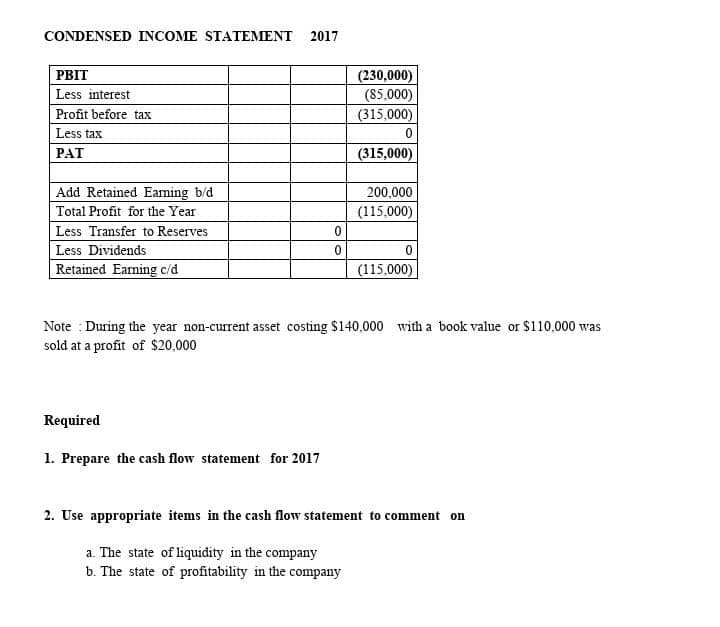

CONDENSED INCOME STATEMENT 2017 PBIT Less interest Profit before tax Less tax PAT Add Retained Earning b/d Total Profit for the Year Less Transfer to Reserves Less Dividends Retained Earning c/d Required 0 1. Prepare the cash flow statement for 2017 0 (230,000) (85,000) (315,000) 0 (315,000) 200,000 (115,000) Note: During the year non-current asset costing $140,000 with a book value or $110,000 was sold at a profit of $20,000 (115,000) 2. Use appropriate items in the cash flow statement to comment on a. The state of liquidity in the company b. The state of profitability in the company

CONDENSED INCOME STATEMENT 2017 PBIT Less interest Profit before tax Less tax PAT Add Retained Earning b/d Total Profit for the Year Less Transfer to Reserves Less Dividends Retained Earning c/d Required 0 1. Prepare the cash flow statement for 2017 0 (230,000) (85,000) (315,000) 0 (315,000) 200,000 (115,000) Note: During the year non-current asset costing $140,000 with a book value or $110,000 was sold at a profit of $20,000 (115,000) 2. Use appropriate items in the cash flow statement to comment on a. The state of liquidity in the company b. The state of profitability in the company

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 59P

Related questions

Question

Transcribed Image Text:CONDENSED INCOME STATEMENT 2017

PBIT

Less interest

Profit before tax

Less tax

PAT

Add Retained Earning b/d

Total Profit for the Year

Less Transfer to Reserves

Less Dividends

Retained Earning c/d

Required

0

0

1. Prepare the cash flow statement for 2017

(230,000)

(85,000)

(315,000)

0

(315,000)

200,000

(115,000)

Note: During the year non-current asset costing $140,000 with a book value or $110,000 was

sold at a profit of $20,000

(115,000)

2. Use appropriate items in the cash flow statement to comment on

a. The state of liquidity in the company

b. The state of profitability in the company

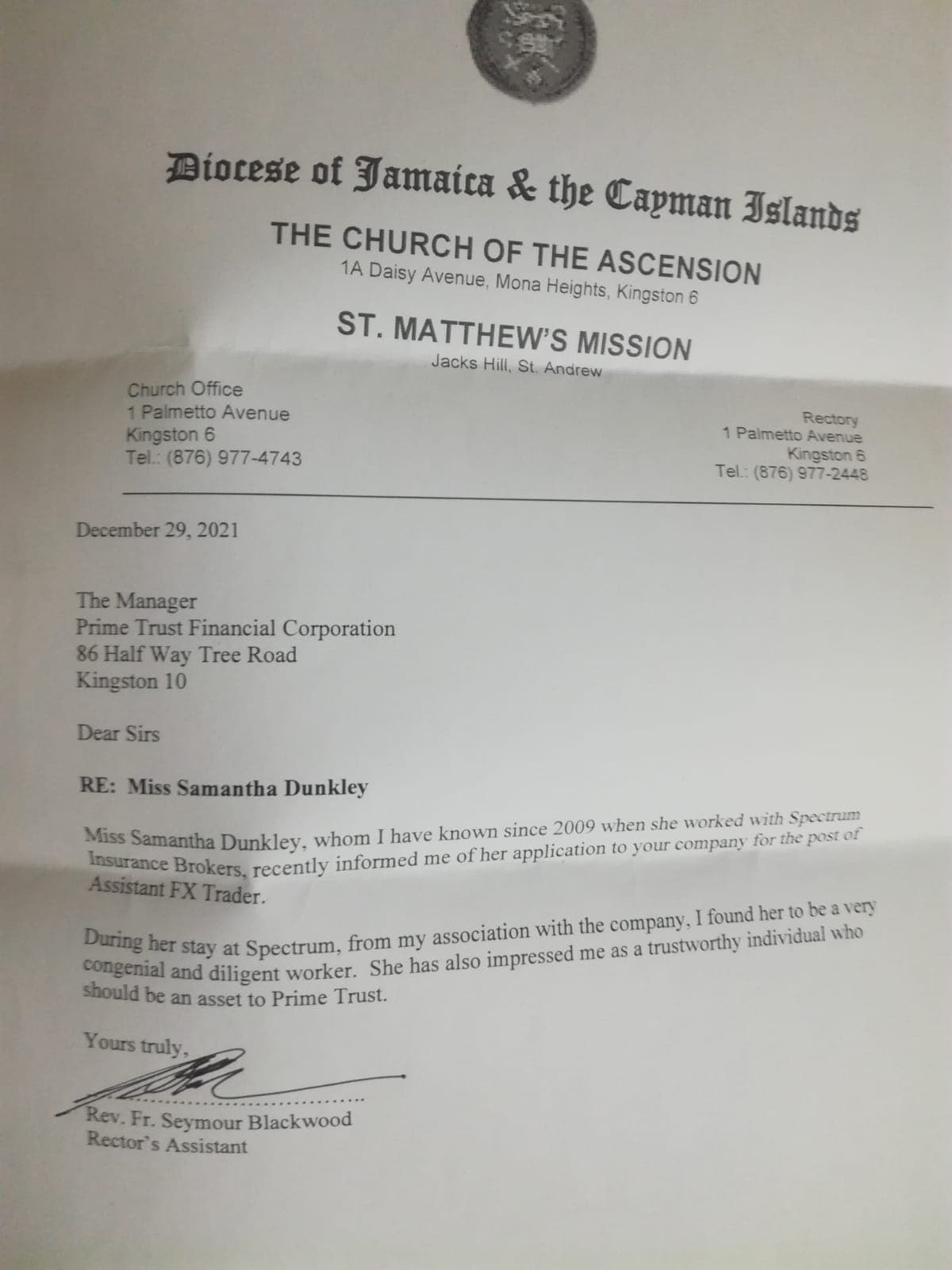

Transcribed Image Text:Diocese of Jamaica & the Cayman Islands

THE CHURCH OF THE ASCENSION

1A Daisy Avenue, Mona Heights, Kingston 6

Church Office

1 Palmetto Avenue

Kingston 6

Tel.: (876) 977-4743

December 29, 2021

The Manager

Prime Trust Financial Corporation

86 Half Way Tree Road

Kingston 10

Dear Sirs

ST. MATTHEW'S MISSION

Jacks Hill, St. Andrew

RE: Miss Samantha Dunkley

Miss Samantha Dunkley, whom I have known since 2009 when she worked with Spectrum

Insurance Brokers, recently informed me of her application to your company for the post of

Assistant FX Trader.

Yours truly,

Rectory

1 Palmetto Avenue

Kingston 6

Tel.: (876) 977-2448

During her stay at Spectrum, from my association with the company, I found her to be a very

congenial and diligent worker. She has also impressed me as a trustworthy individual who

should be an asset to Prime Trust.

Rev. Fr. Seymour Blackwood

Rector's Assistant

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you