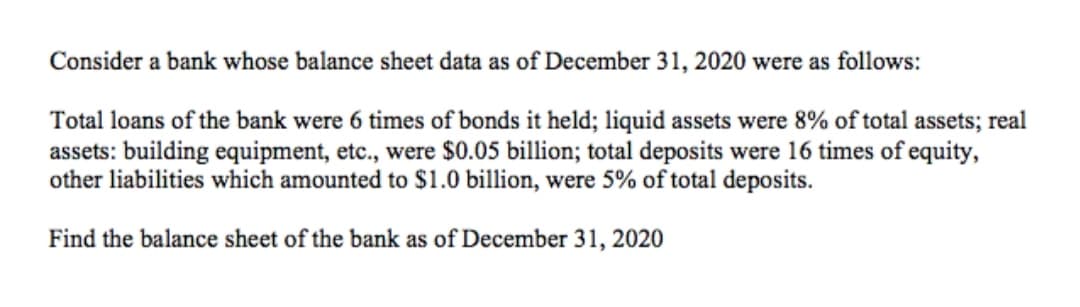

Consider a bank whose balance sheet data as of December 31, 2020 were as follows: Total loans of the bank were 6 times of bonds it held; liquid assets were 8% of total assets; real assets: building equipment, etc., were $0.05 billion; total deposits were 16 times of equity, other liabilities which amounted to $1.0 billion, were 5% of total deposits. Find the balance sheet of the bank as of December 31, 2020

Q: Sandhill Electronics reported the following information at its annual meetings: The company had cash…

A: Net working capital is the difference between the total current assets and current liabilities.

Q: Swinnerton Clothing Company's balance sheet showed total current assets of $2,450, all of which were…

A: GIven Information, Total Current Assets = $2,450 Current Liabilities: Accounts Payable = $550 5%…

Q: Use the table for the question(s) below. Consider the following balance sheet: Luther…

A: Debt to capital ratio present the portion of debt employed in company out of its total capital. It…

Q: The following are the information on the assets and liabilities of HARUTO Corporation on December…

A: Acid test ratio is calculated by dividing the total current assets, except for inventory, by the…

Q: Consider the balance sheet for Inspired to Thrive (IT) Bank below: Inspired to Thrive Bank Balance…

A: Leverage ratio = Debt to Equity Ratio = Debt/Equity Debt to Capital ratio = Debt/Total Capital Debt…

Q: Mimi Company revealed the following account balances on December 31, 2020 Accounts payable.…

A: A statement of financial position is the Balance sheet that states the balances of the assets and…

Q: the ratio of 4: 2: 4. Set out below was their balance sheet as on 31-12-2021. Balance Sheet…

A: Reconstitution of Partnership Firm: Partnership has a partnership agreement and whenever a change is…

Q: The following data are provided for Cet Company: December 31 2021 2020 Cash $ 1,500,000 $ 1,000,000…

A: Current ratio = Current assets / Current liabilities

Q: The following data are provided for Cet Company: December 31 2021 2020 Cash $ 1,500,000 $ 1,000,000…

A: Current ratio: Current ratio is one of the liquidity ratios, which measures the capacity of the…

Q: Rashed Company's balance sheet showed total current assets of $4,250, all of which were required in…

A: We know, net operating working capital= Total current assets - Total current liabilities

Q: 2. At December 31, 2023, Davie Company had the following balances in the accounts it maintains at…

A: Hi student, Since there are multiple questions, we will answer only first question. Since, first…

Q: A recent balance sheet of Sweet Tooth, Inc., included the following items, among others. (Dollar…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: The table below shows accounting data of ABC company as of 30 June 2020. From the data, establish an…

A: Interest on mortgage = Mortgage x rate of interest = $250,000 x…

Q: You've collected the following information about a company: Assets Liabilities and Equity Cash…

A: Retained earnings = total assets - total liabilities - paid in capital

Q: A company has the following items for the fiscal year 2020: Cash = 2 million Marketable securities =…

A: Current ratio is the short term liquidity ratio calculated by dividing current assets by its current…

Q: Required: Analyse the scenarios below and provide brief explanation for your analysis. 1. In year…

A: Ratio analysis is an art as well as science, because it helps to aalayse the financial position in a…

Q: Penny Wong has extracted the following information from her income statement and balance sheet for…

A: Ratios are used to measure the financial health of the organization. The current ratio indicates the…

Q: a. Compute Sweet Tooth’s (1) quick assets, (2) current assets, and (3) current liabilities. b.…

A: Current Assets = These are those Assets which are easily convertible into liquid cash to meet…

Q: Ayayai Inc., a greeting card company, had the following statements prepared as of December 31, 2020.…

A: The cash flow statement is prepared to record cash flow from various activities during the period…

Q: Statement of Financial Position A Company December 31, 2010 Liabilities & Owners' Equity Assets…

A: Statement of financial position shows all assets, all liabilities and equity balances as on date.

Q: Assume the following account balances on January 1, 2019 for a corporation. Accounts Payable $30,000…

A: Given, Beginning cash balance = $30,000 Cash receipts = $21,000 Repayment of loan = $10,000

Q: The following balances stood in the books of Aryian Bank as on 31/12/2020 after preparing the Income…

A: Balance sheet shows the position of the entity in monetary terms in the market by showing the…

Q: he following is the balance sheet and income statement for Metro Eagle Outfitters, in condensed…

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: Below is the Statement of Financial Position for Rafah Islamic Bank: RAFAH ISLAMIC BANK STATEMENT OF…

A: Zakat Payment It is an important part in Islamic culture to pay portion of income which are donated…

Q: Sprague Company has been operating for several years, and on December 31, 2020, presented the…

A: a. Calculate current ratio: Current ratio = current assets / current liabilities Current ratio =…

Q: A company has the following items for the fiscal year 2020: Total Equity = 15 million Total Assets =…

A: Explanation of the concept Ratio analysis is the concept where various financial ratios are…

Q: Given the following Year 9 selected balance sheet data: Assets $136,000 255,000 230,000 $485,000…

A: The debt and equity percentages can be computed by dividing the total liabilities by summation of…

Q: In 2018, a firm borrowed a long term debt of $840,000 from a bank. It issued a long -term bond of…

A: Answer

Q: Calculate the current ratio and the quick ratio for the following partial financial statement for…

A: Ratio analysis involves computing the ratios using the elements of financial statements in order to…

Q: The Murdock Corporation reported the following balance sheet data for 2021 and 2020: 2021…

A: The cash flow statement shows the cash inflow and cash outflow that includes the operating activity,…

Q: · Cash on hand – 200,000 · Cash in bank – 108,000 · Notes receivable –…

A: Solution: Current assets are those assets which are convertible into cash in next one year or…

Q: A list of financial statement items for Maloney Company at June 30, 2022 includes the following:…

A: Assets which are converted into cash within one year from the date of balance sheet or within the…

Q: Data for Lozano Chip Company and its industry averages follow. Lozano Chip Company: Balance Sheet as…

A: As posted multiple sub parts we are answering only first three sub parts kindly repost the…

Q: A recent balance sheet of Sweet Tooth, Ic., included the following items, among others. (Dollar…

A: Definition of Quick Assets: Quick assets refer to assets owned by a company with a commercial or…

Q: Below is the financial information for AXZ Corporation for fiscal year-ending June 30, 2020.…

A: Balance sheet: It is a statement which reports both assets and liabilities as on a particular date…

Q: The following are the balances stood in the books of Middle East Bank Limited for Year 2020. OMR OMR…

A: Balance Sheet is a statement showing balances of Real and Personal Accounts in a systematic manner.…

Q: Using the data given below, compute for the total amount of items that meet the definition of…

A: A financial liability is a liability where there is a contractual obligation to pay/deliver cash or…

Q: The following are taken from the financial statements of Curry Company as of December 2021. Assets:…

A: Cash = 341,600 Accounts receivable = 200,000 Inventory = 308,400 Notes payable = 280,000 Accounts…

Q: In 2021, Bank Muscat reported the following amounts in its Balance sheet and Income Statement.…

A: To find the spread, we will first have to find out the earning assets and interest bearing…

Q: The working capital of BT21 Co. on December 31, 2021 are presented below: · Cash on hand –…

A: The current liabilities represent those liabilities that has to be settled within 12 months from the…

Q: Saint John Corporation provided you with the following statements of Financial Statements as of…

A: Before Adjustments Adjustments After Adjustments Current Assets- Cash 250000 -80000…

Q: Suppose a firm has the following information: Accounts payable =$1 million; notes payable = $1.1…

A: Introduction Current liabilities: Current liabilities are the portion of liabilities which are to be…

Q: Baker & Co. has applied for a loan from the Trust Us Bank in order to invest in several potential…

A: The question is related to Ratio Analysis. The details are given regarding the same. The comparison…

Q: Below are the 2014 and 2015 year-end balance sheets for Tran Enterprises: Assets: 2015 2014 Cash $…

A: As the balance sheet is an important financial statement it should be considered when any investment…

Q: nterpret the results of the debt to equity ratio and how the company has managed debt over the last…

A: Debt equity ratio of the business means that out of total equity balance owned by the company, how…

Q: Prepare a Projected Statement of Financial Position of Sky Company dated December 31, 2019. Below…

A: Sky Company…

Q: Barry Computer Company: Balance Sheet as of December 31, 2018 (In Thousands) $172,900 Accounts…

A: Computation of the following ratios: Current Ratio = current assets/current liabilities…

Q: The following information is from Dejlah, Inc.s, financial statements. Sales (all credit) were AED…

A: Balance sheet refers to the kind of financial statement of a company which is prepared at the end of…

Q: Balance Sheet as of December 31, 2020 Assets Liabilities and Owners' Equity Current liabilities…

A: For sustaining the growth of company there is need of additional investment required. This…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

- Ratio Analysis Rising Stars Academy provided the following information on its 2019 balance sheet and state mcnt of cash flows: Long-term debt S 4,400 Interest expense S 398 Total liabilities 8,972 Net income 559 Total assets 38,775 Interest payments 432 Total equity 29,803 Cash flows from operations 1.015 Operating income 1.223 Income tax expenses 266 Income taxes paid 150 Required: Calculate the following ratios for Rising Stars: (a) debt to equity, (b) debt to total assets, (c) long-term debt to equity, (d) times interest earned (accrual basis), and (e) times interest earned (cash basis). (Note: Round answers to three decimal places.) CONCEPTUAL CONNECTION Interpret these results. 3.What does it mean if a bond is callableBelow is the Statement of Financial Position for Rafah Islamic Bank: RAFAH ISLAMIC BANK STATEMENT OF FINANCIAL POSITION FOR THE YEAR ENDED 31 DECEMBER 2020 Assets RM Non current Asset 5,670,000 Long Term Investment 654,000,000 Financing (Net) 1,244,000,000 Corporate Bond Investment 919,094,000 Commercial Securities Investment 389,543,000 Deposits in other financial institutions 487,043,700 Other current assets…Consider the following financial data for Nguyen Industries: Statement of Financial Position as of December 31, 2018 Cash $ 232,500 Accounts payable $ 86,500 Accts. receivable 357,500 Short-term bank note 254,000 Inventories 150,500 Accrued wages & taxes 80,000 Total current assets $ 740,500 Total current liabilities $ 420,500 Long-term debt 566,000 Net fixed assets 774,500 Common equity 528,500 Total assets $ 1,515,000 Total liab. & equity $ 1,515,000 Profit & Loss Statement for 2018 Industry Average Ratios Net sales $ 1,894,000 Current ratio 1.4× Cost of goods sold 1,382,500 Quick ratio 1.0× Gross profit $ 511,500 Days sales outstanding 63 days Operating expenses 373,000 Inventory turnover 9.5× EBIT $ 138,500 Total asset turnover 1.5× Interest expense 64,000 Net…

- Brecker Inc., a greeting card company, had the following statements prepared as of December 31, 2020. BRECKER INC.COMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $6,000 $7,000 Accounts receivable 62,000 51,000 Short-term debt investments (available-for-sale) 35,000 18,000 Inventory 40,000 60,000 Prepaid rent 5,000 4,000 Equipment 154,000 130,000 Accumulated depreciation—equipment (35,000 ) (25,000 ) Copyrights 46,000 50,000 Total assets $313,000 $295,000 Accounts payable $46,000 $40,000 Income taxes payable 4,000 6,000 Salaries and wages payable 8,000 4,000 Short-term loans payable 8,000 10,000 Long-term loans payable 60,000 69,000 Common stock, $10 par 100,000 100,000 Contributed…Brecker Inc., a greeting card company, had the following statements prepared as of December 31, 2020. Brecker Inc.Comparative Balance SheetAs of December 31, 2020 and 2019 12/31/20 12/31/19 Cash $ 6,000 $ 7,000 Accounts receivable 62,000 51,000 Short-term debt investments (available-for-sale) 35,000 18,000 Inventory 40,000 60,000 Prepaid rent 5,000 4,000 Equipment 154,000 130,000 Accumulated depreciation—equipment (35,000) (25,000) Copyrights 46,000 50,000 Total assets $313,000 $295,000 Accounts payable $ 46,000 $ 40,000 Income taxes payable 4,000 6,000 Salaries and wages payable 8,000 4,000 Short-term loans payable 8,000 10,000 Long-term loans payable 60,000 69,000 Common stock, $10 par 100,000 100,000 Contributed capital, common stock 30,000 30,000 Retained earnings 57,000 36,000 Total liabilities and stockholders' equity $313,000 $295,000 Brecker Inc.Income StatementFor the Year…Brecker Inc., a greeting card company, had the following statements prepared as of December 31, 2020. BRECKER INC.COMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $6,000 $7,000 Accounts receivable 62,000 51,000 Short-term debt investments (available-for-sale) 35,000 18,000 Inventory 40,000 60,000 Prepaid rent 5,000 4,000 Equipment 154,000 130,000 Accumulated depreciation—equipment (35,000 ) (25,000 ) Copyrights 46,000 50,000 Total assets $313,000 $295,000 Accounts payable $46,000 $40,000 Income taxes payable 4,000 6,000 Salaries and wages payable 8,000 4,000 Short-term loans payable 8,000 10,000 Long-term loans payable 60,000 69,000 Common stock, $10 par 100,000 100,000 Contributed…

- Suppose an SEVP tells you that last year a bank had total interest expenses on all borrowings of BDT 12 million and noninterest expenses of BDT 5 million, while interest income from earning assets totaled BDT 16 million and noninterest revenues totaled BDT 2 million. Suppose further that assets amounted to BDT 480 million, of which earning assets represented 85 percent of that total asset while total interest-bearing liabilities amounted to 75 percent of total assets. See if you can determine the bank’s net interest and non-interest margins and its earnings base and earnings spread for the most recent year.Consider the following financial data for Smith Corp.: Balance Sheet as of December 31, 2019 Cash $ 195,000 Accounts payable $ 94,000 Receivables 185,500 Short-term bank note 119,500 Inventories 214,500 Accruals 71,000 Total current assets $ 595,000 Total current liabilities $ 284,500 Long-term debt 462,500 Net plant & equip. 621,500 Common equity 469,500 Total assets $ 1,216,500 Total liab. & equity $ 1,216,500 Profit & Loss Statement for 2019 Industry Average Ratios Net sales $ 1,265,000 Current ratio 1.9× Cost of sales 986,500 Quick ratio 1.2× Gross profit $ 278,500 Days sales outstanding 64 days Operating expenses 166,500 Inventory turnover 3.3× EBIT $ 112,000 Total asset turnover 0.7× Interest expense 32,000 Net profit margin 9.1% Pre-tax income $ 80,000…Of the following, what would be classified as an asset, liability, and equity on a bank's balance sheet? Investment Securities- $23,000 •Demand Deposits- $19,000 •Now Accounts- $89,000 •Cash and Due from Banks- $9,000 •Retail CDs- $28,000 •Long-Term Debt- $19,000 •Reverse Repos- 42,000 •Loans- $90,000 •Fixed Assets- $15,000 •Other Assets- $4,000 •Paid-In Capital- $4,000 •Retained Earnings- $12,000 •Common Stock- $12,000 •Provision for Loan Losses- $2,000

- A company has the following items for the fiscal year 2020: Cash = 2 million Marketable securities = 3 million Account receivables (A/R) = 1.5 million Inventories = 8.5 million Total current liabilities = 8 million Calculate the company’s current ratio and quick ratioFollowing are selected financial and operating data taken from the financial statements of Antiporda Corporation: As of December 31 2019 2020 Cash. ₱80,000 ₱640,000 Notes&Accounts receivable,net 400,000 1,200,000 Merchandise inventory 720,000 1,200,000 Marketable Securities-short term 240,000 80,000 Land and buildings(net) 2,720,000 2,880,000 Bonds payable-long term 2,160,000 2,240,000 Accounts payable-trade 560,000 880,000 Notes payable-short term 160,000 320,000 For the year ended December 31 2019 2020 Sales (20%cash, 80% credit sales) 18,400,000 19,200,000 Cost of goods sold 8,000,000 11,200,000 Compute the following…Bridgeport Inc., a greeting card company, had the following statements prepared as of December 31, 2020. BRIDGEPORT INC.COMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $6,100 $7,100 Accounts receivable 61,500 51,000 Short-term debt investments (available-for-sale) 34,800 17,900 Inventory 39,800 59,900 Prepaid rent 5,000 4,000 Equipment 155,200 129,900 Accumulated depreciation—equipment (35,200 ) (24,800 ) Copyrights 45,800 49,800 Total assets $313,000 $294,800 Accounts payable $45,800 $39,800 Income taxes payable 4,100 6,000 Salaries and wages payable 7,900 3,900 Short-term loans payable 8,000 9,900 Long-term loans payable 60,100 68,900 Common stock, $10 par 100,000 100,000…