Consider a first-price sealed-bid auction with a reserve price. A single indivisible object is to be allocated. The reserve price r2 0 is a number set by the auctioneer in advance and known by participants. Each participant submits a bid inside a sealed envelope. The bids are submitted simultaneously and independently. The auctioneer collects all bids and selects the highest one highest bid is no smaller than the reserve price, then the person with the highest bid pays the to the auctioneer and gets the object. Otherwise, if all the bids are smaller than the reserve pr then the auctioneer keeps the object and none of the participants pays anything. (a) Write down a game representing the sealed-bid first-price auction. You can assume that pe have quasilinear utility over money. (b) Suppose that r= 0, is overbidding weakly dominated? Justify your answer. (c) Suppose that r = 0, is underbidding weakly dominated by truthful bidding? Justify your ans (d) How would your answer to (b) and (c) change if r> 0?

Consider a first-price sealed-bid auction with a reserve price. A single indivisible object is to be allocated. The reserve price r2 0 is a number set by the auctioneer in advance and known by participants. Each participant submits a bid inside a sealed envelope. The bids are submitted simultaneously and independently. The auctioneer collects all bids and selects the highest one highest bid is no smaller than the reserve price, then the person with the highest bid pays the to the auctioneer and gets the object. Otherwise, if all the bids are smaller than the reserve pr then the auctioneer keeps the object and none of the participants pays anything. (a) Write down a game representing the sealed-bid first-price auction. You can assume that pe have quasilinear utility over money. (b) Suppose that r= 0, is overbidding weakly dominated? Justify your answer. (c) Suppose that r = 0, is underbidding weakly dominated by truthful bidding? Justify your ans (d) How would your answer to (b) and (c) change if r> 0?

Chapter18: Asymmetric Information

Section: Chapter Questions

Problem 18.10P

Related questions

Question

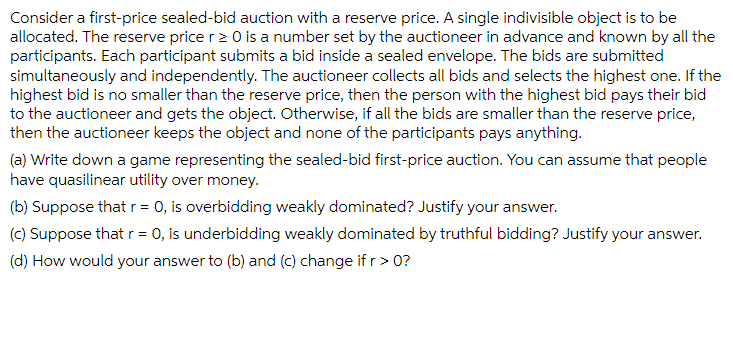

Transcribed Image Text:Consider a first-price sealed-bid auction with a reserve price. A single indivisible object is to be

allocated. The reserve price r> 0 is a number set by the auctioneer in advance and known by all the

participants. Each participant submits a bid inside a sealed envelope. The bids are submitted

simultaneously and independently. The auctioneer collects all bids and selects the highest one. If the

highest bid is no smaller than the reserve price, then the person with the highest bid pays their bid

to the auctioneer and gets the object. Otherwise, if all the bids are smaller than the reserve price,

then the auctioneer keeps the object and none of the participants pays anything.

(a) Write down a game representing the sealed-bid first-price auction. You can assume that people

have quasilinear utility over money.

(b) Suppose that r = 0, is overbidding weakly dominated? Justify your answer.

(c) Suppose that r = 0, is underbidding weakly dominated by truthful bidding? Justify your answer.

(d) How would your answer to (b) and (c) change if r> 0?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning