Conclusion: Based on your findings on ratio analysis and interpretation, what conclusion can you make?

Conclusion: Based on your findings on ratio analysis and interpretation, what conclusion can you make?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 26BE

Related questions

Question

IV. Conclusion:

Based on your findings on ratio analysis and interpretation, what conclusion can you make?

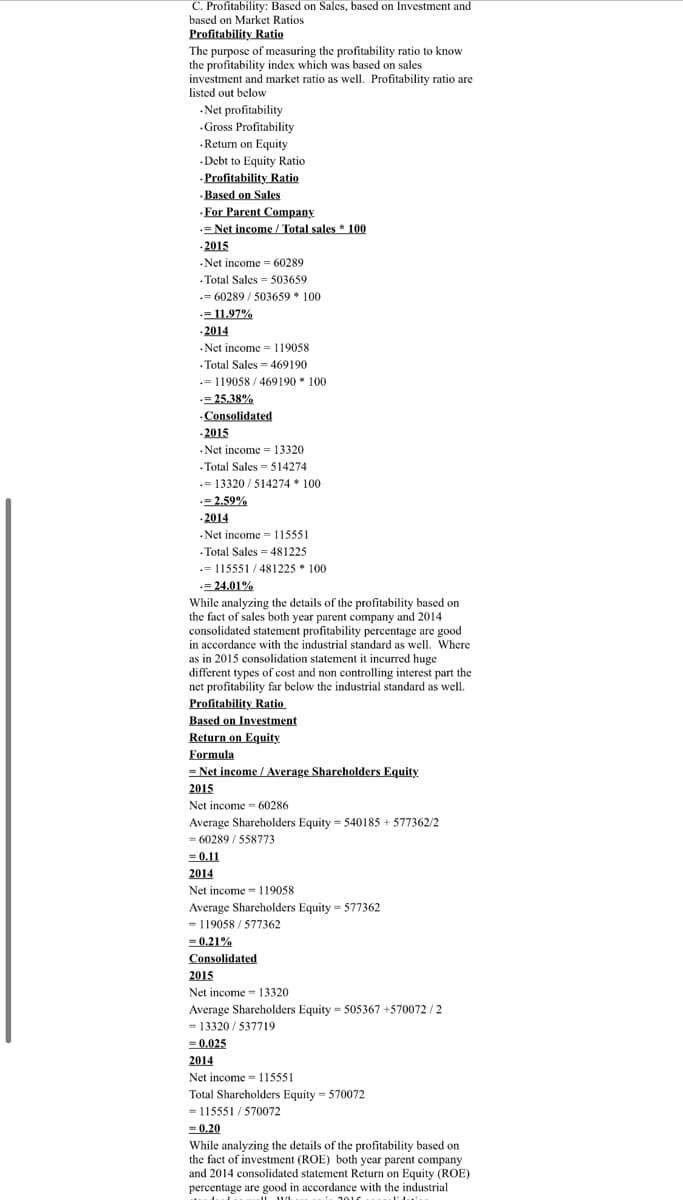

Transcribed Image Text:C. Profitability: Based on Sales, based on Investment

based on Market Ratios

Profitability Ratio

The purpose of measuring the profitability ratio to know

the profitability index which was based

investment and market ratio as well. Profitability ratio are

listed out below

sales

.Net profitability

.Gross Profitability

·Return on Equity

.Debt to Equity Ratio

.Profitability Ratio

·Based on Sales

·For Parent Company

= Net income / Total sales * 100

-2015

Net income = 60289

.Total Sales = 503659

.= 60289 / 503659 * 100

=11.97%

- 2014

-Net income = 119058

· Total Sales = 469190

.= 119058 / 469190 * 100

= 25.38%

Consolidated

- 2015

- Net income = 13320

- Total Sales 514274

= 13320 / 514274 * 100

-=2.59%

-2014

Net income 115551

.Total Sales = 481225

.= 115551 / 481225 * 100

-= 24.01%

While analyzing the details of the profitability based on

the fact of sales both year parent company and 2014

consolidated statement profitability percentage are good

in accordance with the industrial standard as well. Where

as in 2015 consolidation statement it incurred huge

different types of cost and non controlling interest part the

net profitability far below the industrial standard as well.

Profitability Ratio

Based on Investment

Return on Equity

Formula

= Net income / Average Shareholders Equity

2015

Net income = 60286

Average Shareholders Equity = 540185 + 577362/2

= 60289 / 558773

= 0.11

2014

Net income = 119058

Average Sharcholders Equity = 577362

= 119058 / 577362

= 0.21%

Consolidated

2015

Net income = 13320

Average Shareholders Equity = 505367 +570072 / 2

= 13320 / 537719

= 0.025

2014

Net income = 115551

Total Shareholders Equity = 570072

115551 / 570072

= 0,20

=

While analyzing the details of the profitability based on

the fact of investment (ROE) both year parent company

and 2014 consolidated statement Return on Equity (ROE)

percentage are good in accordance with the industrial

2010

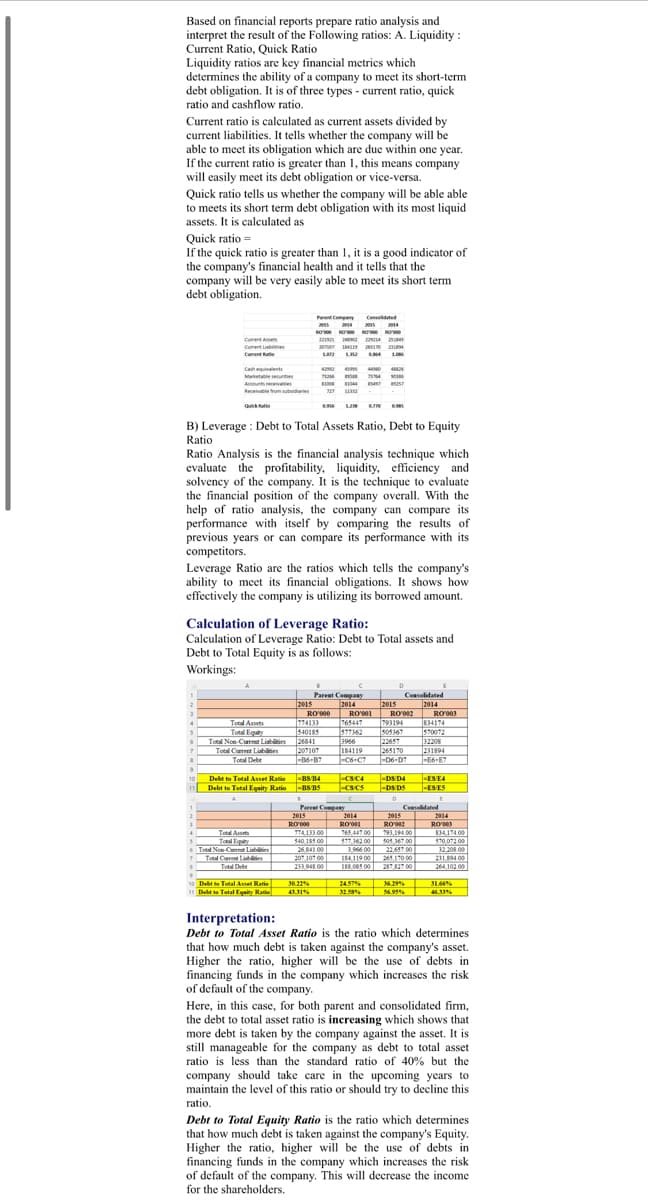

Transcribed Image Text:Based on financial reports prepare ratio analysis and

interpret the result of the Following ratios: A. Liquidity :

Current Ratio, Quick Ratio

Liquidity ratios are key financial metrics which

determines the ability of a company to meet its short-term

debt obligation. It is of three types - current ratio, quick

ratio and cashflow ratio.

Current ratio is calculated as current assets divided by

current liabilities. It tells whether the company will be

able to meet its obligation which are due within one year.

If the current ratio is greater than 1, this means company

will easily meet its debt obligation or vice-versa.

Quick ratio tells us whether the company will be able able

to meets its short term debt obligation with its most liquid

assets. It is calculated as

Quick ratio =

If the quick ratio is greater than 1, it is a good indicator of

the company's financial health and it tells that the

company will be very easily able to meet its short term

debt obligation.

Parent Company Conated

20s 24 2s 214

4

RO ROe so o

Cument Ase

22I 4 a

Cument ebe

Cument te

sara La 10

s 42

Cah equivalents

Matetable secunties

Accounts receivles

Recelvale om ubdaries

L2M e

Quic atio

B) Leverage : Debt to Total Assets Ratio, Debt to Equity

Ratio

Ratio Analysis is the financial analysis technique which

evaluate the profitability, liquidity, efficiency and

solvency of the company. It is the technique to evaluate

the financial position of the company overall. With the

help of ratio analysis, the company can compare

performance with itself by comparing the results of

previous years or can compare its performance with its

competitors.

Leverage Ratio are the ratios which tells the company's

ability to meet its financial obligations. It shows how

effectively the company is utilizing its borrowed amount.

Calculation of Leverage Ratio:

Calculation of Leverage Ratio: Debt to Total assets and

Debt to Total Equity is as follows:

Workings:

Pareat Company

Cossolidated

2015 2014 2015

2014

774133

I540185

26841

207107

|RO'00 RO'001 RO'002 ROV03

793194

505367

22657

765447

57762

3966

184119 265170 231894

1-C6+C7 -D6-D? -E6-E7

834174

570072

32208

Total Assets

Total Eouiy

Total Non-Curet Liabities

7

Total Carent Liabliies

Total Debe

10 -BS B4

Debt to Total Asset Ratio

-CSC4 -DS D4 4

-ESE4

Debt to Total Equity Ratio -BS B5

-CSCS -DS DS

-ESES

Paret Compaay

Cesolidated

2015 2014 2015 2014

RO00 RO01 RO002 RO'0S

774133.00 193,194.00

Tetl Aset

765,447 00

S40.185 00 S77,362 00 s05,367 00

Total Fquity

Total Non-Cemt Lisbilitien

Tol Curet Labes

134174.00

170.072 00

3220 00

231894 00

264 102 00

26,841.00

3,966 00 22,657.00

207.107 00 184119 00 265,170 00

188,085 00

Total Deb

233 948 00

287 827.00

no Debt to Total Asset Ratie 30.22 2457% 36 19% 31.66%

Delt te Tatal Equity Ratie

36.19%

4% 32.8% 4.95% 4.U

Interpretation:

Debt to Total Asset Ratio is the ratio which determines

that how much debt is taken against the company's asset.

Higher the ratio, higher will be the use of debts in

financing funds in the company which increases the risk

of default of the company.

Here, in this case, for both parent and consolidated firm,

the debt to total asset ratio is increasing which shows that

more debt is taken by the company against the asset. It is

still manageable for the company as debt to total asset

ratio is less than the standard ratio of 40% but the

company should take care in the upcoming years to

maintain the level of this ratio or should try to decline this

ratio.

Debt to Total Equity Ratio is the ratio which determines

that how much debt is taken against the company's Equity.

Higher the ratio, higher will be the use of debts in

financing funds in the company which increases the risk

of default of the company. This will decrease the income

for the shareholders.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT