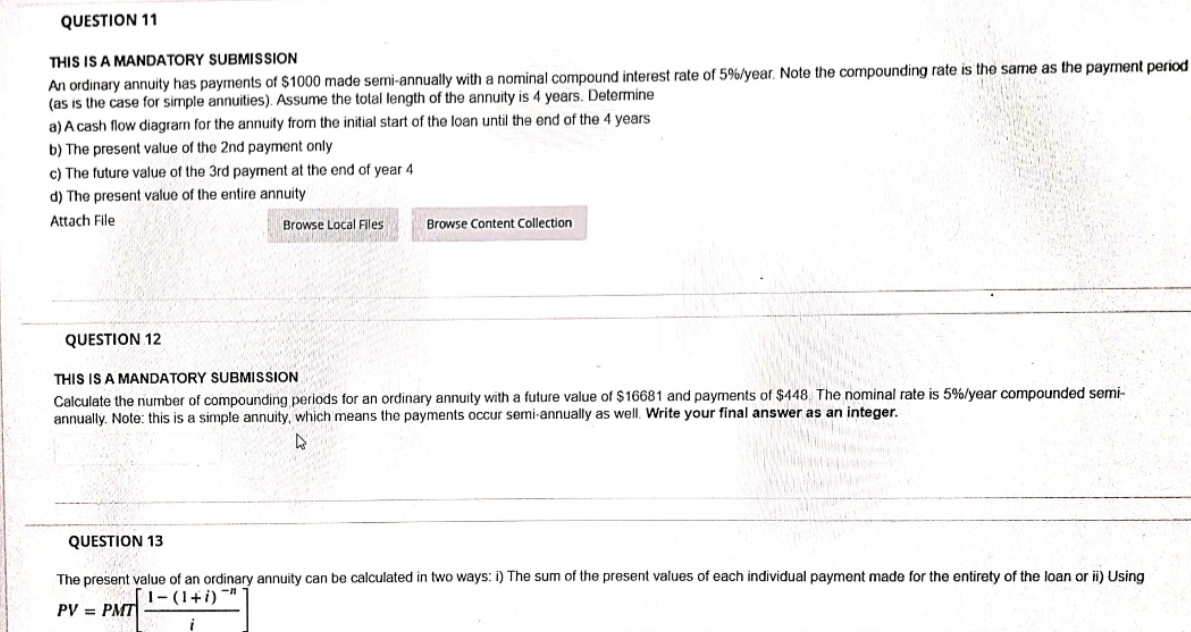

Transcribed Image Text:QUESTION 11

THIS IS A MANDATORY SUBMISSION

An ordinary annuity has payments of $1000 made semi-annually with a nominal compound interest rate of 5%/year. Note the compounding rate is the same as the payment period

(as is the case for simple annuities). Assume the total length of the annuity is 4 years. Determine

a) A cash flow diagran for the annuity from the initial start of the loan until the end of the 4 years

b) The present value of the 2nd payment only

c) The future value of the 3rd payment at the end of year 4

d) The present value of the entire annuity

Attach File

Browse Local Files

Browse Content Collection

QUESTION 12

THIS IS A MANDATORY SUBMISSION

Calculate the number of compounding periods for an ordinary annuity with a future value of $16681 and payments of $448, The nominal rate is 5%/year compounded semi-

annually. Note: this is a simple annuity, which means the payments occur semi-annually as well, Write your final answer as an integer.

QUESTION 13

The present value of an ordinary annuity can be calculated in two ways: i) The sum of the present values of each individual payment made for the entirety of the loan or i) Using

1- (1+i) ¯"

PV = PMT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning