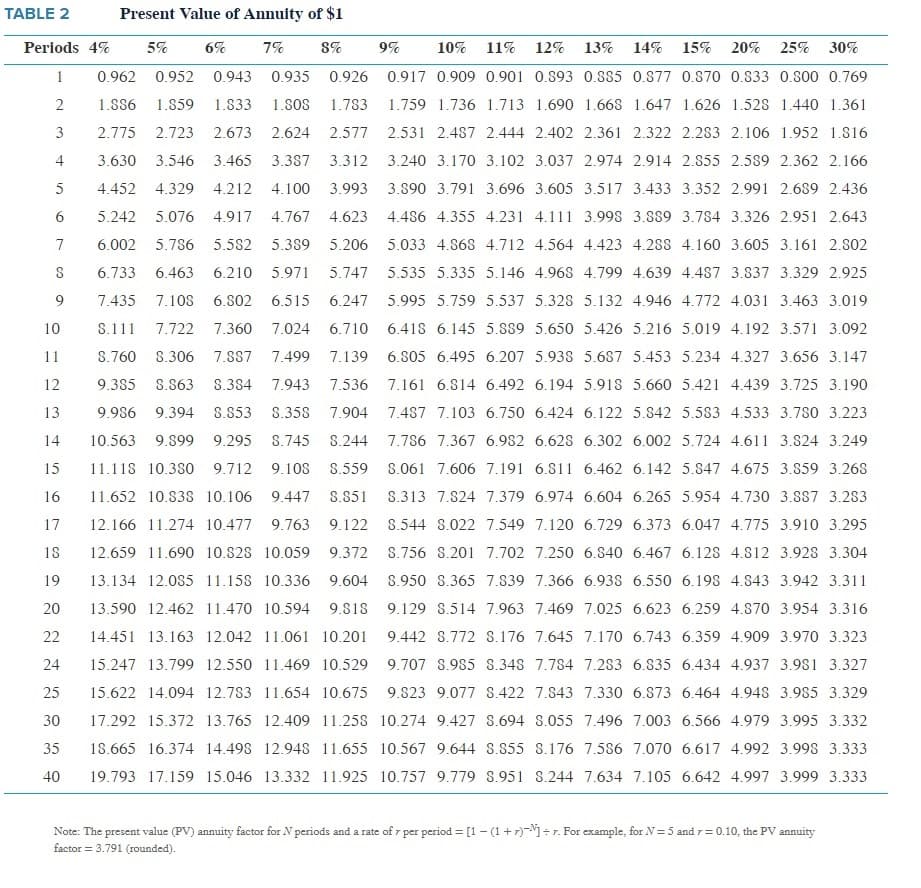

Griffey & Son operates a plant in Cincinnati and is considering opening a new facility in Seattle. The initial outlay will be $3,500,000 and should produce after-tax net cash inflows of $600,000 per year for 15 years. Due to the effects of the ocean air in Seattle, however, the plant’s useful life may be only 12 years. Cost of capital (discount rate) is 14%. Required: 1. Based on an NPV analysis, should the project be accepted if a 15-year useful life is assumed? What if a 12-year useful life is used? Use appropriate present value annuity factors from Appendix C, Table 2. (Round final answers to the nearest whole dollar. Negative amounts should be indicated with a minus sign.) 2. How many years will be needed for the Seattle facility to earn at least a 14% return? (Hint: Use the =NPER function in Excel or the formula for the present value annuity factor given at the bottom of Appendix C, Table 2 to answer this question.) (Do not round intermediate calculations and round final answer to 1 decimal place.) Appendix C, Table :

Griffey & Son operates a plant in Cincinnati and is considering opening a new facility in Seattle. The initial outlay will be $3,500,000 and should produce after-tax net

Required:

1. Based on an

2. How many years will be needed for the Seattle facility to earn at least a 14% return? (Hint: Use the =NPER function in Excel or the formula for the present value annuity factor given at the bottom of Appendix C, Table 2 to answer this question.) (Do not round intermediate calculations and round final answer to 1 decimal place.)

Appendix C, Table :

Trending now

This is a popular solution!

Step by step

Solved in 3 steps