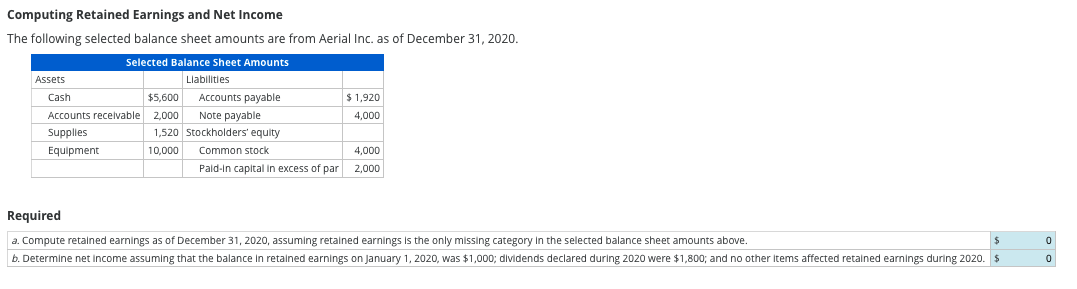

Computing Retained Earnings and Net Income The following selected balance sheet amounts are from Aerial Inc. as of December 31, 2020. Selected Balance Sheet Amounts Assets Llabilities Cash $5,600 Accounts payable $ 1,920 Accounts recelvable 2,000 Note payable 4,000 Supplies 1,520 Stockholders' equity Equipment 10,000 Common stock 4,000 Pald-in capital in excess of par 2,000 Required a. Compute retalined earnings as of December 31, 2020, assuming retained earnings is the only missing category in the selected balance sheet amounts above. b. Determine net income assuming that the balance in retained earnings on January 1, 2020, was $1,000; dividends declared during 2020 were $1,800; and no other items affected retained earnings during 2020. S

Computing Retained Earnings and Net Income The following selected balance sheet amounts are from Aerial Inc. as of December 31, 2020. Selected Balance Sheet Amounts Assets Llabilities Cash $5,600 Accounts payable $ 1,920 Accounts recelvable 2,000 Note payable 4,000 Supplies 1,520 Stockholders' equity Equipment 10,000 Common stock 4,000 Pald-in capital in excess of par 2,000 Required a. Compute retalined earnings as of December 31, 2020, assuming retained earnings is the only missing category in the selected balance sheet amounts above. b. Determine net income assuming that the balance in retained earnings on January 1, 2020, was $1,000; dividends declared during 2020 were $1,800; and no other items affected retained earnings during 2020. S

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 17E: Income Statement and Retained Earnings Huff Company presents the following items derived from its...

Related questions

Question

100%

Please Solve In 20mins

I will Thumbs-up promise

Transcribed Image Text:Computing Retained Earnings and Net Income

The following selected balance sheet amounts are from Aerial Inc. as of December 31, 2020.

Selected Balance Sheet Amounts

Assets

Llabilities

Cash

$5,600

Accounts payable

$ 1,920

Accounts recelvable

2,000

Note payable

4,000

Supplies

1,520 Stockholders' equity

Equipment

10,000

Common stock

4,000

Pald-in capital in excess of par

2,000

Required

a. Compute retained earnings as of December 31, 2020, assuming retained earnings Is the only missing category in the selected balance sheet amounts above.

b. Determine net income assuming that the balance in retained earnings on January 1, 2020, was $1,000; dividends declared during 2020 were $1,800; and no other Items affected retained earnings during 2020. $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning