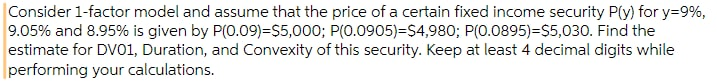

Consider 1-factor model and assume that the price of a certain fixed income security P(y) for y=9% 9.05% and 8.95% is given by P(0.09)=$5,000; P(0.0905)=$4,980; P(0.0895)=$5,030. Find the estimate for DVO1, Duration, and Convexity of this security. Keep at least 4 decimal digits while performing your calculations.

Q: Discuss the following statement about hedging: “There is no such thing as a hedge. Any hedge is an a...

A: In any market there are three traders are available to play in the market namely, speculator, arbitr...

Q: Dufner Co. issued 17-year bonds one year ago at a coupon rate of 7.8 percent. The bonds make semiann...

A: Cash Flow at the time of maturity = $1000 Interest (Annuity) semiannually = ($1000 * 7.8%)*6/12 = ...

Q: You are interested in buying a piece of real estate property that could be worth $450,000 in five ye...

A: The worth of property in five years represents the future value of the property. The present value o...

Q: Calculate the effective rate given continuously compounding 2% interest. a 2.07% b 2.12% c 3.02% ...

A:

Q: 2. Interpreting Bond Yields Suppose you buy a 7 percent coupon, 20-year bond today when it's first i...

A: Solution: Since only Question 2 is reflecting full, so only solution to that question is mentioned b...

Q: Which of the following are true statements on the principal-agent problem between corporate managers...

A: the principal-agent problem occurs when there is conflicts of interest between the principal and age...

Q: Compare the results of the three methods by quality of information for decision making. Using what y...

A: The question is related to Capital Budgeting. The Net Present Value is the exess of Present Value of...

Q: Assume the time from acceptance to maturity on a $10,000,000 banker's acceptance is 90 days. Further...

A: We can calculate the amount that the exporter pays in discounting by applying the required formula. ...

Q: What is the difference between mutual and stock insurance company?

A: Risk is an inseparable part of investment. To reduce the risk, different techniques are used. Insura...

Q: If the required return on the stock is 10 percent, what is the current share price?

A: Share price: It represents the current market value to buyers and sellers. The price of a share can...

Q: Assume semi-annual payments. A bond has a coupon rate of 2.8% when yields are 4.33%. If the bond has...

A: Bond price is the present discounted value of its expected cash flow at the given interest rate. A b...

Q: man deposit P 1,000 at the end of each month for 3 years at nominal rate 12% compounded monthly. Com...

A: Here we have to find the future value of the monthly deposits using the concept of time value of mon...

Q: If an investment of P750,000 that matures in 15 years but with certain specification that P 500000 w...

A: We are required to find out the Return on its maturity and to choose which is the best option

Q: What is the present worth of this cash flow assuming i = 5%? $1000 $400 2 $200 3 O 1000 - 200(1.05)-...

A: Present worth of the given cash flows can be calculated by sum of the values of multiplying cash flo...

Q: Beginning Balances for Quentin's Four Credit Cards Card A Card C Card D Balance $4,134.00 $932.00 $1...

A: The value of interest payable over the term of the loan and the loan value due is equal to the total...

Q: What happens when N (d2) of the Black Scholes Morten Model is in the negative figure? What does this...

A: Following a lengthy search by financial economists for a viable option-pricing model. A formula for ...

Q: a gym charges $45 per month and a $75 one time starting fee what equation will show how much it cost...

A: Total cost is the sum of fixed cost, variable cost, and semi-variable costs. Fixed costs remain cons...

Q: F10 - 8% B B. B B B. |= 6.5 % 0 1 2 3 4 5 6 7 8 9 10 1 12 18 19 20 // A A A A 100,000

A: If the deposits are made on the time they grow with time bigger amounts and than they retuned into g...

Q: Griffey & Son operates a plant in Cincinnati and is considering opening a new facility in Seattle. T...

A: The cost of capital is the minimum return estimated by the analyst and potential investors. The comp...

Q: 6. 3 End of Year 2000 1800 1600 1400 2,194 2,194 2,194 2,194 Revenue 286 286 286 286 Expenses 500 50...

A: Future value/worth Future value of a present value is calculated by multiplying the present value wi...

Q: he following data was reported by Saturday Corporation: Authorized shares: 30,000 Issued shares: 25...

A: Authorized shares are the number of shares that a company is legally allowed to issue.

Q: Every 15 days a company receives P10,000 worth of raw materials from its suppliers. The credit terms...

A: Number of raw materials worth P 10000 received in a year = 360/15 = 24 2/15, net 30 credit terms all...

Q: The market risk premium is 5%. The firm has an estimated beta of 0.9 and the current risk free rate ...

A: Given Information : Market risk premium = 5%Beta = 0.9 Risk free rate = 3%

Q: When Microsoft went public, the company sold 2 million new shares (the primary issue). In addition, ...

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for yo...

Q: Asa has invested money from the settlement of an insurance claim. She plans to withdraw $1,920 from ...

A: Fist we need to calculate present value of all withdrawals by using present value of ordinary annuit...

Q: An individual has $20,000 invested in a stock with a beta of 0.6 and another $75,000 invested in a s...

A: Portfolio beta is the sum of weighted average of the individual beta of the stocks in the portfolio....

Q: Freedom Corporation acquired a fixed asset for $230,000. Its estimated life at time of purchase was ...

A: The incremental value for depreciation will be the excess amount of depreciation generated from prop...

Q: Bourdon Software has 7.4 percent coupon bonds on the market with 15 years to maturity. The bonds mak...

A: First we need to calculate yield to maturity of the bond by using the following formula in excel. fo...

Q: Corp. is growing quickly. Dividends are expected to grow at a rate of 29 percent for the next three ...

A: The current price of stock is the present value of dividends and present value of terminal value.

Q: Galaxy Co. purchases rights to collect monthly rents from real-estate owners and securitizes it into...

A: Annual Coupon Payment = 40,000 Total Face Value = 1,000,000

Q: suppose a stock worth $50 today is equally likely to be worth $100 or $25 a year from today. What is...

A: Stock Worth = $50 Equally worth stock $100 or $25 Highest price = $100 Lowest price = $25 Probabili...

Q: Cape Corp. will pay a dividend of $2.70 next year. The company has stated that it will maintain a co...

A: Stock value = Dividend next year/(Required rate - Growth rate)

Q: RTN: What is its significance?

A: RTN is an abbreviation of Routing Transit Number, which is very important aspect in the banking as w...

Q: Ethan invested $2,200 at the beginning of every 6 months in an RRSP for 11 years. For the first 8 ye...

A: Accumulated amount includes the amount of principal amount deposited and plus interest amount accumu...

Q: The firm invests $1,000 today, and realizes after tax cashflows in the amounts of $110, $660, and $8...

A:

Q: An investor takes a long position on an FRA that is based on 90-day LIBOR and has 6 months till expi...

A: A forward rate agreement is referred to those agreements that are made over-the-counter to determine...

Q: Judy was givin $3000 to invest that would last 8 years. $1050 earned exponentially at a rate of 3.2%...

A:

Q: The simple interest rate charged If the principal and interest are to be paid in seven months, how m...

A: We need to use simple interest formula to calculate simple interest amount. The formula is Simple i...

Q: What is the greatest risk in mortgage banking? Group of answer choices Price Risk Fallout Risk Inter...

A: Mortgage Banking:- In Moratage banking, a bank provides Loan servicing, Mortagage banks are register...

Q: BE6.5 (LO 3) Sally Medavoy will invest $8,000 a year for 20 years in a fund that will earn 6% annual...

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for...

Q: (CFO) of New Age Fashion Lta t received a request from a project manager lo auhonze an expene 145,00...

A: The decision regarding the allocation of the £45000 will depend whether the proppsed amount spent on...

Q: ow impotant is the time value of money and what is it that the time value provides

A: The time value of money is a very important concept in finance.

Q: You are given the following long-run annual rates of return for alternative investment instruments: ...

A: The real rate of return : The real rate is inflation adjusted rate of return. The real rate is the r...

Q: Question 19, P1-12 One of the key risk areas that corporates need to manage is "ethical risks." Do y...

A: An ethical risk is defined as an ethical risk, which is an unexpected negative repercussions of an u...

Q: Suppose you decide to save P3,000 per month for the next three years. If you invest all of these sa...

A: Here, Equal amount at equal interval (A) = P3,000 per month Time period in years (n)= 3 years Rate o...

Q: The future value of this cash flow would be the present value of this cash flow, assuming i = 2% A$1...

A: Future value = [Cash flow year 0 x (1 + r)3] + [Cash flow year 1 x (1 + r)2] + Cash flow year 3 ...

Q: Mariah invested $10,000 in a bank certificate of deposit at a rate of 5% interest compounded annuall...

A: Certificate of deposits is an investment product offered by banks. The interest rates on certificate...

Q: If RRSP contributions of $3730.02 at the end of every six months are projected to generate a plan wo...

A: The nominal rate of return can be defined as the return which does not consider the compounding effe...

Q: Situation: Assume that you are planning to invest for the expansion of your business. You consider t...

A: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first ...

Q: Juan Reyes inherited P280,000 on his 30th birthday. This he placed in his own pension fund (bank acc...

A: Compounding is a technique which is used to compute the future value (FV) of the present amount by u...

Step by step

Solved in 2 steps with 3 images

- Compute the expected rate of return on investment i given the followinginformation: Rf = 8%; E(RM) = 14%; βi = 1.0.b. Recalculate the required rate of return assuming βi is 1.8.25. a. Compute the expected rate of return on investment i given the followinginformation: the market risk premium is 5%; Rf = 6%; βi = 1.2.b. Compute E(RM)Assume that the risk-free rate, RF, is currently 9% and that the market return, rm, is currently 16%. a. Calculate the market risk premium. b. Given the previous data, calculate the required return on asset A having a beta of 0.4 and asset B having a beta of 1.8.Assume that the risk free rate is currently 3% and that the market retunr is currently 11%. Calculate the market risk premium Give the previous datea, calculate the required retun on asset A having a beta of 0.3 and asset B having a beta of 1.5.

- Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has a beta, of 1.10 a) Draw the security market line (SML) b) Use the CAPM to calculate the required return, on asset A. c) Assume that as a result of recent economic events, inflationary expectations have declined by 3%, lowering RF and RM to 5% and 9%, respectively. Draw the new SML on the axes in part a, and calculate and show the new required return for asset A. d) Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 2%, to be14%. Ignoring the shift in part c, draw the new SML on the same set of axes that you used before, and calculate and show the new required return for asset A. e) From the previous changes, what conclusions can be drawn about the impact of (1) decreased inflationary expectations and (2) increased risk aversion on the required returns of risky assets?d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to pay returns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standard deviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also has standard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whether asset A and B are overvalued or undervalued, and explain why.Example of CAPM Equation: Case Risk free Rate (Rf) Market return (Km) Beta (b) Required Return A 5% 8% 1.30 ? B 8% 13% 0.90 ? C 10% 15% -0.20% ? D ? 12% 1.0 12% E 6% ? 0.60 9% F 5% 16% ? 10% Required: Using CAPM equation, compute the missing value (?)

- Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has a beta, of 1.10. (could be done on word document or excel). a) Draw the security market line (SML) b) Use the CAPM to calculate the required return, on asset A. c) Assume that as a result of recent economic events, inflationary expectations have declined by 3%, lowering RF and RM to 5% and 9%, respectively. Draw the new SML on the axes in part a, and calculate and show the new required return for asset A. d) Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 2%, to be14%. Ignoring the shift in part c, draw the new SML on the same set of axes that you used before, and calculate and show the new required return for asset A. e) From the previous changes, what conclusions can be drawn about the impact of (1) decreased inflationary expectations and (2) increased risk aversion on the required returns of risky assets?assume that risk free rate, RF, is currently 8%, the market return, 1m, is 12%, and asset a beta ba, is 1.10. (a) Draw the SML on a set of "non-diversifiable risk Please sent me complete this question for further reliance.Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has a beta, of 1.10. (could be done on word document or excel). Assume that as a result of recent economic events, inflationary expectations have declined by 3%, lowering RF and RM to 5% and 9%, respectively. Draw the new SML on the axes in part a, and calculate and show the new required return for asset A. Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 2%, to be14%. Ignoring the shift in part c, draw the new SML on the same set of axes that you used before, and calculate and show the new required return for asset A. From the previous changes, what conclusions can be drawn about the impact of (1) decreased inflationary expectations and (2) increased risk aversion on the required returns of risky assets?

- Within the context of the capital asset pricing model (CAPM), assume:∙ Expected return on the market = 15%∙ Risk-free rate = 8%∙ Expected rate of return on XYZ security = 17%∙ Beta of XYZ security = 1.25Which one of the following is correct?a. XYZ is overpriced.b. XYZ is fairly priced.c. XYZ’s alpha is −.25%.d. XYZ’s alpha is .25%. Please explain in detail the calculationAssume that the short-term risk-free rate is 3%, the market index S&P500 is expected to payreturns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standarddeviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also hasstandard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whetherasset A and B are overvalued or undervalued, and explain whyWithin the context of the capital asset pricing model (CAPM), assume:∙ Expected return on the market = 15%∙ Risk-free rate = 8%∙ Expected rate of return on XYZ security = 17%∙ Beta of XYZ security = 1.25Which one of the following is correct?a. XYZ is overpriced.b. XYZ is fairly priced.c. XYZ’s alpha is −.25%.d. XYZ’s alpha is .25%.