Q: An investment has an installed cost of $537,800. The cash flows over the four-year life of the…

A: A number of financial computations, including figuring out the present value of future cash flows,…

Q: Chapter 11 Assignment Suppose that Goodwin Co, a U.S. based MNC, knows that it will receive 100,000…

A: A currency put option serves as a financial safeguard, endowing its holder with the right, though…

Q: Return to question The stock of Nogro Corporation is currently selling for $16 per share Earnings…

A: Share price = $16Expected EPS = $4Payout ratio = 40%ROE = 25%

Q: Nogueiras Corp’s budgeted monthly sales are $7,000, and they are constant from month to month. 40%…

A: cash budget refers to the format including the details of the inflows and outflows of the cash…

Q: 1. Your company is exporting product to Peru. Your best guess is that, over the coming year, you…

A: The objective of the question is to understand the risks associated with hedging foreign exchange…

Q: High Towers, Inc., has sales of $586,000, costs of $363,000, depreciation expense of $32,000, and…

A: The operating cash flow refers to the profits available after deducting all cost and expenses like…

Q: This question has TWO parts. Please be sure to scroll down and make sure you answer both parts.…

A: The higher sensitivity to a change in the interest rates if YTM is similar for all will represent…

Q: Last year, Absolute Zero Freezers paid a dividend equal to $0.77 per share. Absolute follows the low…

A: minimum (low regular) dividend = Dividend paid last year - Extra dividend paid

Q: You are given the following information for Smashville, Incorporated. Cost of goods sold: Investment…

A: earnings per share refers to the earnings attributable to the one share holding of the shareholders…

Q: K. Jackson Corporation Assets Cash Accounts receivable Inventory Net fixed assets Total assets…

A: Curernt ratio of a company depicts the short term debt payment capacity that are going to mature…

Q: A doctor is on contract to a medium-sized oil company to provide medical services at remotely…

A: Given the following data,MARR (r) = 14.00% = 0.14Inflation rate (f) = 3.2% = 0.032Now we know the…

Q: Explain the differences among bonds offered by the state. Explain the differences among bonds…

A: The objective of this question is to understand the differences between bonds offered by the state…

Q: Based on the CAPM model, a stock with a negative beta has which of the following characteristics?…

A: The objective of the question is to understand the characteristics of a stock with a negative beta…

Q: Antonio Melton, the chief executive officer of Rooney Corporation, has assembled his top advisers to…

A: a positive net present value (NPV) is usually a good indicator or signal, decision-makers should…

Q: Raymond Mining Corporation has 8.6 million shares of common stock outstanding, 300,000 shares of 5%…

A: WACC or cost of capital or company' s discount rate is the overall cost of capital of all sources of…

Q: Homeowners 3 (Special Form) is an all-risks policy that insures the dwelling and other structures…

A: Homeowners 3 (Special Form) is a comprehensive insurance policy designed to protect homeowners from…

Q: Suppose that you have $10,000 to invest and you are trying to decide between investing in project A…

A: Present Value is the current price of future value which will be received in near future at some…

Q: What is the coupon rate of a ten-year, $10,000 bond with semiannual coupons and a price of…

A: A bond's coupon rate is the fixed annual interest rate paid to the bondholder, expressed as a…

Q: Suppose you plan to start a saving account. You plan to deposit $98 each month in to a money market…

A: Compound = Monthly = 12Payment = p = $98Interest Rate = r = 6 / 12 = 0.5%Future Value = fv = $2000

Q: Consider a stock that has a Beta of 0.85. You expect the long-term return on the market to be 9.75%…

A: CAPM is also known as capital asset pricing model. It helps in know the expected return on the…

Q: Falon coorperation is using new common stock at a market price of $28.35. Dividends last year were…

A: We will use the dividend discount model here to get the answer.As per the dividend discount model…

Q: You BUY a futures contract with the characteristics below. Assuming the S&P500 contract suddenly…

A: ExplanationThe S&P 500 E-mini is a futures contract that is based on the S&P 500 index. The…

Q: S. Bouchard and Company hired you as a consultant to help estimate its cost of common equity. You…

A: As per DCF,P = D1 / (Ke-g)P=stock priceD1=value of next year dividendKe=constant cost of equity…

Q: B2B Company is considering the purchase of equipment that would allow the company to add a new…

A: There is the only difference of depreciation being non-cash expense in net income and net cash…

Q: Wyatt oil presently pays no dividend. You anticipate Wyatt Oil will begin paying an annual dividend…

A: Current price of stock is the price which can be paid for purchase of the stock. It is also called…

Q: The Dauten Toy Corporation currently uses an injection molding machine that was purchased prior to…

A: Net present value refers to the method of capital budgeting used for evaluating the viability of the…

Q: do not earn

A: Non- Banking Financial Institutions - NBFCs are financial institutions that provide bank-related…

Q: You have purchased 1 million shares in a restaurant chain venture. At this zero-stage investment,…

A: Number of shares =1,000,000Price per share = 0.50Additional value of shares…

Q: Calculate the IRR and NPV 1

A: Net present value is determined by deducting the initial investment from the current value of cash…

Q: L. From the following data, calculate break-even point expressed in terms of units and also the new…

A: 1.Fixed cost :Depreciation = SR200,000Salaries = SR50,000Variable expenses:Materials = SR10 per…

Q: IBM is evaluating a project in Eutopia. The project will create the following cash flows: Year $ 0…

A: The reinvestment rate is 3.5%.The required rate of return is 12%.The cash flows are as follows:

Q: 6. The TPs sold the following stock in 2023: 300 shares of Adam, Inc.; Purchased on 8/21/20 for $52…

A: The correct entry on the TP's return is a. $3,000 on Schedule D, Part I, Line 1, column…

Q: The CFO of Lenox Industries hired you as a consultant to help estimate its cost of capital. You have…

A: Cost of equity refers to the amount that is required to distribute or pay to shareholders for using…

Q: Time 0 Time 1 Time 2 Time 3 Project A - 10,000 5,000 4,000 3,000 Project B - 10,000 4,000 3,000…

A: Options that are available for an investor to buy assets using the available funds are known as…

Q: Industries can reduce its operating expenses so that EBIT becomes 12% of sales, by how much will its…

A: The value of a company is the sum of all its marketable assets. The Modigliani-Miller proportion…

Q: Required information [The following information applies to the questions displayed below.] Kate's…

A: A firm must make crucial choices that need significant capital expenditure. Business development and…

Q: Dynamic - Problem and answer changes with each attempt (consider an Excel solution) Monet,…

A: Net present value (NPV) is the difference between the current value of cash and the future worth of…

Q: You have been given the following return information for a mutual fund, the market index, and the…

A: YearFundMarketRisk-free2018-19.4%-37.5%1%201925.1%20.8%4%202013.7%13.3%2%20217.2%8.4%6%2022-1.98%-4.…

Q: (2) Which of the following investment opportunities offers a better deal for the investor, (a) Roads…

A: Effective rate is the rate after considering the impact of compounding on the interest rate.…

Q: Graphical Designs is offering 15-15 preferred stock. The stock will pay an annual dividend of $15…

A: Preferred stock represent ownership in a company. This aspect of preferred stock is the same as…

Q: Consider two stocks, Stock D, with an expected return of 13 percent and a standard deviation of 25…

A:

Q: 2023 TAXABLE INCOME FIRST $53,359 OVER $53,359 TO $106,717 OVER $106,717 TO $165,430 OVER $ $165,430…

A: Taxable income is the portion of an individual's or business's total income that is subject to…

Q: Seven years ago, the Goodyear Tire & Rubber Company issued a series of 20-year coupon bonds. These…

A: Number of years to maturity will be 20 years minus 7 years, i.e., 13 years.

Q: Following results were obtained for the period of six months ending September 2022. Birla Sundaram…

A: To rank the funds based on predictive ablility we can use Sharpe ratio. The sharpness ratio is…

Q: Which of the following relationships is most accurate regarding a 20-year corporate bond that sells…

A: Bonds are debt instruments in which interest payments are made each year and par value is paid on…

Q: Orwell Building Supplies' last dividend was $2. Its dividend growth rate is expected to be constant…

A: Price can be calculated asWhere,P0 = Stock valueD0 = Current dividendg = growth rateD0 ( 1 + g)…

Q: Usually ground leases are for relatively short periods of time. True or False

A: That statement is somewhat False. Ground leases can vary in duration, ranging from relatively short…

Q: In benefit cliff discussion: program provides $6,600 of benefits to a family with two kids, one und…

A: Maximum benefit=$6600Bottom limit=$150000Top limit=$400000

Q: Project Z has an initial investment of $67,945.00. The project is expected to have cash inflows of…

A: To calculate the Net Present Value (NPV) of Project Z, we'll discount the future cash inflows to…

Q: You own a portfolio equally invested in a risk free asset and two stocks. If one of the stocks has a…

A: The beta of a portfolio refers to the measure of the sensitivity of the portfolio to the movement in…

Step by step

Solved in 3 steps with 2 images

- Brook Corporation’s free cash flow for the current year (FCF0) was $3.00 million. Its investors require a 13% rate of return on (WACC = 13%). What is the estimated value of operations if investors expect FCF to grow at a constant annual rate of (1) −5%, (2) 0%, (3) 5%, or (4) 10%?Ogier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?Assume that an investment of 100,000 produces a net cash flow of 60,000 per year for two years. The discount factor for year 1 is 0.89 and for year 2 is 0.80. The NPV is a. 0 b. 6,800 c. 1,400 d. (4,000)

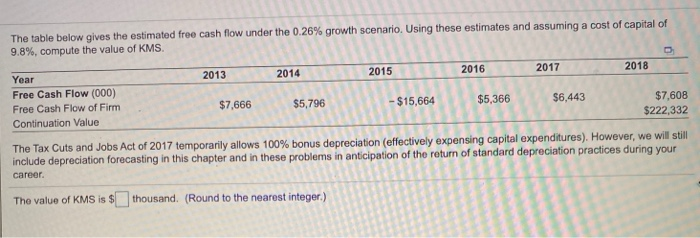

- Start with the partial model in the file Ch07 P25 Build a Model.xlsx on the textbook’s Web site. Selected data for the Derby Corporation are shown here. Use the data to answer the following questions. Calculate the estimated horizon value (i.e., the value of operations at the end of the forecast period immediately after the Year-4 free cash flow). Assume growth becomes constant after Year 3. Calculate the present value of the horizon value, the present value of the free cash flows, and the estimated Year-0 value of operations. Calculate the estimated Year-0 price per share of common equity.Free Cash Flow Valuation Dozier Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFs) during the next 3 years, after which FCF is expected to grow at a constant 7% rate. Dozier’s weighted average cost of capital is WACC = 13%. What is Dozier’s horizon value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) What is the current value of operations for Dozier? Suppose Dozier has $10 million in marketable securities, $100 million in debt, and 10 million shares of stock. What is the intrinsic price per share?The most recent free cash flow (FCF) for Heath Inc. was $200 million, and the management expects the free cash flow to begin growing immediately at a 7% constant rate. The cost of capital is 12%. Using the constant growth model, determine the value of operations of Heath Inc.

- The free cash flows (in millions) shown below are forecast by Simmons Inc. If the weighted average cost of capital is 13% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3, what is the Year 0 value of operations, in millions? Year: 1 Free Cash Flow: -$20, Year 2 Free Cash Flow: $44, Year 3 Free Cah Flow: $47.Assume the following free cash flows for Elle Inc. for Year 6 and forecasted FCFF for Year 7 onward (in millions): Current Forecast Horizon Terminal Year ($millions) Year 7 Year 8 Year 9 Year 10 Year 11 Free cash flows to the firm (FCFF) $4,973 $5,222 $5,482 $5,757 $6,045 $6,166 The DCF value of the firm using the FCFF information above, a discount rate of 6%, and an expected terminal growth rate of 2%, is: $150,020 million $141,529 million $134,617 million $100,828 million None of these are correct.You are evaluating Adidas and expect it to generate the following free cash flows over your forecast horizon: Year 1 2 3 4 5 FCF ($ millions) 53.1 66.9 77.8 75.5 82.1 After your forecast horizon, you expect FCF to grow at 4.3% per year forever. If the weighted average cost of capital (dsicount rate) is 13.8%, what is: a. The enterprise value of Adidas. b. Assume Adidas has no excess cash, debt of $318 million, and 39 million shares outstanding, what is its stock price? Question content area bottom Part 1 a. The enterprise value will be $enter your response here million. (Round to two decimal places.) b. The stock price will be $enter your response here. (Round to two decimal places.)