Conduct an acquisition analysis for Bermuda Purchase Consideration [ Choose ] Net Identifiable Assets (Hint: E = A- L) [ Choose ] Business Combination Valuation Reserve [Choose ) Goodwill/ (Bargain Purchase) [ Choose )

Conduct an acquisition analysis for Bermuda Purchase Consideration [ Choose ] Net Identifiable Assets (Hint: E = A- L) [ Choose ] Business Combination Valuation Reserve [Choose ) Goodwill/ (Bargain Purchase) [ Choose )

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter12: Auditing Long-lived Assets And Merger And Acquisition Activity

Section: Chapter Questions

Problem 37RQSC

Related questions

Question

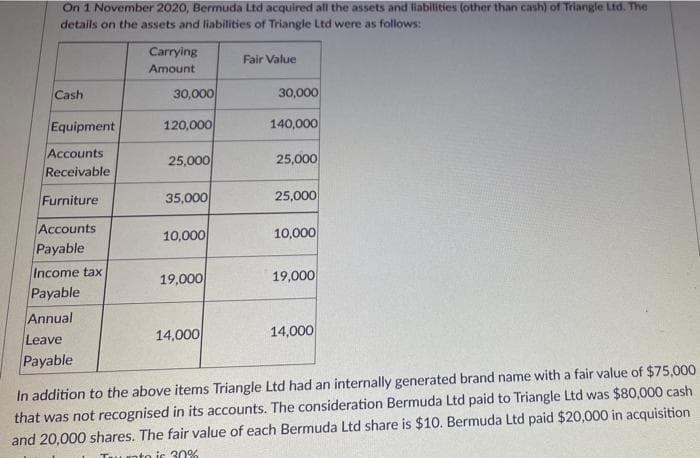

Transcribed Image Text:On 1 November 2020, Bermuda Ltd acquired all the assets and fiabilities (other than cash) of Triangle Ltd. The

details on the assets and liabilities of Triangle Ltd were as follows:

Carrying

Fair Value

Amount

Cash

30,000

30,000

Equipment

120,000

140,000

Accounts

Receivable

25,000

25,000

Furniture

35,000

25,000

Accounts

Payable

10,000

10,000

Income tax

19,000

19,000

Payable

Annual

Leave

14,000

14,000

Payable

In addition to the above items Triangle Ltd had an internally generated brand name with a fair value of $75,000

that was not recognised in its accounts. The consideration Bermuda Ltd paid to Triangle Ltd was $80,000 cash

and 20,000 shares. The fair value of each Bermuda Ltd share is $10. Bermuda Ltd paid $20,000 in acquisition

to ic 30%

![In addition to the above items Triangle Ltd had an internally generated brand name with a fair value of $75,000

that was not recognised in its accounts. The consideration Bermuda Ltd paid to Triangle Ltd was $80,000 cash

and 20,000 shares. The fair value of each Bermuda Ltd share is $10. Bermuda Ltd paid $20,000 in acquisition

related costs. Tax rate is 30%.

Required:

Conduct an acquisition analysis for Bermuda

Purchase Consideration

[ Choose )

Net Identifiable Assets (Hint: E= A- L)

[ Choose )

Business Combination Valuation Reserve

[ Choose)

Goodwill/ (Bargain Purchase)

[ Choose ]

>](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F5a078a20-138b-41df-82a5-3ba57399e103%2Fd18b276b-4550-480d-819e-253c4d2cf02e%2Fi82jhur_processed.jpeg&w=3840&q=75)

Transcribed Image Text:In addition to the above items Triangle Ltd had an internally generated brand name with a fair value of $75,000

that was not recognised in its accounts. The consideration Bermuda Ltd paid to Triangle Ltd was $80,000 cash

and 20,000 shares. The fair value of each Bermuda Ltd share is $10. Bermuda Ltd paid $20,000 in acquisition

related costs. Tax rate is 30%.

Required:

Conduct an acquisition analysis for Bermuda

Purchase Consideration

[ Choose )

Net Identifiable Assets (Hint: E= A- L)

[ Choose )

Business Combination Valuation Reserve

[ Choose)

Goodwill/ (Bargain Purchase)

[ Choose ]

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning