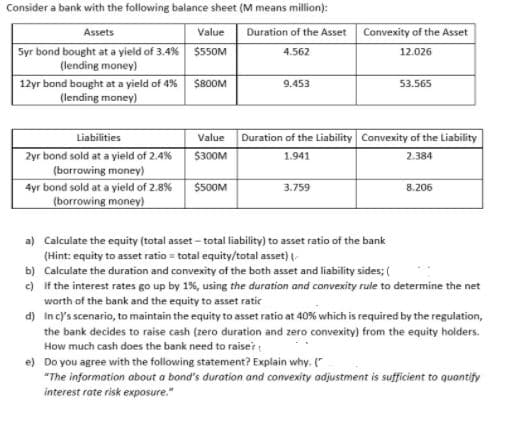

Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset Syr bond bought at a yield of 3.4% $55OM (lending money) 4.562 12.026 12yr bond bought at a yield of 4% (lending money) $80OM 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability Zyr bond sold at a yield of 2.4% (borrowing money) 4yr bond sold at a yield of 2.8% (borrowing money) $300M 1.941 2.384 $500M 3.759 8.206 a) Calculate the equity (total asset- total liability) to asset ratio of the bank (Hint: equity to asset ratio = total equity/total asset) b) Calculate the duration and convexity of the both asset and liability sides; ( c) If the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratic d) Incys scenario, to maintain the equity to asset ratio at 40% which is required by the regulation, the bank decides to raise cash (zero duration and zero convexity) from the equity holders. How much cash does the bank need to raiser e) Do you agree with the following statement? Explain why. (" "The information about a bond's duration and convexity adjustment is sufficient to quantify interest rate risk exposure."

Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset Syr bond bought at a yield of 3.4% $55OM (lending money) 4.562 12.026 12yr bond bought at a yield of 4% (lending money) $80OM 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability Zyr bond sold at a yield of 2.4% (borrowing money) 4yr bond sold at a yield of 2.8% (borrowing money) $300M 1.941 2.384 $500M 3.759 8.206 a) Calculate the equity (total asset- total liability) to asset ratio of the bank (Hint: equity to asset ratio = total equity/total asset) b) Calculate the duration and convexity of the both asset and liability sides; ( c) If the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratic d) Incys scenario, to maintain the equity to asset ratio at 40% which is required by the regulation, the bank decides to raise cash (zero duration and zero convexity) from the equity holders. How much cash does the bank need to raiser e) Do you agree with the following statement? Explain why. (" "The information about a bond's duration and convexity adjustment is sufficient to quantify interest rate risk exposure."

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter11: Determining The Cost Of Capital

Section: Chapter Questions

Problem 16P

Related questions

Question

Transcribed Image Text:Consider a bank with the following balance sheet (M means million):

Assets

Value

Duration of the Asset Convexity of the Asset

Syr bond bought at a yield of 3.4% $55OM

(lending money)

4.562

12.026

12yr bond bought at a yield of 4%

(lending money)

$80OM

9.453

53.565

Liabilities

Value

Duration of the Liability Convexity of the Liability

Zyr bond sold at a yield of 2.4%

(borrowing money)

4yr bond sold at a yield of 2.8%

(borrowing money)

$300M

1.941

2.384

$500M

3.759

8.206

a) Calculate the equity (total asset- total liability) to asset ratio of the bank

(Hint: equity to asset ratio = total equity/total asset)

b) Calculate the duration and convexity of the both asset and liability sides; (

c) If the interest rates go up by 1%, using the duration and convexity rule to determine the net

worth of the bank and the equity to asset ratic

d) Incys scenario, to maintain the equity to asset ratio at 40% which is required by the regulation,

the bank decides to raise cash (zero duration and zero convexity) from the equity holders.

How much cash does the bank need to raiser

e) Do you agree with the following statement? Explain why. ("

"The information about a bond's duration and convexity adjustment is sufficient to quantify

interest rate risk exposure."

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning