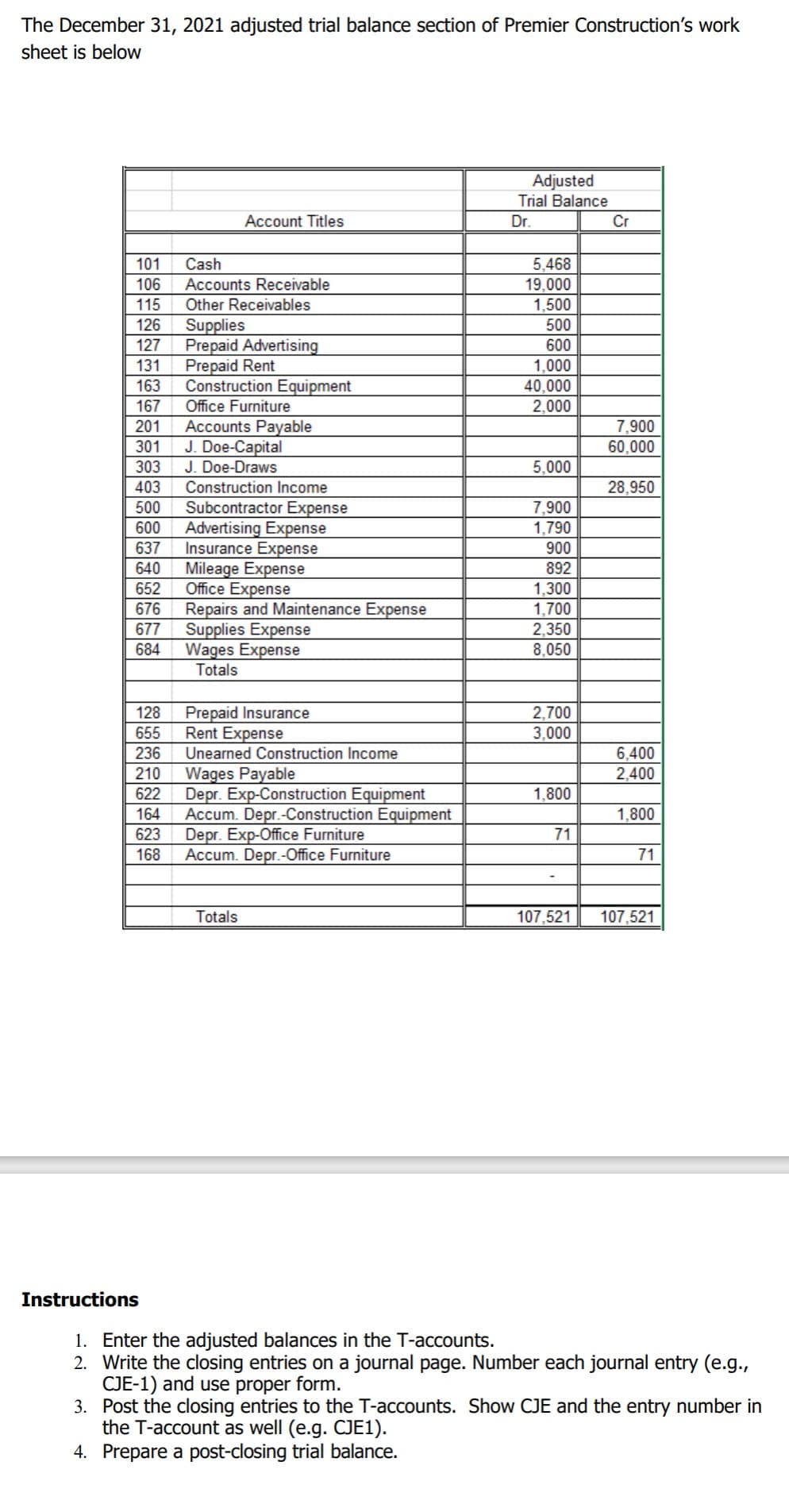

The December 31, 2021 adjusted trial balance section of Premier Construction's work sheet is below Adjusted Trial Balance Account Titles Dr. Cr 101 Cash 5,468 106 Accounts Receivable 19,000 1,500 115 Other Receivables 126 Supplies 500 127 Prepaid Advertising 600 131 Prepaid Rent 1,000 40,000 2,000 163 Construction Equipment 167 Office Furniture Accounts Payable J. Doe-Capital J. Doe-Draws 7,900 60,000 201 301 303 5,000 403 Construction Income 28,950 Subcontractor Expense Advertising Expense Insurance Expense Mileage Expense Office Expense Repairs and Maintenance Expense Supplies Expense Wages Expense Totals 500 7,900 600 1,790 637 900 640 892 1,300 1,700 2,350 8,050 652 676 677 684 Prepaid Insurance Rent Expense 128 2,700 655 3,000 236 Unearned Construction Income 6,400 2,400 Wages Payable Depr. Exp-Construction Equipment 164 210 622 1,800 Accum. Depr.-Construction Equipment 623 1,800 Depr. Exp-Office Furniture Accum. Depr.-Office Furniture 71 168 71 Totals 107,521 107,521 Instructions 1. Enter the adjusted balances in the T-accounts. 2. Write the closing entries on a journal page. Number each journal entry (e.g., CJE-1) and use proper form. 3. Post the closing entries to the T-accounts. Show CJE and the entry number in the T-account as well (e.g. CJE1). 4. Prepare a post-closing trial balance.

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images