Consider a market with two firms (Firm 1 and Firm 2), which produce an identical good. Both firms have the same constant marginal cost: MC = m = 40. The demand in this market is given by: Q = 100 – .25p =p = 400 – 4Q denote the price charged by firm 1, the quantity firm 1 produces and sells, and firm 1's profits, respectively. Analogously, let p2, 92, and t, denote the price, the quantity, and profits for firm 2. When appropriate, assume the firms split total quantity and profits evenly. Let p1, 91, and a. Assume that consumers in this market demand Q = 50 and the two firms compete by choosing prices simultaneously (Bertrand oligopoly with identical products). What will be the price, quantity, and profit for each firm in equilibrium? How does this equilibrium compare to a perfectly competitive equilibrium? b. Assume now that the two firms compete by choosing quantities simultaneously (Cournot oligopoly with identical products). What will be the price, quantity, and profit for each firm in equilibrium? c. Assume now that the two firms now collude to act as monopolist. That is, they form a cartel. What will be the price, quantity, and profit for each firm in equilibrium?

Consider a market with two firms (Firm 1 and Firm 2), which produce an identical good. Both firms have the same constant marginal cost: MC = m = 40. The demand in this market is given by: Q = 100 – .25p =p = 400 – 4Q denote the price charged by firm 1, the quantity firm 1 produces and sells, and firm 1's profits, respectively. Analogously, let p2, 92, and t, denote the price, the quantity, and profits for firm 2. When appropriate, assume the firms split total quantity and profits evenly. Let p1, 91, and a. Assume that consumers in this market demand Q = 50 and the two firms compete by choosing prices simultaneously (Bertrand oligopoly with identical products). What will be the price, quantity, and profit for each firm in equilibrium? How does this equilibrium compare to a perfectly competitive equilibrium? b. Assume now that the two firms compete by choosing quantities simultaneously (Cournot oligopoly with identical products). What will be the price, quantity, and profit for each firm in equilibrium? c. Assume now that the two firms now collude to act as monopolist. That is, they form a cartel. What will be the price, quantity, and profit for each firm in equilibrium?

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter13: best-practice Tactics: Game Theory

Section: Chapter Questions

Problem 1E

Related questions

Question

Can you help me solve this please?

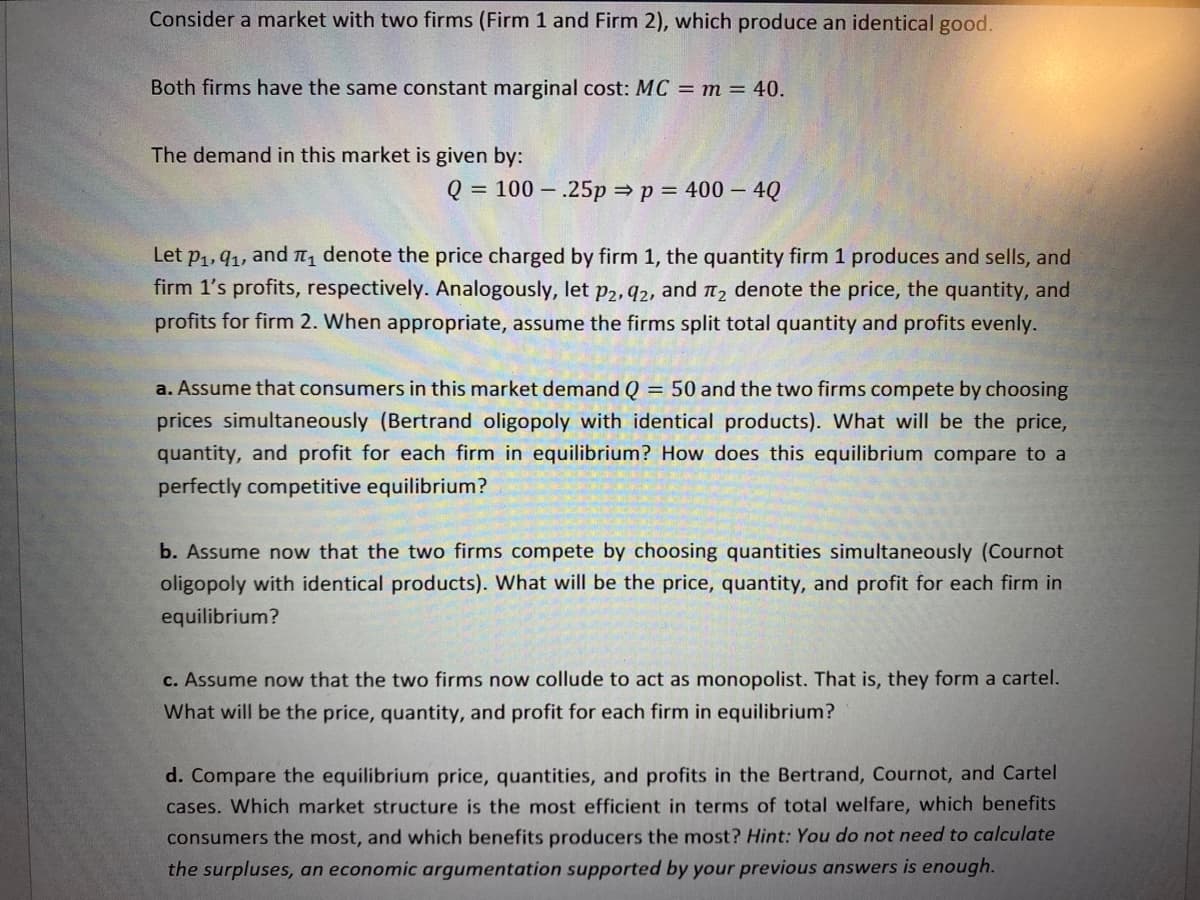

Transcribed Image Text:Consider a market with two firms (Firm 1 and Firm 2), which produce an identical good.

Both firms have the same constant marginal cost: MC = m = 40.

The demand in this market is given by:

Q = 100 – .25p =p = 400 – 4Q

Let p1, 91, and , denote the price charged by firm 1, the quantity firm 1 produces and sells, and

firm 1's profits, respectively. Analogously, let p2, 42, and n, denote the price, the quantity, and

profits for firm 2. When appropriate, assume the firms split total quantity and profits evenly.

a. Assume that consumers in this market demand Q

= 50 and the two firms compete by choosing

prices simultaneously (Bertrand oligopoly with identical products). What will be the price,

quantity, and profit for each firm in equilibrium? How does this equilibrium compare to a

perfectly competitive equilibrium?

b. Assume now that the two firms compete by choosing quantities simultaneously (Cournot

oligopoly with identical products). What will be the price, quantity, and profit for each firm in

equilibrium?

c. Assume now that the two firms now collude to act as monopolist. That is, they form a cartel.

What will be the price, quantity, and profit for each firm in equilibrium?

d. Compare the equilibrium price, quantities, and profits in the Bertrand, Cournot, and Cartel

cases. Which market structure is the most efficient in terms of total welfare, which benefits

consumers the most, and which benefits producers the most? Hint: You do not need to calculate

the surpluses, an economic argumentation supported by your previous answers is enough.

Transcribed Image Text:the surpluses, an economic argumentation supported by your previous answers is enough.

e. Assume that the two firms compete by choosing their quantities sequentially (Stackelberg

oligopoly with identical products). Assume further, that firm 1 moves first. What will be the price,

quantity, and profit for each firm in equilibrium? Compared to the Cournot-Nash equilibrium,

which firm is better off and which firm is worse off? Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning