Consider a hypothetical closed economy in which there are no income taxes. If households spend $0.75 of each additional dollar they earn and save the remainder, the expenditure multiplier for this economy is

Consider a hypothetical closed economy in which there are no income taxes. If households spend $0.75 of each additional dollar they earn and save the remainder, the expenditure multiplier for this economy is

Chapter9: The Keynesian Model In Action

Section9.4: Recessionary And Inflationary Gaps

Problem 1YTE

Related questions

Question

Transcribed Image Text:Consider a hypothetical closed economy in which there are no income taxes. If households spend $0.75 of each additional dollar they earn and save

the remainder, the expenditure multiplier for this economy is

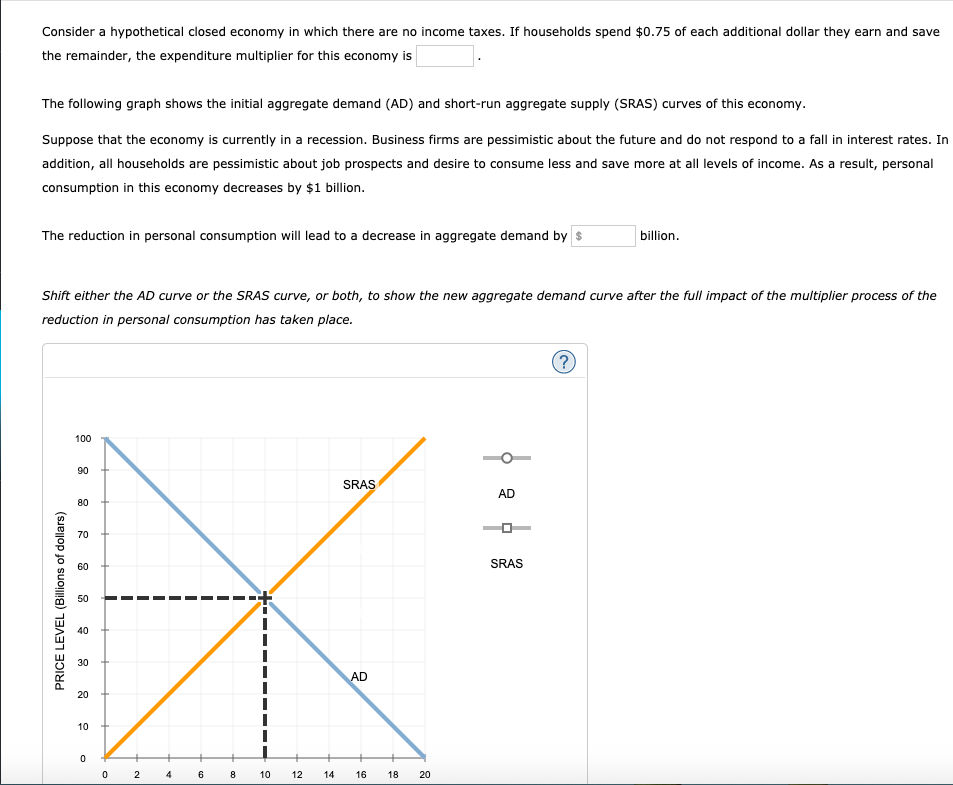

The following graph shows the initial aggregate demand (AD) and short-run aggregate supply (SRAS) curves of this economy.

Suppose that the economy is currently in a recession. Business firms are pessimistic about the future and do not respond to a fall in interest rates. In

addition, all households are pessimistic about job prospects and desire to consume less and save more at all levels of income. As a result, personal

consumption in this economy decreases by $1 billion.

The reduction in personal consumption will lead to a decrease in aggregate demand by $

billion.

Shift either the AD curve or the SRAS curve, or both, to show the new aggregate demand curve after the full impact of the multiplier process of the

reduction in personal consumption has taken place.

(?

100

90

SRAS

AD

80

70

60

SRAS

50

40

30

AD

20

10

0 2

4

6

8

10

12

14

16

18

20

PRICE LEVEL (Billions of dollars)

Transcribed Image Text:100

90

SRAS

AD

80

70

60

SRAS

50

AD

20

10

2

6

8

10

12

14

16

18

20

REAL GDP (Index numbers)

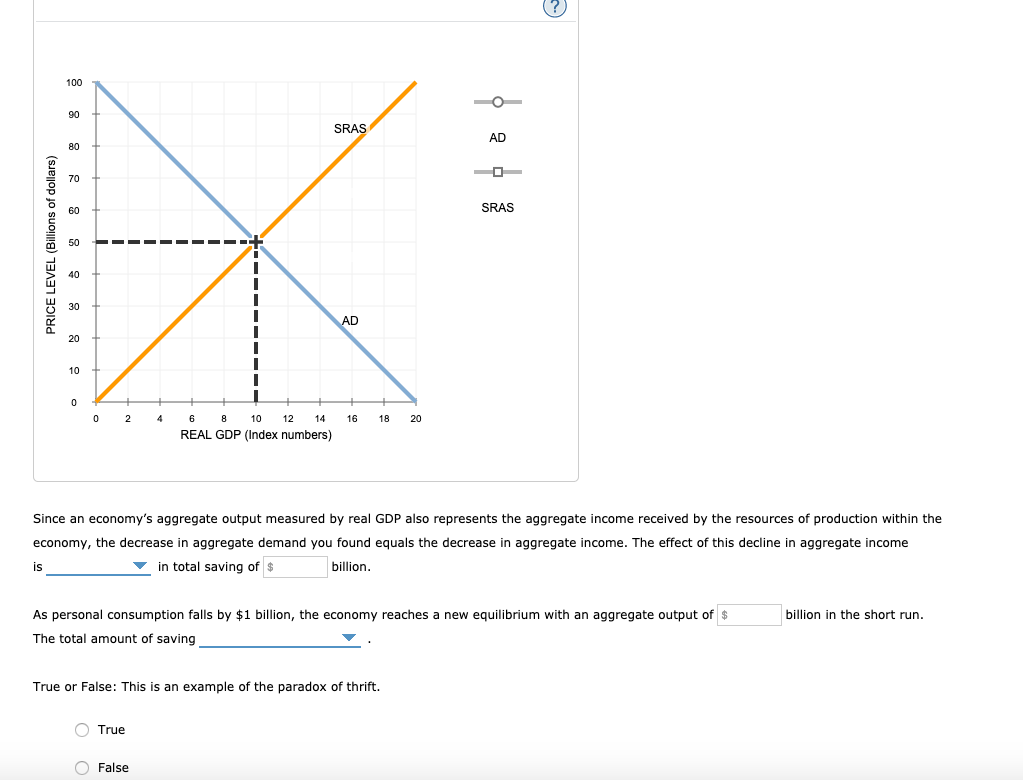

Since an economy's aggregate output measured by real GDP also represents the aggregate income received by the resources of production within the

economy, the decrease in aggregate demand you found equals the decrease in aggregate income. The effect of this decline in aggregate income

is

v in total saving of $

billion.

As personal consumption falls by $1 billion, the economy reaches a new equilibrium with an aggregate output of $

billion in the short run.

The total amount of saving

True or False: This is an example of the paradox of thrift.

O True

False

PRICE LEVEL (Billions of dollars)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning